The US House of Representatives yesterday passed the US-Taiwan Expedited Double-Tax Relief Act by a 423 to 1 vote.

The act would first exempt taxation for qualifying Taiwanese residents who provide services in the US, and offer a lower withholding tax rate for qualified Taiwanese residents with particular types of US-sourced income such as dividends or interest.

Secondly, the United States-Taiwan Tax Agreement Authorization Act would improve tax cooperation between the two countries, granting the US president authority to negotiate and establish a tax agreement with Taiwan.

Photo: EPA

The bill is to be first sent to the US Senate to vote on before being sent to the US president for his signature to be passed into legislation.

Taiwan has been pushing for a double taxation act in recent years to benefit businesses on both sides of the Pacific.

The act failed to pass in the previous session of the US congress, but yesterday was passed after a second consideration in a new session of congress.

The act “paves the way for increased Taiwanese investment in the U.S. economy,” the New Democrat Coalition of the House said yesterday in a joint statement.

As the US and Taiwan have no formal diplomatic relations, for decades there was previously no tax agreement, forcing individuals to pay taxes to both governments if they live or work in both nations and giving Taiwanese businesses “an excessively high withholding tax when compared to other close trading partners,” the coalition said.

The bill aims to “lower costs on cross-border investment, help expand domestic production of key technologies including chips, and create high-paying jobs in communities across the [US],” it said.

As Taiwan is one of the US’ largest trade partners, the act would “unleash American manufacturing jobs, support [US] semiconductor and chip manufacturing capabilities and secure strategic supply chains, while reducing [US] dependence on China,” House Committee on Ways and Means Chairman Jason Smith said yesterday on X.

Without the agreement, US employees sent to Taiwan for training at semiconductor factories would have to pay double taxes on their income, US House Representative Judy Chu (趙美心) said.

The US has already signed double taxation agreements with more than 60 countries, but due to Taiwan’s unique political position it cannot partake in traditional tax agreements, making Taiwan the only one of the US’ top 10 trade partners without such an agreement, she added.

Taiwanese businesses have expressed to Chu that in the face of large tax bills, they have reduced investment in the US, while a survey conducted by the American Institute in Taiwan (AIT) found that 79 percent of respondents agreed that double taxation was a deterrent to US investments, she said.

In light of the House passing the bill, President William Lai (賴清德) said he hopes that Legislative Speaker Han Kuo-yu (韓國瑜), who is leading a delegation of bipartisan lawmakers to attend the US presidential inauguration of Donald Trump, could celebrate this new milestone in US-Taiwan relations in Washington as Lai met with the delegation at the Presidential Office this morning.

An essay competition jointly organized by a local writing society and a publisher affiliated with the Chinese Communist Party (CCP) might have contravened the Act Governing Relations Between the People of the Taiwan Area and the Mainland Area (臺灣地區與大陸地區人民關係條例), the Mainland Affairs Council (MAC) said on Thursday. “In this case, the partner organization is clearly an agency under the CCP’s Fujian Provincial Committee,” MAC Deputy Minister and spokesperson Liang Wen-chieh (梁文傑) said at a news briefing in Taipei. “It also involves bringing Taiwanese students to China with all-expenses-paid arrangements to attend award ceremonies and camps,” Liang said. Those two “characteristics” are typically sufficient

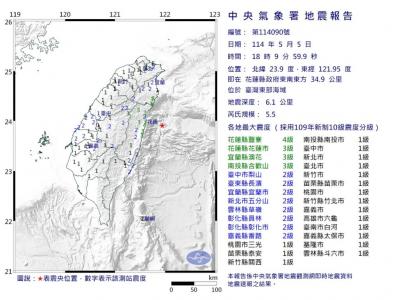

A magnitude 5.9 earthquake that struck about 33km off the coast of Hualien City was the "main shock" in a series of quakes in the area, with aftershocks expected over the next three days, the Central Weather Administration (CWA) said yesterday. Prior to the magnitude 5.9 quake shaking most of Taiwan at 6:53pm yesterday, six other earthquakes stronger than a magnitude of 4, starting with a magnitude 5.5 quake at 6:09pm, occurred in the area. CWA Seismological Center Director Wu Chien-fu (吳健富) confirmed that the quakes were all part of the same series and that the magnitude 5.5 temblor was

The brilliant blue waters, thick foliage and bucolic atmosphere on this seemingly idyllic archipelago deep in the Pacific Ocean belie the key role it now plays in a titanic geopolitical struggle. Palau is again on the front line as China, and the US and its allies prepare their forces in an intensifying contest for control over the Asia-Pacific region. The democratic nation of just 17,000 people hosts US-controlled airstrips and soon-to-be-completed radar installations that the US military describes as “critical” to monitoring vast swathes of water and airspace. It is also a key piece of the second island chain, a string of

The Central Weather Administration has issued a heat alert for southeastern Taiwan, warning of temperatures as high as 36°C today, while alerting some coastal areas of strong winds later in the day. Kaohsiung’s Neimen District (內門) and Pingtung County’s Neipu Township (內埔) are under an orange heat alert, which warns of temperatures as high as 36°C for three consecutive days, the CWA said, citing southwest winds. The heat would also extend to Tainan’s Nansi (楠西) and Yujing (玉井) districts, as well as Pingtung’s Gaoshu (高樹), Yanpu (鹽埔) and Majia (瑪家) townships, it said, forecasting highs of up to 36°C in those areas