Low interest rates contribute to rising house prices and the central bank should take steps to reverse their negative effect on wealth distribution, central bank Deputy Governor Chen Nan-kuang (陳南光) said in an article in the January edition of Taiwan Banker magazine, challenging the central bank’s longstanding stance that low interest rates should not be blamed for rising house prices.

While he agreed that interest rates, income, tax, demographics and inflation expectations all have a bearing on house prices, data at home and abroad show low interest rates do contribute to rising house prices, Chen said.

The link between low interest rates and rising house prices holds true in emerging and advanced economies, regardless of the calculation method, he said.

Photo: screen grab from the Web site of National Taiwan University’s Department of Economics

Loose monetary policy helps bolster house prices by spurring demand, reducing purchase costs, fueling expectations of price increases and encouraging risk-taking, he added.

If the central bank’s low interest rate policy has played a part in fostering demand for property and price increases, it should take action to reverse the negative effect of house price increases on wealth distribution, rather than staying on the sidelines and limiting itself to maintaining the stability of the financial system, Chen said.

Central bank Governor Yang Chin-long (楊金龍) has said fiscal measures are more effective tools in curbing housing price increases and central bank interventions aim to prevent funds flowing to the property market for the sake of financial stability.

Yang has said houses price increases and inflation are “moderate,” but Chen pointed out that house prices surged 262 percent between 2000 and last year, with the real increase exceeding 160 percent after factoring in inflation.

That pace is behind only New Zealand and Sweden, and it surpassed more than 20 other economies, including South Korea, the US, Denmark and Israel, he said, adding that house prices in South Korea and the US increased 45 percent and 64 percent in the past 20 years respectively.

Furthermore, the ratio of house prices to family income confirms deteriorating affordability, he added.

House prices in 2002 averaged 4.5 times household income with the mortgage burden at 24 percent of family income, but spiked at 9.1 times household income in the third quarter of last year, with the mortgage burden at 36 percent, Chen said.

Unaffordable housing has also been top of the public’s grievances list for many years, he said.

It is inappropriate for policymakers to contend that low interest rates have little to do with rising house prices, Chen said, bucking the stance of Yang and his predecessor, former central bank governor Perng Fai-nan (彭淮南).

ENDEAVOR MANTA: The ship is programmed to automatically return to its designated home port and would self-destruct if seized by another party The Endeavor Manta, Taiwan’s first military-specification uncrewed surface vehicle (USV) tailor-made to operate in the Taiwan Strait in a bid to bolster the nation’s asymmetric combat capabilities made its first appearance at Kaohsiung’s Singda Harbor yesterday. Taking inspiration from Ukraine’s navy, which is using USVs to force Russia’s Black Sea fleet to take shelter within its own ports, CSBC Taiwan (台灣國際造船) established a research and development unit on USVs last year, CSBC chairman Huang Cheng-hung (黃正弘) said. With the exception of the satellite guidance system and the outboard motors — which were purchased from foreign companies that were not affiliated with Chinese-funded

PERMIT REVOKED: The influencer at a news conference said the National Immigration Agency was infringing on human rights and persecuting Chinese spouses Chinese influencer “Yaya in Taiwan” (亞亞在台灣) yesterday evening voluntarily left Taiwan, despite saying yesterday morning that she had “no intention” of leaving after her residence permit was revoked over her comments on Taiwan being “unified” with China by military force. The Ministry of the Interior yesterday had said that it could forcibly deport the influencer at midnight, but was considering taking a more flexible approach and beginning procedures this morning. The influencer, whose given name is Liu Zhenya (劉振亞), departed on a 8:45pm flight from Taipei International Airport (Songshan airport) to Fuzhou, China. Liu held a news conference at the airport at 7pm,

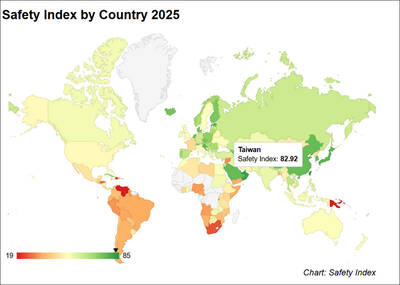

Taiwan was ranked the fourth-safest country in the world with a score of 82.9, trailing only Andorra, the United Arab Emirates and Qatar in Numbeo’s Safety Index by Country report. Taiwan’s score improved by 0.1 points compared with last year’s mid-year report, which had Taiwan fourth with a score of 82.8. However, both scores were lower than in last year’s first review, when Taiwan scored 83.3, and are a long way from when Taiwan was named the second-safest country in the world in 2021, scoring 84.8. Taiwan ranked higher than Singapore in ninth with a score of 77.4 and Japan in 10th with

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —