Lawmakers yesterday passed an amendment to the Act on COVID-19 Prevention, Relief and Recovery (嚴重特殊傳染性肺炎防治及紓困振興特別條例), raising the upper limit of a special budget to bail out industries and people whose livelihoods have been affected by the pandemic to NT$210 billion (US$7 billion).

The new limit represents a NT$150 billion increase to the budget’s ceiling, NT$60 billion, passed last month by the Legislative Yuan, and the amended act is to serve as the legal basis for a matching budget increase proposed this month by the Executive Yuan for its expanded economic stimulus package.

Depending on the development of the pandemic, a second special budget may be planned, but its amount must not exceed the current one, the amendment says.

Photo: CNA

The planning and spending of the accompanying special budget, for which the Executive Yuan is soon to submit a request, would not be bound by limitations in the Budget Act (預算法), it says, meaning that funds allocated to one agency can be redistributed to another.

Exceptions are special budgetary items that have been annulled by the legislature, it adds.

The budget is to be sourced from surplus revenue from previous fiscal years and borrowing, which is not subject to rules in the Public Debt Act (公共債務法) that limit the amount of capital the government can borrow for the special budget in a fiscal year to 15 percent of the proportion used, the amendment says.

Photo: Wang Yi-sung, Taipei Times

Two proposals tendered by the Chinese Nationalist Party (KMT) caucus — to waive or reduce business tax for operators in sectors significantly affected by the pandemic and waive their import duties — were vetoed.

At the start of the legislative plenary session, KMT Legislator Chiang Wan-an (蔣萬安) criticized the Executive Yuan’s policy for bailing out self-employed workers and freelancers, saying that requirements such as having participated in the Labor Insurance Fund and having an insured monthly salary of less than NT$24,000 to be eligible for a NT$30,000 subsidy are too strict.

He also criticized the Cabinet’s reluctance to issue cash handouts to people subject to an income tax rate of up to 20 percent, saying that what Taiwanese need now is a timely subsidy to help them through the pandemic, citing countries such as the US, the UK and Malaysia, which are giving citizens cash handouts.

However, the KMT caucus did not tender the proposal mentioned by Chiang.

Democratic Progressive Party Legislator Wu Ping-jui (吳秉叡) said that the KMT proposal would have given even people earning an annual salary of NT$2.42 million a subsidy of NT$6,000.

Even lawmakers, whose annual salary is more than NT$2 million and who have no need for subsidies, would have received NT$6,000 under the KMT’s initial proposal, he said.

The KMT is trying to score political points with the proposal, but that would only encroach on the budget allocated for people who most need it; for example, taxi drivers, whose business has been seriously affected by the pandemic, he added.

The Central Election Commission has amended election and recall regulations to require elected office candidates to provide proof that they have no Chinese citizenship, a Cabinet report said. The commission on Oct. 29 last year revised the Measures for the Permission of Family-based Residence, Long-term Residence and Settlement of People from the Mainland Area in the Taiwan Area (大陸地區人民在台灣地區依親居留長期居留或定居許可辦法), the Executive Yuan said in a report it submitted to the legislature for review. The revision requires Chinese citizens applying for permanent residency to submit notarial documents showing that they have lost their Chinese household record and have renounced — or have never

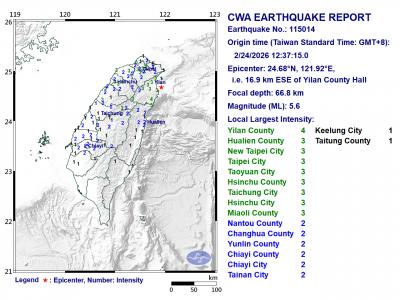

A magnitude 5.6 earthquake struck off the coast of Yilan County at 12:37pm today, with clear shaking felt across much of northern Taiwan. There were no immediate reports of damage. The epicenter of the quake was 16.9km east-southeast of Yilan County Hall offshore at a depth of 66.8km, Central Weather Administration (CWA) data showed. The maximum intensity registered at a 4 in Yilan County’s Nanao Township (南澳) on Taiwan’s seven-tier scale. Other parts of Yilan, as well as certain areas of Hualien County, Taipei, New Taipei City, Taoyuan, Hsinchu County, Taichung and Miaoli County, recorded intensities of 3. Residents of Yilan County and Taipei received

Taiwan has secured another breakthrough in fruit exports, with jujubes, dragon fruit and lychees approved for shipment to the EU, the Ministry of Agriculture said yesterday. The Animal and Plant Health Inspection Agency on Thursday received formal notification of the approval from the EU, the ministry said, adding that the decision was expected to expand Taiwanese fruit producers’ access to high-end European markets. Taiwan exported 126 tonnes of lychees last year, valued at US$1.48 million, with Japan accounting for 102 tonnes. Other export destinations included New Zealand, Hong Kong, the US and Australia, ministry data showed. Jujube exports totaled 103 tonnes, valued at

BIG SPENDERS: Foreign investors bought the most Taiwan equities since 2005, signaling confidence that an AI boom would continue to benefit chipmakers Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) market capitalization swelled to US$2 trillion for the first time following a 4.25 percent rally in its American depositary receipts (ADR) overnight, putting the world’s biggest contract chipmaker sixth on the list of the world’s biggest companies by market capitalization, just behind Amazon.com Inc. The site CompaniesMarketcap.com ranked TSMC ahead of Saudi Aramco and Meta Platforms Inc. The Taiwanese company’s ADRs on Tuesday surged to US$385.75 on the New York Stock Exchange, as strong demand for artificial intelligence (AI) applications led to chip supply constraints and boost revenue growth to record-breaking levels. Each TSMC ADR represents