The US has sharpened its assault on China’s technology industry with a flurry of export bans and stifling restrictions on companies, an escalation that leaves Beijing with few options for retaliation.

Washington’s moves are part of a strategy to prevent China from dominating the industries of the future and arming its military with advanced weaponry, while also securing its tech supply chain by enticing chipmakers to set up shop in the US.

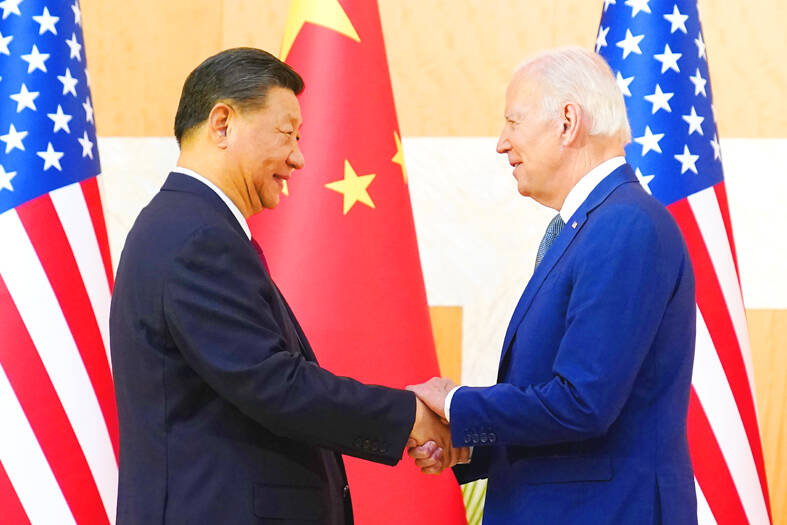

US President Joe Biden’s administration this week escalated those efforts, blacklisting dozens of Chinese tech firms, while signs emerged Japan and the Netherlands are aligning with US restrictions on selling crucial chipmaking equipment to China, a major blow to Beijing’s ambitions to produce advanced semiconductors.

Photo: AP

China has accused the US of protectionism, lodged a complaint with the WTO and courted chipmaking powerhouse South Korea, a key US ally. Beijing is also reportedly preparing a multibillion-dollar aid package for its semiconductor industry, a crucial sector for the global economy.

However, China does not have many options, or incentives, to go further. Any moves to block US investment threatens an economy already reeling from China’s zero-tolerance COVID-19 policies, which are being rolled back.

“China’s lack of good options is precisely why the US is striking hard and fast now with export controls,” said Rhodium Group director Reva Goujon, who advises corporate clients on US-China relations and industrial policies.

Beijing’s response to the recent US moves on semiconductors has been “very reserved,” said Wang Huiyao (王輝耀), founder of the Center for China and Globalization, a policy research group in Beijing.

The new actions unveiled this week — which follow export controls announced in October aimed at preventing China’s access to machines and knowhow to make high-end chips — placed a number of Chinese companies on a so-called Entity List, requiring suppliers to get difficult-to-obtain US government licenses.

Among the most notable firms on that list is emerging chip equipment-maker Shanghai Micro Electronics Equipment Group Co (SMEE, 上海微電子), which could stifle Beijing’s efforts to create next-generation semiconductors. The machines that make the chips are among the most complicated devices produced by humans, and defy reverse engineering, making it difficult for China to develop its own domestic capabilities if it cannot get the equipment elsewhere.

“Having SMEE on the Entity List is a major blow for China’s chip sector,” said former CIA analyst Martijn Rasser, now a senior fellow at the Center for a New American Security.

“It’s the one company that Beijing saw as having potential to produce advanced chipmaking machines, which is essential for China to be a competitive force in the global semiconductor ecosystem,” he said. “Those hopes are now greatly diminished, if not dashed altogether.”

Even if China wins the WTO case, the US can veto any ruling by bringing it to the trade organization’s appellate body.

China’s best option might be to pour money into developing its own high-tech chips. Beijing is preparing to unleash a US$143 billion aid package for its chip industry, but it is not clear how much impact this might have.

“They can invest more, but the issues right now are not really a lack of resources,” Council on Foreign Relations technology analyst Adam Segal said. “It’s these technological chokepoints they are still vulnerable to.”

There is a risk that unilateral actions could alienate key US partners, Carnegie Endowment for International Peace senior fellow Jon Bateman said.

Beijing has not shown a willingness to leverage its dominance of rare earth minerals or its role as a manufacturing hub because it “has more to lose than to gain,” Bateman said.

“China has a lot of capability to retaliate, but very limited willingness to do so thus far,” he added.

Taiwan is gearing up to celebrate the New Year at events across the country, headlined by the annual countdown and Taipei 101 fireworks display at midnight. Many of the events are to be livesteamed online. See below for lineups and links: Taipei Taipei’s New Year’s Party 2026 is to begin at 7pm and run until 1am, with the theme “Sailing to the Future.” South Korean girl group KARA is headlining the concert at Taipei City Hall Plaza, with additional performances by Amber An (安心亞), Nick Chou (周湯豪), hip-hop trio Nine One One (玖壹壹), Bii (畢書盡), girl group Genblue (幻藍小熊) and more. The festivities are to

Auckland rang in 2026 with a downtown fireworks display launched from New Zealand’s tallest structure, Sky Tower, making it the first major city to greet the new year at a celebration dampened by rain, while crowds in Taipei braved the elements to watch Taipei 101’s display. South Pacific countries are the first to bid farewell to 2025. Clocks struck midnight in Auckland, with a population of 1.7 million, 18 hours before the famous ball was to drop in New York’s Times Square. The five-minute display involved 3,500 fireworks launched from the 240m Sky Tower. Smaller community events were canceled across New Zealand’s

‘IRRESPONSIBLE’: Beijing’s constant disruption of the ‘status quo’ in the Taiwan Strait has damaged peace, stability and security in the Indo-Pacific region, MOFA said The Presidential Office yesterday condemned China’s launch of another military drill around Taiwan, saying such actions are a “unilateral provocation” that destabilizes regional peace and stability. China should immediately stop the irresponsible and provocative actions, Presidential Office spokeswoman Karen Kuo (郭雅慧) said, after the Chinese People’s Liberation Army (PLA) yesterday announced the start of a new round of joint exercises around Taiwan by the army, navy and air force, which it said were approaching “from different directions.” Code-named “Justice Mission 2025,” the exercises would be conducted in the Taiwan Strait and in areas north, southwest, southeast and east of Taiwan

UNDER WAY: The contract for advanced sensor systems would be fulfilled in Florida, and is expected to be completed by June 2031, the Pentagon said Lockheed Martin has been given a contract involving foreign military sales to Taiwan to meet what Washington calls “an urgent operational need” of Taiwan’s air force, the Pentagon said on Wednesday. The contract has a ceiling value of US$328.5 million, with US$157.3 million in foreign military sales funds obligated at the time of award, the Pentagon said in a statement. “This contract provides for the procurement and delivery of 55 Infrared Search and Track Legion Enhanced Sensor Pods, processors, pod containers and processor containers required to meet the urgent operational need of the Taiwan air force,” it said. The contract’s work would be