The production value of the local semiconductor industry is to grow 15.8 percent this year to NT$4.3 trillion (US$135.4 billion), following robust growth of 26.8 percent last year, the Market Intelligence & Consulting Institute (MIC, 產業情報研究所) projected yesterday.

The institute attributed the growth in output to Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) sharp production growth, which helped cushion the impact of an industrial slump due to shrinking demand for consumer electronics.

Taiwan’s growth this year would outpace the global semiconductor industry’s forecast annual expansion of 8.9 percent after an increase of 26.2 percent the previous year amid a drastic revision to projected shipments of notebook computers, smartphones and TVs, it said.

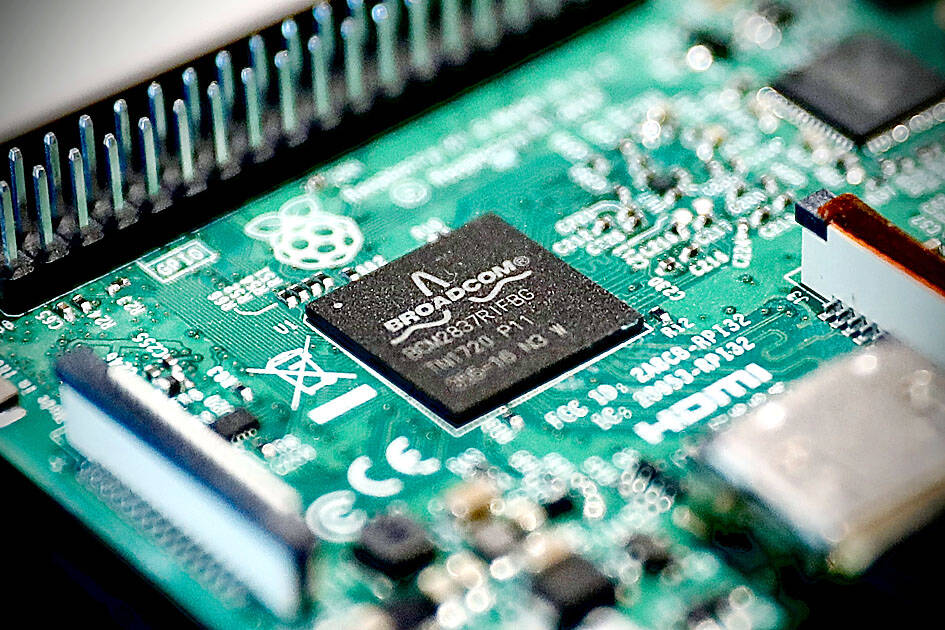

Photo: Ritchie B. Tongo, EPA-EFE

MIC cut its forecast for global notebook computer shipments this year by 10.76 percent to 199 million units.

Sagging demand for consumer electronics was deeply felt by local chip designers and manufacturers, MIC analyst Cynthia Yang (楊可歆) told an online forum.

Taiwan’s chip designers in the second quarter reported the first annual decline in production value in about two years — a 13.3 percent drop.

The best-case scenario for local chip designers is to report a flat production value this year compared with last year, as sluggish demand is compounding problems with high inventories, Yang said.

Memorychip makers would see a quarterly price decline of between 10 and 15 percent each quarter in the second half of this year due to oversupply, she said.

Increasing supply of NOR flash memory chips from China could undermine price quotes for this type of memory chips, she added.

However, local foundries, led by TSMC, would lend support to the nation’s chip manufacturing industry, with production value expanding 26.5 percent year-on-year last quarter and 20.7 percent this quarter, although the growth is weaker than last year due to dwindling demand for 8-inch wafers in light of weak consumer electronics sales, MIC said.

The long-lasting chip crunch has improved significantly this year, but the supply of microcontrollers for vehicles and power management chips for industrial devices remains tight, Yang said.

Commenting on the impact of an escalating US-China trade row, Yang said Washington is stepping up its curbs on semiconductor and equipment exports to China, while the US is forming partnerships with Taiwan, South Korea and Japan to enhance its chip supply resilience through the CHIPS and Science Act and Chip 4 alliance, she said.

Against this backdrop, China is accelerating its efforts to upgrade semiconductor technologies and boost self-sufficiency, Yang said.

Chinese firms are likely to catch up with Taiwanese foundries within three to five years in supplying mature semiconductor technologies, she said.

Separately, Minister of Economic Affairs Wang Mei-hua (王美花) said in an interview published yesterday in Japan’s Yomiuri Shimbun that semiconductor supplies would be disrupted if a contingency were to occur in the Taiwan Strait.

As Taiwanese makers account for a more than 60 percent share of the global foundry market, and Beijing relies on Taiwan for 36 percent of its semiconductor imports, any confrontation between the two sides would have a severe impact on China, Wang said.

The CIA has a message for Chinese government officials worried about their place in Chinese President Xi Jinping’s (習近平) government: Come work with us. The agency released two Mandarin-language videos on social media on Thursday inviting disgruntled officials to contact the CIA. The recruitment videos posted on YouTube and X racked up more than 5 million views combined in their first day. The outreach comes as CIA Director John Ratcliffe has vowed to boost the agency’s use of intelligence from human sources and its focus on China, which has recently targeted US officials with its own espionage operations. The videos are “aimed at

STEADFAST FRIEND: The bills encourage increased Taiwan-US engagement and address China’s distortion of UN Resolution 2758 to isolate Taiwan internationally The Presidential Office yesterday thanked the US House of Representatives for unanimously passing two Taiwan-related bills highlighting its solid support for Taiwan’s democracy and global participation, and for deepening bilateral relations. One of the bills, the Taiwan Assurance Implementation Act, requires the US Department of State to periodically review its guidelines for engagement with Taiwan, and report to the US Congress on the guidelines and plans to lift self-imposed limitations on US-Taiwan engagement. The other bill is the Taiwan International Solidarity Act, which clarifies that UN Resolution 2758 does not address the issue of the representation of Taiwan or its people in

US Indo-Pacific Commander Admiral Samuel Paparo on Friday expressed concern over the rate at which China is diversifying its military exercises, the Financial Times (FT) reported on Saturday. “The rates of change on the depth and breadth of their exercises is the one non-linear effect that I’ve seen in the last year that wakes me up at night or keeps me up at night,” Paparo was quoted by FT as saying while attending the annual Sedona Forum at the McCain Institute in Arizona. Paparo also expressed concern over the speed with which China was expanding its military. While the US

SHIFT: Taiwan’s better-than-expected first-quarter GDP and signs of weakness in the US have driven global capital back to emerging markets, the central bank head said The central bank yesterday blamed market speculation for the steep rise in the local currency, and urged exporters and financial institutions to stay calm and stop panic sell-offs to avoid hurting their own profitability. The nation’s top monetary policymaker said that it would step in, if necessary, to maintain order and stability in the foreign exchange market. The remarks came as the NT dollar yesterday closed up NT$0.919 to NT$30.145 against the US dollar in Taipei trading, after rising as high as NT$29.59 in intraday trading. The local currency has surged 5.85 percent against the greenback over the past two sessions, central