Ting Hsin International Group (頂新集團) said yesterday that it would shut down two of its subsidiaries until consumer confidence is restored.

Ting Hsin Oil and Fat Industrial Co (頂新製油實業) and Cheng I Food Co Ltd (正義) are to suspend operations until consumers’ food safety concerns end, Wei Ying-chun (魏應充), former chairman of Ting Hsin Oil, Cheng I and Wei Chuan Foods Corp (味全食品工業), said at a press conference.

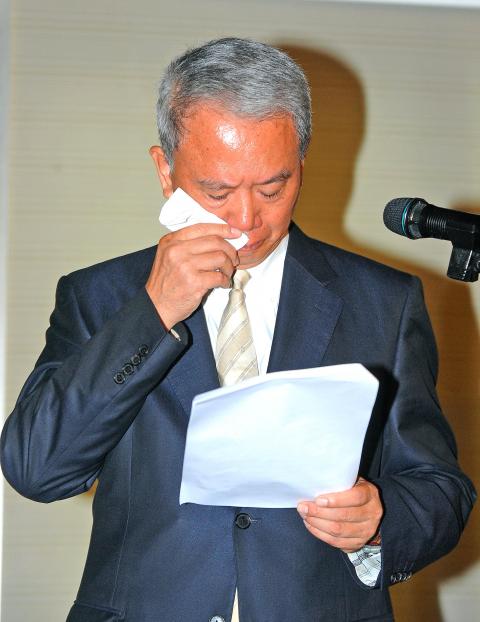

It was Wei’s first public appearance since Cheng I was accused on Wednesday last week of adding oil meant for animal feed to products meant for human consumption.

Photo: Wang Min-wei, Taipei Times

“I really have to apologize to the public for making them uneasy,” said Wei, who left his role as chairman of the three firms on Thursday last week amid the latest cooking oil scandal.

In addition to the temporary shutdowns, the presidents of the two subsidiaries would also step down, Wei said.

The Ting Hsin group will invite food safety experts and consultants to inspect and evaluate the safety issues facing the firms, Wei said, adding that exiting the nation’s cooking oil manufacturing market for good may be an option if the group cannot assure food safety in the future.

Photo: Wang Min-wei, Taipei Times

Wei said the group promises to take “the best care” of the about 260 employees to be affected by the closures.

Sales for the two companies averaged NT$2 billion to NT$2.2 billion (US$65.7 million to US$72.3 million) a year.

While apologizing to the public, employees, shareholders and the government over the latest scandal, Wei said the group would take full responsibility for consumers’ rights, but did not specify details of any potential compensation plans.

Wei choked with sobs several times during the press conference, reiterating that he would become a lifelong volunteer contributor to the nation’s food safety, hoping consumers would give the food firm one more chance to stand up.

However, even though Wei made pledges to reform the two companies’ management and ensure food safety, Ting Hsin faces rising pressure from consumers, as well as several city and county governments, amid a wide range of product boycotts, as this has been the third food safety scandal involving the group within a year.

Meanwhile, shares of Wei Chuan, a listed subsidiary of the group, might face another selling spree tomorrow.

On Thursday, Wei Chuan, the nation’s second-largest food manufacturer, saw its shares tumble 6.25 percent to close at NT$31.5, shrinking for the second straight trading day amid the scandal.

ACTION PLAN: Taiwan would expand procurement from the US and encourage more companies to invest in the US to deepen bilateral cooperation, Lai said The government would not impose reciprocal tariffs in retaliation against US levies, President William Lai (賴清德) said yesterday, as he announced five strategies to address the issue, including pledging to increase Taiwanese companies’ investments in the US. Lai has in the past few days met with administrative and national security officials, as well as representatives from various industries, to explore countermeasures after US President Donald Trump on Wednesday last week announced a 32 percent duty on Taiwanese imports. In a video released yesterday evening, Lai said that Taiwan would not retaliate against the US with higher tariffs and Taiwanese companies’ commitments to

Intelligence agents have recorded 510,000 instances of “controversial information” being spread online by the Chinese Communist Party (CCP) so far this year, the National Security Bureau (NSB) said in a report yesterday, as it warned of artificial intelligence (AI) being employed to generate destabilizing misinformation. The bureau submitted a written report to the Legislative Yuan in preparation for National Security Bureau Director-General Tsai Ming-yen’s (蔡明彥) appearance before the Foreign Affairs and National Defense Committee today. The CCP has been using cognitive warfare to divide Taiwanese society by commenting on controversial issues such as Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) investments in the

HELPING HAND: The steering committee of the National Stabilization Fund is expected to hold a meeting to discuss how and when to utilize the fund to help buffer the sell-off The TAIEX plunged 2,065.87 points, or 9.7 percent, to close at 19,232.35 yesterday, the highest single-day percentage loss on record, as investors braced for US President Donald Trump’s tariffs after an extended holiday weekend. Amid the pessimistic atmosphere, 945 listed companies led by large-cap stocks — including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Hon Hai Precision Industry Co (鴻海精密) and Largan Precision Co (大立光) — fell by the daily maximum of 10 percent at the close, Taiwan Stock Exchange data showed. The number of listed companies ending limit-down set a new record, the exchange said. The TAIEX plunged by daily maxiumu in just

‘COMPREHENSIVE PLAN’: Lin Chia-lung said that the government was ready to talk about a variety of issues, including investment in and purchases from the US The National Stabilization Fund (NSF) yesterday announced that it would step in to staunch stock market losses for the ninth time in the nation’s history. An NSF board meeting, originally scheduled for Monday next week, was moved to yesterday after stocks plummeted in the wake of US President Donald Trump’s announcement of 32 percent tariffs on Taiwan on Wednesday last week. Board members voted to support the stock market with the NT$500 billion (US$15.15 billion) fund, with injections of funds to begin as soon as today. The NSF in 2000 injected NT$120 billion to stabilize stocks, the most ever. The lowest amount it