US President Donald Trump’s threat of tariffs on semiconductor chips has complicated Taiwan’s bid to remain a global powerhouse in the critical sector and stay onside with key backer Washington, analysts said.

Since taking office last month, Trump has warned of sweeping tariffs against some of his country’s biggest trade partners to push companies to shift manufacturing to the US and reduce its huge trade deficit.

The latest levies announced last week include a 25 percent, or higher, tax on imported chips, which are used in everything from smartphones to missiles.

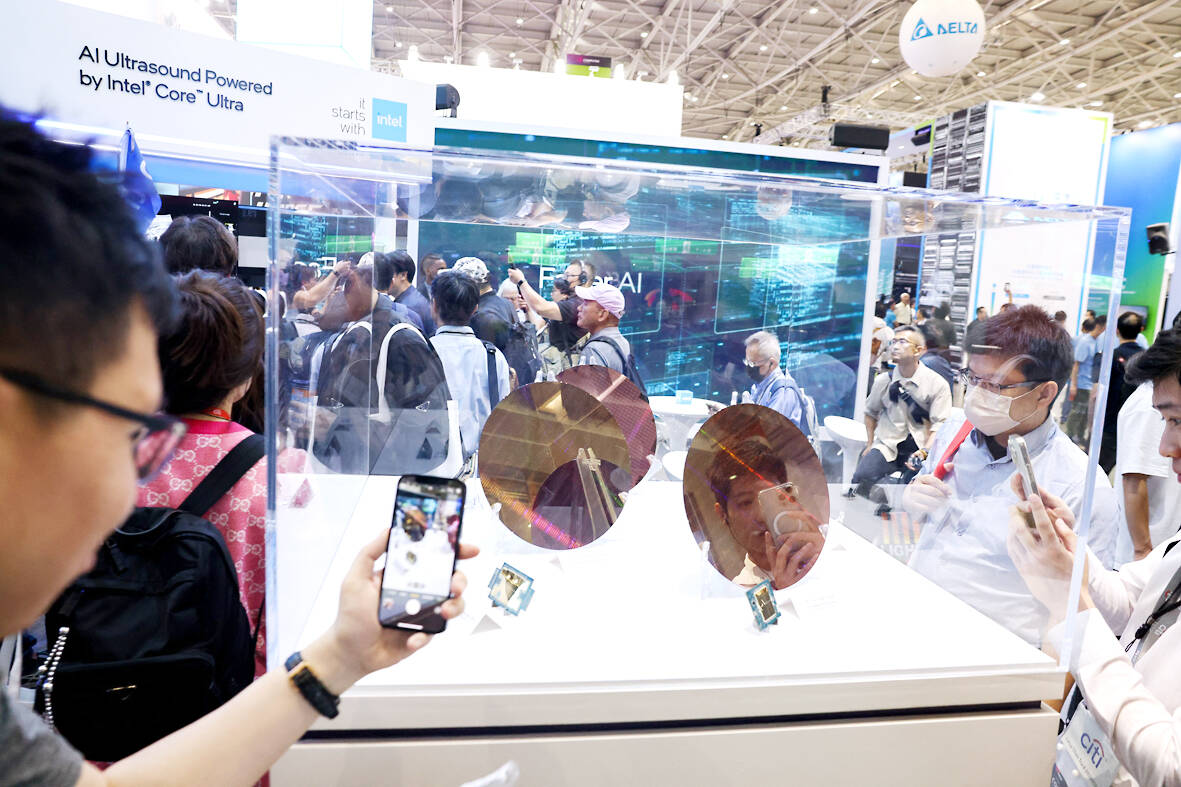

Photo: AFP

Taiwan produces more than half of the world’s chips and nearly all of the most advanced ones, making the country essential to global supply chains.

The island’s economic importance has been described as a “Silicon Shield” against an invasion or blockade by China, which claims it as part of its territory and has threatened to use force to bring it under its control.

“Taiwan’s economic security depends heavily on its leadership in semiconductor manufacturing, which it has been using strategically to maintain its importance in global supply chains,” said Julien Chaisse, an international trade expert at City University of Hong Kong.

Photo: AFP

“I think that Trump’s tariff threats make this strategy much more complicated. For instance, Taiwan could face pressure to make concessions.”

Despite strong bipartisan support in the US Congress for Taiwan, there are fears Trump might not consider the country worth defending if China attacked.

Trump has accused Taiwan of stealing the US chip industry and suggested it should pay the US for its protection.

Photo: AFP

Taiwan President William Lai (賴清德) has already vowed to boost investment in the US to reduce the trade imbalance and spend more on the island’s military, while his government is also considering increasing US natural gas imports.

GIVE IT ALL AWAY

The pressure from Trump may accelerate the shift of Taiwanese chip production to the US, said Wayne Lin of Witology Markettrend Research Institute in Taipei, but he added it would take years to build new foundries.

Taiwan’s TSMC, which is the world’s largest chipmaker, has long faced demands to move more of its production away from Taiwan.

The company has pledged to invest more than US$65 billion in three factories in Arizona, one of which began production late last year. TSMC plans a second facility in Japan and last year it broke ground on its first European plant. But there are concerns Taiwan could lose its “silicon” protection if its companies build too many factories overseas.

“It’s a very dicey situation that they’re in,” said Dan Hutcheson, a California-based senior research fellow at specialist platform TechInsights. “It’s in (Taiwan’s) interest to move some of their manufacturing (to the US), but not to give it all away, because if they give it all away, then they lose their importance.”

RECESSION THREAT

Taiwan’s government is still calculating the potential impact of Trump’s tariffs and has flagged support for affected industries.

One determining factor would be whether levies are applied only to chips shipped to the US or also on chips in finished products.

A fraction of Taiwan’s US$165 billion in chip exports last year went directly to the US, official data show.

The vast majority were sent to other countries where they were put into electronic products for export.

“A 25 percent tariff is significant, but it is unlikely to be a game changer for Taiwan’s semiconductor industry, certainly in the short term,” said Robyn Klingler-Vidra, an innovation policy expert at King’s College London.

But, she warned, the tariffs “will likely have broader global supply chain effects rather than simply curbing direct Taiwan-to-US exports.”

Tariffs could raise the price of smartphones and laptops, hurting demand for chips and potentially triggering a “recession in the semiconductor industry,” Hutcheson said.

Taiwan National Security Council chief Joseph Wu said last Thursday that US consumers would end up bearing the cost of the levies.

“I’m sure, eventually, the US will reconsider its decision,” Wu said.

In the March 9 edition of the Taipei Times a piece by Ninon Godefroy ran with the headine “The quiet, gentle rhythm of Taiwan.” It started with the line “Taiwan is a small, humble place. There is no Eiffel Tower, no pyramids — no singular attraction that draws the world’s attention.” I laughed out loud at that. This was out of no disrespect for the author or the piece, which made some interesting analogies and good points about how both Din Tai Fung’s and Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) meticulous attention to detail and quality are not quite up to

April 21 to April 27 Hsieh Er’s (謝娥) political fortunes were rising fast after she got out of jail and joined the Chinese Nationalist Party (KMT) in December 1945. Not only did she hold key positions in various committees, she was elected the only woman on the Taipei City Council and headed to Nanjing in 1946 as the sole Taiwanese female representative to the National Constituent Assembly. With the support of first lady Soong May-ling (宋美齡), she started the Taipei Women’s Association and Taiwan Provincial Women’s Association, where she

It is one of the more remarkable facts of Taiwan history that it was never occupied or claimed by any of the numerous kingdoms of southern China — Han or otherwise — that lay just across the water from it. None of their brilliant ministers ever discovered that Taiwan was a “core interest” of the state whose annexation was “inevitable.” As Paul Kua notes in an excellent monograph laying out how the Portuguese gave Taiwan the name “Formosa,” the first Europeans to express an interest in occupying Taiwan were the Spanish. Tonio Andrade in his seminal work, How Taiwan Became Chinese,

Mongolian influencer Anudari Daarya looks effortlessly glamorous and carefree in her social media posts — but the classically trained pianist’s road to acceptance as a transgender artist has been anything but easy. She is one of a growing number of Mongolian LGBTQ youth challenging stereotypes and fighting for acceptance through media representation in the socially conservative country. LGBTQ Mongolians often hide their identities from their employers and colleagues for fear of discrimination, with a survey by the non-profit LGBT Centre Mongolia showing that only 20 percent of people felt comfortable coming out at work. Daarya, 25, said she has faced discrimination since she