Taiwan’s capital markets remain stable despite volatility on international financial markets, President Tsai Ing-wen (蔡英文) said yesterday.

Tsai made opening remarks at the Master’s Forum jointly organized by the Chinese-language Economic Daily News and Mega Bank, at which the winner of last year’s Nobel Prize in Economics Douglas Diamond was invited to speak on the recent banking crisis in the US.

“As part of the international community, Taiwan has been cautiously responding to the dramatic political and economic changes worldwide in the post-COVID-19 era,” Tsai said. “Facing global inflation, Taiwan has raised interest rates five times since last year.”

Photo: CNA

Aside from adopting a moderate and progressive approach to raising interest rates, the government has introduced a mechanism to stabilize consumer prices, Tsai said, adding that subsidies and tax relief measures were offered to ease the pressure brought by inflation.

The Legislative Yuan passed a special budget to ease the burden on economically disadvantaged people in the post-pandemic era, she said.

“Although global inflation and raising interest rates affect financial institutions worldwide, the overall health of financial institutions in Taiwan is sound. The government has also taken corresponding measures to address issues that might arise with the liquidity of the domestic banking system and fluctuating value of the domestic insurance industry,” Tsai said.

Due to the stability of the domestic capital markets, Fitch Ratings and S&P Global Ratings gave Taiwan “AA” and “AA+” ratings respectively, which recognizes the nation’s ability to manage and maintain a resilient financial system, she added.

Asked whether the recent banking crisis in the US and Europe presents any risks in the global banking sector, Diamond said that the crisis is different to the subprime mortgage crisis of 2008.

“In 2008, with big investment banks like Lehman Brothers, there was this problem of banks being too interconnected with each other, and some banks having a bunch of very bad mortgage-backed securities on the books. In that case, you have to have a very careful stress test and see if any bad securities were on a particular bank’s book. That was the reason the crisis was spreading,” Diamond said.

“In the most recent problem, Credit Suisse was thought to have a bunch of bad loans, but it seems that what they had were management problems. In the US banks, it was purely just interest rate risks. In the case of the First Republic, it was the problem with the mortgage, and with the Silicon Valley Bank, it was problems with its trading [of] US government securities,” he said.

The reason the bank run seemed to be spreading this time was not so much because banks have illiquid or bad assets, but because people think that the banks’ supervisors have not done their job well and there might be some insolvent banks out there, Diamond said.

“As a depositor, if I am not sure my bank is solvent, and I see other people thinking about runs, then I start thinking about runs. Once it happens, it is going to be difficult for the system. As such, fear of runs is the global factor that seems to be spreading this time,” he said.

When the issue is interest rate risks, using market prices to make sure banks stay solvent is smart, he added.

The recent banking crisis resulted in a loss of savings to money market funds, which affects whether small and medium-sized banks in the US can offer loans to small and medium-sized businesses, Fubon Financial senior executive vice president and chief economist Rick Lo (羅瑋) said.

This could slow the US economy, a problem that people should monitor closely, Lo said.

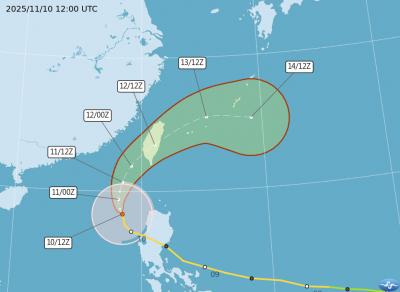

The Central Weather Administration (CWA) today issued a sea warning for Typhoon Fung-wong effective from 5:30pm, while local governments canceled school and work for tomorrow. A land warning is expected to be issued tomorrow morning before it is expected to make landfall on Wednesday, the agency said. Taoyuan, and well as Yilan, Hualien and Penghu counties canceled work and school for tomorrow, as well as mountainous district of Taipei and New Taipei City. For updated information on closures, please visit the Directorate-General of Personnel Administration Web site. As of 5pm today, Fung-wong was about 490km south-southwest of Oluanpi (鵝鑾鼻), Taiwan's southernmost point.

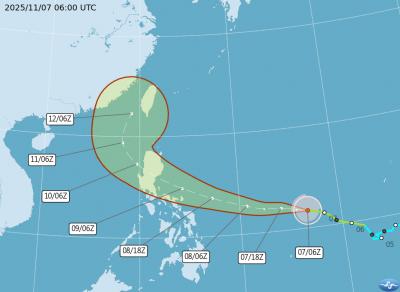

Tropical Storm Fung-Wong would likely strengthen into a typhoon later today as it continues moving westward across the Pacific before heading in Taiwan’s direction next week, the Central Weather Administration (CWA) said. As of 8am, Fung-Wong was about 2,190km east-southeast of Cape Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving westward at 25kph and possibly accelerating to 31kph, CWA data showed. The tropical storm is currently over waters east of the Philippines and still far from Taiwan, CWA forecaster Tseng Chao-cheng (曾昭誠) said, adding that it could likely strengthen into a typhoon later in the day. It is forecast to reach the South China Sea

Almost a quarter of volunteer soldiers who signed up from 2021 to last year have sought early discharge, the Legislative Yuan’s Budget Center said in a report. The report said that 12,884 of 52,674 people who volunteered in the period had sought an early exit from the military, returning NT$895.96 million (US$28.86 million) to the government. In 2021, there was a 105.34 percent rise in the volunteer recruitment rate, but the number has steadily declined since then, missing recruitment targets, the Chinese-language United Daily News said, citing the report. In 2021, only 521 volunteers dropped out of the military, the report said, citing

Nearly 5 million people have signed up to receive the government’s NT$10,000 (US$322) universal cash handout since registration opened on Wednesday last week, with deposits expected to begin tomorrow, the Ministry of Finance said yesterday. After a staggered sign-up last week — based on the final digit of the applicant’s national ID or Alien Resident Certificate number — online registration is open to all eligible Taiwanese nationals, foreign permanent residents and spouses of Taiwanese nationals. Banks are expected to start issuing deposits from 6pm today, the ministry said. Those who completed registration by yesterday are expected to receive their NT$10,000 tomorrow, National Treasury