The government yesterday unveiled incentives for private banks in the hopes that they would join state-run lenders in bailing out business affected by the COVID-19 pandemic.

A deposit that banks are required to make to hedge against bad debts has been lowered from 1 percent to 0.5 percent of total accounts receivable when a bank issues a loan to a small or medium-sized enterprise (SME) by tapping a NT$200 billion (US$6.64 million) fund provided by the central bank, Financial Supervisory Commission Chairman Wellington Koo (顧立雄) told a news conference at the Executive Yuan in Taipei.

That would allow the nation’s banks to save approximately NT$1 billion on such deposits, he said.

Photo: CNA

The commission has also set aside NT$180 million, or 2 percent, of a deposit insurance reserve fund to reward banks that help their clients secure loans from the central bank fund, Koo said.

The top three banks in number of loans issued, total amount of loans issued and fastest service on loans would have their deposit insurance premiums reduced, he said.

The money allocated for the rewards would likely be divided into portions of NT$90 million each, which would be tapped when banks are required to pay premiums in the second half of this and next year, he added.

In addition, processing fees for workers and small firms would be waived when they request loans from banks or are required to undergo credit history checks with the Joint Credit Information Center or the Taiwan Clearing House, Koo said.

This would save applicants about NT$300, he said.

As applications for subsidized loans available to workers and SMEs would be accepted until Dec. 31, central bank Governor Yang Chin-long (楊金龍) was asked whether the preferential interest rates that accompany the packages would be canceled once they end.

If the pandemic does not abate after a prolonged period, the central bank would be able to double the fund to be loaned to workers and SMEs, Yang said, adding that he believes that the SME Credit Guarantee Fund of Taiwan, which offers loans of up to NT$150 million for SMEs, would be able to up the ante as well.

As of Monday, the nation’s eight state-owned banks had received 5,406 requests for loans from businesses and individuals, of which 3,300 requests totaling NT$40.2 billion had been granted, Minister of Finance Su Jain-rong (蘇建榮) said.

An essay competition jointly organized by a local writing society and a publisher affiliated with the Chinese Communist Party (CCP) might have contravened the Act Governing Relations Between the People of the Taiwan Area and the Mainland Area (臺灣地區與大陸地區人民關係條例), the Mainland Affairs Council (MAC) said on Thursday. “In this case, the partner organization is clearly an agency under the CCP’s Fujian Provincial Committee,” MAC Deputy Minister and spokesperson Liang Wen-chieh (梁文傑) said at a news briefing in Taipei. “It also involves bringing Taiwanese students to China with all-expenses-paid arrangements to attend award ceremonies and camps,” Liang said. Those two “characteristics” are typically sufficient

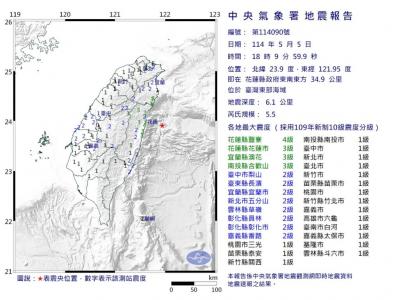

A magnitude 5.9 earthquake that struck about 33km off the coast of Hualien City was the "main shock" in a series of quakes in the area, with aftershocks expected over the next three days, the Central Weather Administration (CWA) said yesterday. Prior to the magnitude 5.9 quake shaking most of Taiwan at 6:53pm yesterday, six other earthquakes stronger than a magnitude of 4, starting with a magnitude 5.5 quake at 6:09pm, occurred in the area. CWA Seismological Center Director Wu Chien-fu (吳健富) confirmed that the quakes were all part of the same series and that the magnitude 5.5 temblor was

The brilliant blue waters, thick foliage and bucolic atmosphere on this seemingly idyllic archipelago deep in the Pacific Ocean belie the key role it now plays in a titanic geopolitical struggle. Palau is again on the front line as China, and the US and its allies prepare their forces in an intensifying contest for control over the Asia-Pacific region. The democratic nation of just 17,000 people hosts US-controlled airstrips and soon-to-be-completed radar installations that the US military describes as “critical” to monitoring vast swathes of water and airspace. It is also a key piece of the second island chain, a string of

The Central Weather Administration has issued a heat alert for southeastern Taiwan, warning of temperatures as high as 36°C today, while alerting some coastal areas of strong winds later in the day. Kaohsiung’s Neimen District (內門) and Pingtung County’s Neipu Township (內埔) are under an orange heat alert, which warns of temperatures as high as 36°C for three consecutive days, the CWA said, citing southwest winds. The heat would also extend to Tainan’s Nansi (楠西) and Yujing (玉井) districts, as well as Pingtung’s Gaoshu (高樹), Yanpu (鹽埔) and Majia (瑪家) townships, it said, forecasting highs of up to 36°C in those areas