A conflict over Taiwan would shock the global semiconductor industry, with Japan, South Korea and the Philippines being the hardest hit, the Economist Intelligence Unit (EIU) said in its latest report.

The Economist Group’s analysis unit — which warned of “devastation” to Asia’s economy in the event of conflict across the Taiwan Strait — said that it was assuming a hypothetical full-conflict scenario, involving direct military participation by Taiwan, China and the US, with the escalation initiated by China and the US’ participation activating its regional security alliances.

The report said that the risk of a direct Chinese military assault on Taiwan was “very unlikely.”

Photo: CNA

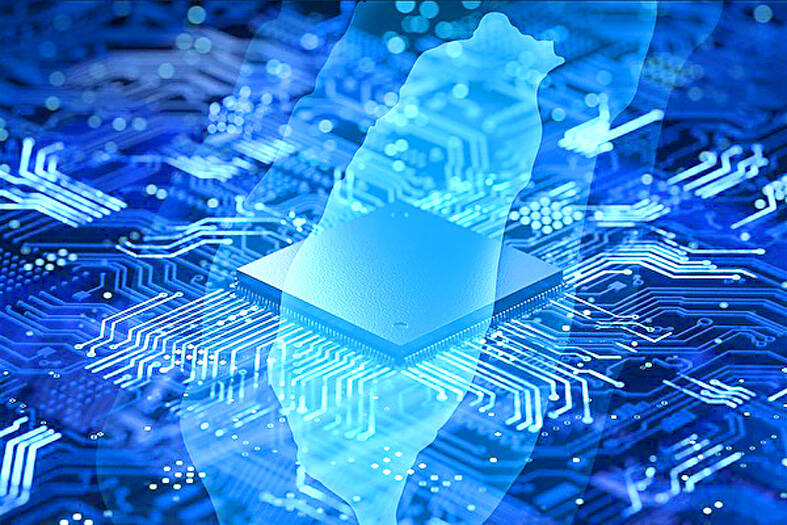

However, Asian economies have significant vulnerabilities tied to Taiwan, especially with regard to advanced chip manufacturing, it said.

A previous EIU report in March said that Taiwan makes 60 percent of the world’s semiconductors and 90 percent of advanced chips.

At best, a conflict would disrupt air and maritime links needed to import items necessary for chip fabrication and exporting chips, the report released this week said.

“At worst, a war would result in the complete destruction of Taiwan’s chipmaking facilities,” it added.

Either outcome would hinder swathes of the global economy, affecting the production of smartphones, computers, home appliances and vehicles, and limiting other sectors, including financial services, it said.

Taiwan is critical to the chip industry, as it is the only place that makes the most advanced semiconductors — those using process technologies of less than 10 nanometers, the report said.

South Korea and Japan would be the obvious alternatives to replace Taiwan’s advanced chipmaking operations, but that would require an effort spanning years and massive investments, it said.

“China is a major exporter of semiconductors, but in the event of a cross-strait conflict we would expect sourcing from the Chinese market to be difficult, not only as a result of disrupted factory production and logistics, but also as a consequence of likely trade and financial prohibitions by the US and others,” the EIU report said. “China could also impose export bans on countries judged to be hostile towards its role in the conflict.”

Japan, South Korea and the Philippines would be the most exposed in the event of a war, while Australia, Hong Kong, Malaysia, Thailand and Vietnam would face “severe exposure,” it said.

It excluded Taiwan and China from its risk of exposure analysis.

The countries most exposed to the economic consequences of war are generally those that might face direct military action due to being members of US-led security alliances and hosting US military bases, it said, adding that heavy reliance on Taiwanese chips was a secondary factor.

“We view the Philippines, Japan and South Korea as the countries most exposed to a conflict over Taiwan,” the report said. “Our assessments for these three countries reflect geopolitical realities, as well as heavy reliance on trade with China. Their geographic proximity to the Taiwan Strait, alongside their roles as important US treaty allies, suggests a high risk that they will be drawn into a conflict.”

“The hosting of US military bases in all three of these countries, in particular, also highlights their vulnerability to a pre-emptive Chinese attack,” it said.

Hong Kong’s vulnerability stems from damaging economic sanctions that the West would likely impose on China and its territories should Beijing invade Taiwan, it said.

The CIA has a message for Chinese government officials worried about their place in Chinese President Xi Jinping’s (習近平) government: Come work with us. The agency released two Mandarin-language videos on social media on Thursday inviting disgruntled officials to contact the CIA. The recruitment videos posted on YouTube and X racked up more than 5 million views combined in their first day. The outreach comes as CIA Director John Ratcliffe has vowed to boost the agency’s use of intelligence from human sources and its focus on China, which has recently targeted US officials with its own espionage operations. The videos are “aimed at

STEADFAST FRIEND: The bills encourage increased Taiwan-US engagement and address China’s distortion of UN Resolution 2758 to isolate Taiwan internationally The Presidential Office yesterday thanked the US House of Representatives for unanimously passing two Taiwan-related bills highlighting its solid support for Taiwan’s democracy and global participation, and for deepening bilateral relations. One of the bills, the Taiwan Assurance Implementation Act, requires the US Department of State to periodically review its guidelines for engagement with Taiwan, and report to the US Congress on the guidelines and plans to lift self-imposed limitations on US-Taiwan engagement. The other bill is the Taiwan International Solidarity Act, which clarifies that UN Resolution 2758 does not address the issue of the representation of Taiwan or its people in

US Indo-Pacific Commander Admiral Samuel Paparo on Friday expressed concern over the rate at which China is diversifying its military exercises, the Financial Times (FT) reported on Saturday. “The rates of change on the depth and breadth of their exercises is the one non-linear effect that I’ve seen in the last year that wakes me up at night or keeps me up at night,” Paparo was quoted by FT as saying while attending the annual Sedona Forum at the McCain Institute in Arizona. Paparo also expressed concern over the speed with which China was expanding its military. While the US

SHIFT: Taiwan’s better-than-expected first-quarter GDP and signs of weakness in the US have driven global capital back to emerging markets, the central bank head said The central bank yesterday blamed market speculation for the steep rise in the local currency, and urged exporters and financial institutions to stay calm and stop panic sell-offs to avoid hurting their own profitability. The nation’s top monetary policymaker said that it would step in, if necessary, to maintain order and stability in the foreign exchange market. The remarks came as the NT dollar yesterday closed up NT$0.919 to NT$30.145 against the US dollar in Taipei trading, after rising as high as NT$29.59 in intraday trading. The local currency has surged 5.85 percent against the greenback over the past two sessions, central