The shock suspension of the Ant Group Co (螞蟻集團) US$35 billion initial public offering (IPO) is just the beginning of a renewed campaign by China to rein in the fintech empire controlled by Jack Ma (馬雲).

Authorities are now setting their sights on Ant’s biggest source of revenue: its credit platforms that funnel loans from banks and other financial institutions to millions of consumers across China, people familiar with the matter said.

The China Banking and Insurance Regulatory Commission (CBIRC) plans to discourage lenders from using Ant’s platforms and has already asked some to ensure their portfolios are compliant with stringent draft regulations announced on Monday, said the people, who asked not to be identified as they were discussing private information.

Photo: AFP

The proposed measures, which call for platform operators to provide at least 30 percent of the funding for loans, would render many of Ant’s existing transactions non-compliant. The company currently keeps about 2 percent of loans on its own balance sheet, with the rest funded by third parties, or packaged as securities and sold on.

The full scope of China’s plans for Ant is unclear and it is possible that lenders could continue to work with the company once it complies with regulators’ requests.

Any suggestion that banks would stop using its platforms is “unsubstantiated,” Ant said in a response to questions from Bloomberg.

“Ant will continue to support bank partners to make independent credit decisions, and leverage Ant’s technology platforms to serve consumers and small businesses,” it said.

The CBIRC did not immediately respond to a request for comment.

“From the perspective of regulators and investors, they all need Ant to provide a better disclosure on the colending business,” said Chen Shujin (陳姝瑾), Hong Kong-based head of China financial research at Jefferies Financial Group Inc (富瑞金融). “Ant needs to be aligned with regulations going forward and show that its business model can help lower borrowing costs for the economy rather than raising them with some kind of monopoly.”

China halted Ant’s IPO on Tuesday after summoning Ma to a meeting on Monday to outline an array of concerns and new regulations.

The Chinese government is tightening its controls on Ant and other fast-growing financial firms after years of allowing them to operate without the capital and leverage requirements imposed on banks.

Authorities have not yet provided much detail about what prompted the turnabout on the IPO, beyond saying that it could not go ahead because of a “significant change” in the regulatory environment.

The halt came after Ma criticized the nation’s financial system and questioned global regulatory models at a conference last month, calling banks “pawn shops.”

China is still a “youth” and needs more innovation to build an ecosystem for the healthy development of local industry, Ma said.

INVESTIGATION: The case is the latest instance of a DPP figure being implicated in an espionage network accused of allegedly leaking information to Chinese intelligence Democratic Progressive Party (DPP) member Ho Jen-chieh (何仁傑) was detained and held incommunicado yesterday on suspicion of spying for China during his tenure as assistant to then-minister of foreign affairs Joseph Wu (吳釗燮). The Taipei District Prosecutors’ Office said Ho was implicated during its investigation into alleged spying activities by former Presidential Office consultant Wu Shang-yu (吳尚雨). Prosecutors said there is reason to believe Ho breached the National Security Act (國家安全法) by leaking classified Ministry of Foreign Affairs information to Chinese intelligence. Following interrogation, prosecutors petitioned the Taipei District Court to detain Ho, citing concerns over potential collusion or tampering of evidence. The

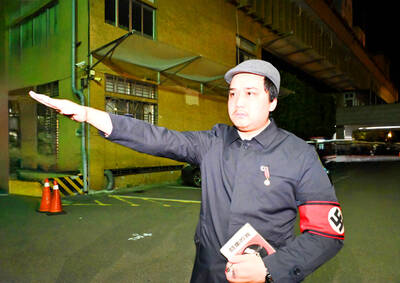

‘FORM OF PROTEST’: The German Institute Taipei said it was ‘shocked’ to see Nazi symbolism used in connection with political aims as it condemned the incident Sung Chien-liang (宋建樑), who led efforts to recall Democratic Progressive Party (DPP) Legislator Lee Kun-cheng (李坤城), was released on bail of NT$80,000 yesterday amid an outcry over a Nazi armband he wore to questioning the night before. Sung arrived at the New Taipei City District Prosecutors’ Office for questioning in a recall petition forgery case on Tuesday night wearing a red armband bearing a swastika, carrying a copy of Adolf Hitler’s Mein Kampf and giving a Nazi salute. Sung left the building at 1:15am without the armband and apparently covering the book with a coat. This is a serious international scandal and Chinese

Seventy percent of middle and elementary schools now conduct English classes entirely in English, the Ministry of Education said, as it encourages schools nationwide to adopt this practice Minister of Education (MOE) Cheng Ying-yao (鄭英耀) is scheduled to present a report on the government’s bilingual education policy to the Legislative Yuan’s Education and Culture Committee today. The report would outline strategies aimed at expanding access to education, reducing regional disparities and improving talent cultivation. Implementation of bilingual education policies has varied across local governments, occasionally drawing public criticism. For example, some schools have required teachers of non-English subjects to pass English proficiency

TRADE: The premier pledged safeguards on ‘Made in Taiwan’ labeling, anti-dumping measures and stricter export controls to strengthen its position in trade talks Products labeled “made in Taiwan” must be genuinely made in Taiwan, Premier Cho Jung-tai (卓榮泰) said yesterday, vowing to enforce strict safeguards against “origin laundering” and initiate anti-dumping investigations to prevent China dumping its products in Taiwan. Cho made the remarks in a discussion session with representatives from industries in Kaohsiung. In response to the US government’s recent announcement of “reciprocal” tariffs on its trading partners, President William Lai (賴清德) and Cho last week began a series of consultations with industry leaders nationwide to gather feedback and address concerns. Taiwanese and US officials held a videoconference on Friday evening to discuss the