By his own admission, J.D. Corp President Gino Tsai doesn't like walking. "My legs are too short, and my walking speed always seems too slow," he says.

Tsai wanted a better way to get around the factory floor, something smaller and more compact than a bike, and easier than walking. He put the company's research and development team to work, and before long they had invented the hottest new product of the year, the Razor Scooters that are suddenly so popular on the streets of New York, Tokyo and Europe.

But the two-year journey from conception to hit product is not a story of savvy marketing and clever promotion. Quite the opposite -- the Razor Scooter proved so popular that customers clamored for it, and J.D. Corp's key concern was to ramp up production fast enough to meet the unexpected demand.

PHOTO: AFP

Basically, Tsai built a better mousetrap, and the world beat a path to his door.

It took five years to develop the current model. The first version had a steel base and 25cm rubber wheels, but at 6kg it was too heavy to carry around. Tsai added electric power to the second version, but it was still heavy, and had the added inconvenience of a battery that had to be charged.

It was the third generation scooter that proved to be the winner. By adding polyurethane wheels and making the base from aircraft-grade aluminum, J.D. Corp produced a compact, easy-to-carry prototype that weighed just 3kg. Never again would Tsai have to walk around the factory floor.

The Razor Scooter's commercial launch came almost by accident. Tsai took the prototype to the NSGA World Sports Expo, held July 17 to 19, 1998 in Chicago, where J.D. Corp was marketing its line of aluminum bicycle parts. As Tsai scooted around the show, he attracted the attention of Sharper Image Corp. Tsai asserts that though his scooter was only a prototype, not a show product, Sharper Image was very interested.

The US retailer placed the first order for the Razor: 4,000 scooters. But it was the Japanese market that gave the Razor its rocket-like launch. In January 1999, J.D. Corp showcased the scooter for the first time, at the Hong Kong Toys and Games Fair. There it caught the attention of Atras Auto Co Ltd, a Japan-based importer of European cars. In April 1999, Atras placed an order for 300 Razor scooters.

Atras knew its market well. Rather than advertise the Razor as a sporting good, Atras promoted it as a fashion accessory, a must-have item for the ultra-hip of Tokyo. That caught the eye of the fashion-conscious consumers, and soon the scooter had attracted the attention of the media as well. By August 1999, Japanese customers were demanding more Razors than J.D. Corp could produce.

In the US meanwhile, the Razor had become a popular toy among daredevil teenagers, and a user group called Razor Team had sprung up in Los Angeles. Tsai admits he doesn't understand the US market, so the company asked Razor Team to be its American agent. In May, Razor Team accepted and formed a company called Razor USA. The Razor's adoption and promotion by trend-setting generation-X Californians helped cement its image as a hip, youthful product.

In its 15 years of existence, J.D. Corp has never had a hit like the Razor. Until recently, it had produced a line of aluminum bicycle parts, along with its own Tranz X bicycle brand and City Bug electric scooters. But sales were middling, and J.D. Corp had always been just another little-known parts producer from Changhua.

Its biggest challenge was ramping up scooter production to keep up with demand, otherwise product awareness would fade and the trend would fizzle. Tsai moved quickly to expand his factory in Shenzhen. The company boosted output from just 500 scooters in May 1999, to 500,000 in June.

Of the half million Razors produced each month, about 150,000 go to the US, 150,000 to Japan, and 125,000 to Europe, with Hong Kong, Australia and other countries accounting for the rest.

"We were able to increase our volume in a very short time, and satisfy the demand very quickly, so we could catch up with the market," Tsai says.

In 1999, just 10 percent of the company's revenue came from the Razor, but this year the figure is expected to approach 90 percent. The company's 1999 revenue of US$40 million will more than double this year, Tsai claims, but beyond that he is not making any predictions.

Now that it has a hit, the company is trying hard to sustain the trend. It plans to introduce three separate models next year: a shorter, stronger Razor Sport for teens; a longer Razor Cruiser with comfortable suspension for leisure riders; and a more compact battery-operated Razor Power for urban transportation.

The streets of Taipei are full of kick-scooters, but you will very seldom see a genuine Razor. Local manufacturers, quick to copy a hit, have flooded the market with cheap imitations. But Tsai says he's not worried. Razor has applied for three US patents, and one has been granted already, and it has applied for another eight patents in Taiwan and China.

Taiwanese and Chinese manufacturers are not known for their respect for patent law, but Tsai believes Razor's customers will remain brand loyal.

"Our distributors tell us that their consumers ask for Razor Scooters only, and so the copies do not sell very well," he says. "Instead our customers increase their Razor Scooter orders."

How long will the trend last? Gary Melyan, a Taipei-based producer and exporter of sporting goods, says it might last as long as the roller blade and the updated skateboard -- or it might not. "It depends on what happens next summer," he says. "It will probably have a two-year lifespan, and after that it's hard to predict."

According to Melyan, prices and quality will fall as cheap producers enter the market. The Razor, with its comparatively high quality, has a reasonable chance of surviving past a second season.

High-quality producers survived the roller-blade shakeout as well, and if kick-scooters do survive, the Razor has a better chance than most of its competitors.

Tsai himself can't explain the sudden success of the Razor. "Even we don't understand why it is so hot right now -- we are very surprised," he says.

But one thing is certain he'll never have to walk around the factory floor again.

AIR SUPPORT: The Ministry of National Defense thanked the US for the delivery, adding that it was an indicator of the White House’s commitment to the Taiwan Relations Act Deputy Minister of National Defense Po Horng-huei (柏鴻輝) and Representative to the US Alexander Yui on Friday attended a delivery ceremony for the first of Taiwan’s long-awaited 66 F-16C/D Block 70 jets at a Lockheed Martin Corp factory in Greenville, South Carolina. “We are so proud to be the global home of the F-16 and to support Taiwan’s air defense capabilities,” US Representative William Timmons wrote on X, alongside a photograph of Taiwanese and US officials at the event. The F-16C/D Block 70 jets Taiwan ordered have the same capabilities as aircraft that had been upgraded to F-16Vs. The batch of Lockheed Martin

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —

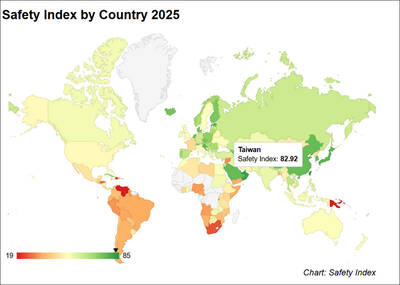

Taiwan was ranked the fourth-safest country in the world with a score of 82.9, trailing only Andorra, the United Arab Emirates and Qatar in Numbeo’s Safety Index by Country report. Taiwan’s score improved by 0.1 points compared with last year’s mid-year report, which had Taiwan fourth with a score of 82.8. However, both scores were lower than in last year’s first review, when Taiwan scored 83.3, and are a long way from when Taiwan was named the second-safest country in the world in 2021, scoring 84.8. Taiwan ranked higher than Singapore in ninth with a score of 77.4 and Japan in 10th with

China's military today said it began joint army, navy and rocket force exercises around Taiwan to "serve as a stern warning and powerful deterrent against Taiwanese independence," calling President William Lai (賴清德) a "parasite." The exercises come after Lai called Beijing a "foreign hostile force" last month. More than 10 Chinese military ships approached close to Taiwan's 24 nautical mile (44.4km) contiguous zone this morning and Taiwan sent its own warships to respond, two senior Taiwanese officials said. Taiwan has not yet detected any live fire by the Chinese military so far, one of the officials said. The drills took place after US Secretary