Since the start of the pandemic, the option to “buy now, pay later’” has skyrocketed in popularity, especially among young and low-income consumers who may not have ready access to traditional credit. If you shop online for clothes or furniture, sneakers or concert tickets, you’ve seen the option at checkout to break the cost into smaller installments over time. Companies like Afterpay, Affirm, Klarna, and Paypal all offer the service, with Apple due to enter the market later this year.

But with economic instability rising, so are delinquencies. Here is what you should know:

HOW DOES BUY NOW, PAY LATER WORK?

Photo: Bloomberg 照片:彭博社

Branded as “interest-free loans,” buy now, pay later services require you to download an app, link a bank account or debit or credit card, and sign up to pay in weekly or monthly installments. Scheduled payments are then automatically deducted from your account or charged to your card. The services generally don’t charge you more than you would have paid up front, meaning there’s technically no interest, so long as you make the payments on time.

But if you pay late, you may be subject to a flat fee or a fee calculated as a percentage of the total you owe. If you miss multiple payments, you may be shut out from using the service in the future, and the delinquency could hurt your credit score.

ARE MY PURCHASES PROTECTED?

Photo: Bloomberg 照片:彭博社

In the US, buy now, pay later services are not currently covered by the Truth in Lending Act, which regulates credit cards and other types of loans (those paid back in more than four installments).

That means you could find it more difficult to settle disputes with merchants, return items, or get your money back in cases of fraud. Companies can offer protections, but they don’t have to.

WHY DO RETAILERS OFFER BUY NOW, PAY LATER?

Photo: Bloomberg 照片:彭博社

Retailers accept the backend fees of buy now, pay later services because the products increase cart sizes. When shoppers are given the option to pay off purchases in installments, they’re more likely to buy more goods in one go.

WHO SHOULD USE BUY NOW, PAY LATER?

Photo: AP 照片:美聯社

If you have the ability to make all payments on time, buy now, pay later loans are a relatively healthy, interest-free form of consumer credit.

But if you’re looking to build your credit score, and you’re able to make payments on time, a credit card is a better choice. The same goes if you want strong legal protections from fraud, and clear, centralized reporting of loans.

If you’re uncertain whether you’ll be able to make payments on time, consider whether the fees charged by buy now, pay later companies will add up to higher charges than the penalties and interest a credit card company or other lender would charge.

(AP)

自疫情開始以來,「先買後付」的選項變得大受歡迎,尤其對可能無法獲得傳統信貸的年輕及低收入消費者而言更是如此。若上網購買衣服或家具、運動鞋或音樂會門票,會在結帳時看到分期付款的選項。Afterpay、Affirm、Klarna和Paypal等公司都提供這種服務,Apple將於今年稍晚進軍此市場。

但隨著經濟不穩定的狀況加劇,拖欠率也在上升。以下是該知道的幾件事:

「先買後付」如何運作?

被「先買後付」標榜「無息貸款」,要求使用者下載應用程式,綁定銀行帳戶或借記卡,或者信用卡,並註冊以每週或每月分期付款。然後,預定的付款會自動從您的帳戶中扣除或記入您的卡。這些服務通常不會收取比您之前所付款項更多的費用,這表示只要您按時付款,從技術上來講是沒有利息的。

但若逾期付款,可能會需要支付一筆金額固定的費用,或是按欠款總額百分比所計算的費用。如果有多筆款項未繳,未來可能無法使用該服務,且拖欠可能有損您的信用評分。

我的購買有保障嗎?

在美國,「先買後付」服務目前並不在《誠實貸款法》的管轄範圍內,該法所監管的是信用卡和其他類型的貸款(分四期以上還款的借貸)。

這表示您可能會發現要解決與商家的糾紛、退貨,或遇到詐欺要把錢取回來會更難。公司可以提供保障,但並無此義務。

零售商為何提供「先買後付」?

零售商接受先買後付的後端費用,因為先買後付增加了顧客的購物量。若購物者有分期付款的選項,就更可能一次購買更多商品。

誰該使用「先買後付」?

若您有能力按時支付所有款項,現在購買,以後支付貸款是一種相對健康、免息的消費信貸形式。

但是,如果您希望建立自己的信用評分,且有能力按時付款,那麼信用卡會是更好的選擇;若您想要強有力的法律保障以避免詐欺,以及清楚、集中的借貸報告,也是如此。

如果您不確定是否能按時付款,請考慮先買後付公司所收取的費用是否會比信用卡公司或其他貸方收取的罰款和利息加起來更高。

(台北時報林俐凱編譯)

In an effort to fight phone scams, British mobile phone company O2 has introduced Daisy, an AI designed to engage phone con artists in time-wasting conversations. Daisy is portrayed as a kindly British granny, exploiting scammers’ tendency to target the elderly. Her voice, based on a real grandmother’s for authenticity, adds to her credibility in the role. “O2” has distributed several dedicated phone numbers online to direct scammers to Daisy instead of actual customers. When Daisy receives a call, she translates the scammers’ spoken words into text and then responds to them accordingly through a text-to-speech system. Remarkably, Daisy

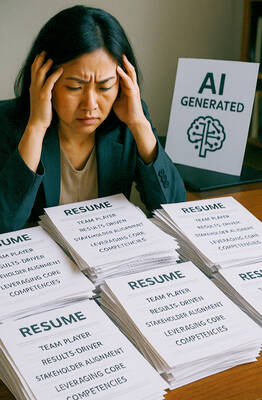

Bilingual Story is a fictionalized account. 雙語故事部分內容純屬虛構。 Emma had reviewed 41 resumes that morning. While the ATS screened out 288 unqualified, she screened for AI slop. She could spot it a mile away. She muttered AI buzzwords like curses under her breath. “Team player.” “Results-driven.” “Stakeholder alignment.” “Leveraging core competencies.” Each resume reeked of AI modeling: a cemetery of cliches, tombstones of personality. AI wasn’t just changing hiring. It was draining the humanity from it. Then she found it: a plain PDF cover letter. No template. No design flourishes. The first line read: “I once tried to automate my

Every May 1, Hawaii comes alive with Lei Day, a festival celebrating the rich culture and spirit of the islands. Initiated in 1927 by the poet Don Blanding, Lei Day began as a tribute to the Hawaiian custom of making and wearing leis. The idea was quickly adopted and officially recognized as a holiday in 1929, and leis have since become a symbol of local pride and cultural preservation. In Hawaiian culture, leis are more than decorative garlands made from flowers, shells or feathers. For Hawaiians, giving a lei is as natural as saying “aloha.” It shows love and

1. 他走出門,左右看一下,就過了馬路。 ˇ He walked outside, looked left and right, and crossed the road. χ He walked outside and looked left and right, crossed the road. 註︰並列連接詞 and 在這句中連接三個述語。一般的結構是 x, y, and z。x and y and z 是加強語氣的結構,x and y, z 則不可以。 2. 他們知道自己的弱點以及如何趕上其他競爭者。 ˇ They saw where their weak points lay and how they could catch up with the other competitors. χ They saw where their weak points lay and how to catch up with the other competitors. 註:and 一般連接同等成分,結構相等的單詞、片語或子句。誤句中 and 的前面是子句,後面是不定詞片語,不能用 and 連接,必須把不定詞片語改為子句,and 前後的結構才相等。 3. 她坐上計程車,直接到機場。 ˇ She took a cab, which took her straight to the airport. ˇ She took a cab and it took her straight