Sometimes, when I read the economic news, I think the Democratic Progressive Party (DPP) ought to drop the second word in its name.

The nation’s latest iteration of its informal national motto of “socialism for the rich, capitalism for the poor” occurred last week when the Ministry of Finance (MOF) announced it was activating the National Financial Stabilization Fund (國安基金). Was this for all the shopkeepers and restauranteurs slammed by inflation? Was it to increase the pay of ordinary working stiffs?

Of course not. The stock market’s benchmark index had fallen 23.4 percent this year, according to a recent Reuters report, which said that the “market closed down 2.7 percent on Tuesday as the worst performer in Asia.”

Photo: Reuters

The gains of 2020 and last year had been wiped out, Reuters said. Clearly action was necessary — the rich might lose money, the poor dears. Better bail them out!

Savor that observation: “the worst performer in Asia.” Charter members of the cult of GDP, Taiwanese policymakers are just like Taiwanese parents, constantly comparing their children to their cousins. Of course, as with all cults, the rake-off goes to the people at the top.

CORPORATE FUNDAMENTALS

Photo: AFP

Corporate fundamentals remain sound, the government said. Quite true. That same week the government proudly reported that tax revenues had risen 43.2 percent year-on-year in June, to NT$491 billion — roughly the limit (NT$500 billion) for bailing out the stock market.

The finance ministry said that corporate income tax was the largest source of the increased income, skyrocketing 77.7 percent over June of last year, to NT$361.5 billion, a new June record. Chen Yu-feng (陳玉豐), deputy director-general of the ministry’s Department of Statistics, said a large chunk of the revenues were from the profits of listed firms.

Listed firms are highly profitable, but their investors need a bail out?

Photo: CNA

Meanwhile, as I biked around Miaoli County, I noticed several restaurants that had signs saying they had no posted prices for their dishes because of inflation. Earlier this month Bloomberg reported that inflation was nearing a 14-year high. Everywhere people are talking about it.

INFLATION: NIGHTMARE FOR THE WORKING CLASS

Roy Ngerng (鄞義林), the Singaporean transplant here who has become a trenchant chronicler of the economic nightmare facing Taiwan’s working class, noted back in February that Taiwan’s minimum wage was “no longer adequate for the cost of living. In 13 of the 25 years since the 1997 economic crisis, Taiwan’s minimum wage did not grow.”

Ngerng pointed out that Taiwan’s median income is NT$41,750 a month, nearly the figure the minimum wage would be at if it had risen since 1997 at the rate it has risen during the administration of President Tsai Ing-wen (蔡英文). Thus, fully half the nation’s workers are under the level of income they need to survive.

In another excellent piece the previous month, Ngerng observed that “since 1959, consumer prices in Taiwan have risen by 9.5 times while producer prices have only risen by four times. In other words, consumers are seeing their prices rise more than twice as fast as the costs for producers.”

These trends have resulted in a “lopsided economy” in which the government struggles to hold down costs for businesses while allowing them to raise prices on consumers, generating enormous profits.

Now add rising inflation to this stewpot of vast income inequality and hand-to-mouth minimum wages.

The Directorate-General of Budget, Accounting and Statistics (DGBAS) said last week that its data suggested that inflation, above 3 percent for four months in a row, is eroding incomes, despite an increase in the basic wage last year.

In a July 1 piece on inflation, Commonwealth magazine wrote on rising food prices: “Eggs have hit a 41-month high, pork stands at an 87-month high and, with a 125-month high, flour is the most expensive its been over the past decade.”

Ten straight months of inflation running at 2 percent is a situation, Commonwealth observed, that has not been seen since the 2007-8 financial crisis.

As many have noted, governments, including Taiwan’s, flooded markets with cheap money in the wake of the financial crisis and, more recently, because of COVID-19. This went into real estate and stocks. That money is now leaving as investors rush to purchase things now, before their prices go up even more — a move that will only drive more inflation.

Decades of mismanagement of water and electricity prices, subsidizing them so businesses can make money — another transfer of wealth from ordinary people to the rich — has forced the government to eat the rising costs of energy. At some point reality will re-assert itself and prices will rise, most likely at the most politically inconvenient moment.

The Commonwealth piece also cited a researcher who showed that the DGBAS’ Consumer Price Index (CPI) wildly understates the actual rises in rents: “more than 90 percent of the 15,000 rented homes covered by the [CPI] survey are located in social housing projects.”

This swirl of economic devastation is hitting the worst-off sectors of society the hardest.

POLITICAL RAMIFICATIONS OF INFLATION

The discussion about inflation in Taiwan has focused on its pernicious economic effects, but the political prospects are also worrisome.

Taiwan’s “opposition” Chinese Nationalist Party (KMT) and other political parties subscribe to the neoliberal consensus that dominates policy thinking, offering little in the way of alternative or imaginative economic thinking, one of the penalties the country pays for lacking a meaningful domestic opposition and a powerful left-wing party.

Could we see people in the streets? The operative word is “when.” Many scholars have linked protests, especially pro-democracy protests, to inflation. As Dawn Brancati notes is his essay “Pocketbook Protests: Explaining the Emergence of Pro Democracy Protests Worldwide,” inflation is a powerful factor in pro-democracy protests.

“For pro-democracy protests to arise in response to poor economic times,” Brancati writes, “people must not only be dissatisfied with the state of the economy, but they must also blame the lack of democracy in their country for it.”

Similarly, in “Bread, Justice, or Opportunity? The Determinants of the Arab Awakening Protests,” Matthew Costello and colleagues find inflation to be a powerful factor in the Arab street protests. A scan of the literature on the inflation-protests link offers numerous examples.

At first glance these insights appear to have no import for Taiwan. Taiwanese have internalized the idea of democracy and the nation’s democratic identity. Elections are free and fair.

How will voters react in a year or two, when the war in Ukraine continues to drive inflation, and the government and political parties above them offers no meaningful choices, while continuing to present economic data that is at odds with the lived reality of everyday lives? There is no dearth of commentators claiming the major parties are all the same, indifferent to the fate of ordinary taxpayers.

Will the people still retain their democratic buy-in? Or will they begin to feel that voting is pointless and only street protests can make change?

Notes from Central Taiwan is a column written by long-term resident Michael Turton, who provides incisive commentary informed by three decades of living in and writing about his adoptive country. The views expressed here are his own.

Taiwan has next to no political engagement in Myanmar, either with the ruling military junta nor the dozens of armed groups who’ve in the last five years taken over around two-thirds of the nation’s territory in a sprawling, patchwork civil war. But early last month, the leader of one relatively minor Burmese revolutionary faction, General Nerdah Bomya, who is also an alleged war criminal, made a low key visit to Taipei, where he met with a member of President William Lai’s (賴清德) staff, a retired Taiwanese military official and several academics. “I feel like Taiwan is a good example of

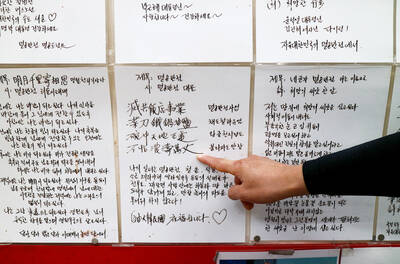

“M yeolgong jajangmyeon (anti-communism zhajiangmian, 滅共炸醬麵), let’s all shout together — myeolgong!” a chef at a Chinese restaurant in Dongtan, located about 35km south of Seoul, South Korea, calls out before serving a bowl of Korean-style zhajiangmian —black bean noodles. Diners repeat the phrase before tucking in. This political-themed restaurant, named Myeolgong Banjeom (滅共飯館, “anti-communism restaurant”), is operated by a single person and does not take reservations; therefore long queues form regularly outside, and most customers appear sympathetic to its political theme. Photos of conservative public figures hang on the walls, alongside political slogans and poems written in Chinese characters; South

Institutions signalling a fresh beginning and new spirit often adopt new slogans, symbols and marketing materials, and the Chinese Nationalist Party (KMT) is no exception. Cheng Li-wun (鄭麗文), soon after taking office as KMT chair, released a new slogan that plays on the party’s acronym: “Kind Mindfulness Team.” The party recently released a graphic prominently featuring the red, white and blue of the flag with a Chinese slogan “establishing peace, blessings and fortune marching forth” (締造和平,幸福前行). One part of the graphic also features two hands in blue and white grasping olive branches in a stylized shape of Taiwan. Bonus points for

Taipei Mayor Chiang Wan-an (蔣萬安) announced last week a city policy to get businesses to reduce working hours to seven hours per day for employees with children 12 and under at home. The city promised to subsidize 80 percent of the employees’ wage loss. Taipei can do this, since the Celestial Dragon Kingdom (天龍國), as it is sardonically known to the denizens of Taiwan’s less fortunate regions, has an outsize grip on the government budget. Like most subsidies, this will likely have little effect on Taiwan’s catastrophic birth rates, though it may be a relief to the shrinking number of