Alfred Chen (陳飛龍) criticizes the attitude of many Taiwanese managers who see temporary posts in Southeast Asia as a shortcut to a promotion and a pay rise upon returning home.

“You can’t get away with that in our company,” Chen says. “Once you go, you migrate.”

When his company, Namchow (南僑), opened its first factory in Thailand in 1991, Chen pledged it would stay in the country for a century. Twenty-six years later, he says his firm’s success stems from deep-level localization and a long-term commitment to the market.

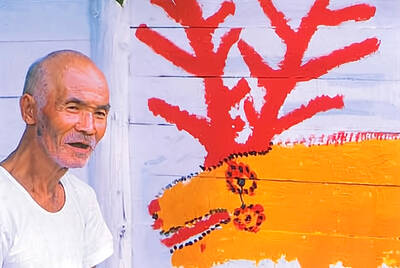

Photo: Economic Daily

Chen says virtually all of Namchow’s Thailand-based senior management have become completely localized, speaking fluent Thai and often moving or starting families there.

“I myself have been there for 25 years, and am not [leaving] anytime soon,” he says.

Chen says making a commitment to a host country is critical to winning the trust of local employees. He adds that Namchow has received awards from the Thai government for their long-term development of the country’s agriculture industry.

Photo: Liam Gibson

Many mistake going to Southeast Asia as the end in and of itself, he says, adding Namchow uses its base in Thailand to distribute its products worldwide, the company’s most successful markets being the US, Australia and Europe.

“You must establish relationships with market players before manufacturing,” Chen says. “Trade partners are the seeds of future growth.”

Chen made these remarks to the Taipei Times and in a speech at the 2018 New Southbound Policy Business Forum earlier this month. Key speakers from industry and government at the event stressed the importance for Taiwanese enterprises to engage in building domestic consumer markets in target countries, which will stimulate demand and deliver mutual economic benefits.

Photo courtesy of Karma Inc.

But members of Taiwan’s business community have their doubts — not only about the challenges of target country markets but also the government’s ability to help them overcome obstacles, revealing real misalignment between official policy and the outlook of Taiwanese enterprises.

THE ELEPHANT IN THE ROOM

There was an audible sigh of recognition when TAITRA chairman James Huang (黃志芳) spoke of the challenges of doing business in India.

“Taiwanese enterprises have cast India as the most impenetrable market on the planet,” he says. “But I tell you, these headaches all stem from not understanding and adapting to it.”

He points to Karma (康揚), a Taiwanese firm that makes equipment for people with disabilities, as evidence of a company that has embraced local market conditions and thrived.

Huang, adapting a catchphrase of Indian Prime Minister Narendra Modi, says Taiwanese companies need to follow Karma’s example to not only “make in India” but “make for India.”

Hu Guo-kai (胡國愷), Karma’s India general manager, says this means simplifying the product and lowering the price as much as possible so Indians can afford it.

“Most Taiwanese companies think they can sell their cheapest low-end products in India, only to find that even those are overpriced for most local consumers,” he says, adding that when the company first arrived in India they had difficulty selling their products.

Paige Chen (陳佩璟), marketing manager at Karma, says that when the company entered the Indian market 10 years ago, wheelchairs, their main product, weren’t so much a product as something people received from charities.

“We had to develop the supply chains from the bottom up,” she says.

The company is now leading the market and distributes its products all across India.

Echoing the words of Namchow’s chairman, Paige Chen says the best way to grow is establishing business partnerships first and developing the market before finally manufacturing. Karma opened its first factory in Calcutta just last year.

Hu says that a stumbling block for Taiwanese firm is wanting to sell upfront without grasping the realities of the Indian market — as they did when they first arrived.

“Many Taiwanese manufacturers want to make one thing and sell it to the whole world,” Hu says. “This kind of business model will run aground in India,” he adds, recalling a Taiwanese nappy producer that quit the market after refusing to adjust its package size from eight pieces per pack to 10 — the standard in India.

Hu says Taiwanese businesses need to be in India for the long haul and to adopt a business-to-business-to-customer structure so that the product development team can use direct feedback loops to refine the product for the market year by year.

Huang’s talk touted Karma as a model for other Taiwanese companies to emulate.

He pointed to market research forecasts for the booming auto industries of Indonesia and India, adding Taiwanese auto parts and electric vehicle firms in particular stand to benefit.

“India is the best business training ground in the world. If you can make it there, you can make it anywhere,” Huang quotes Karma’s CEO as saying.

But not everyone is buying in.

“India is very complex,” says Leslie Chen (陳治守) of ProGreens, an electric vehicle battery manufacturer, adding it can take up to a year to set up a company there.

His colleague George Tao (陶治中) says his company has recently set up distribution channels in Vietnam, but is hesitant to invest further in the region, especially India.

Leslie Chen says electric vehicles need critical infrastructure for recharging and maintenance, something both India and much of Southeast Asia lack, but the US, for example, is in the midst of rolling out.

“The US is reliable,” he says. “Buyers in the US are more consistent and less likely to shop and change between suppliers, as is often the case in developing markets.”

“There are even greater risks in India as it’s a people-oriented, not law-based market,” Leslie Chen adds.

Yet Karma’s Hu says that while contacts with officials may be needed for government-affiliated projects, his company hasn’t experienced such headaches in India’s medical industry.

Hu adds that despite infamous red tape, there are channels to contest decisions through India’s rules-based bureaucracy. He says Karma’s wheelchairs were once wrongly categorized by customs and incurred extra import costs, but his company made an appeal and had the decision overturned.

However, Leslie Chen says if the government wants Taiwanese companies to invest in India, they must improve their own track record.

“The government itself doesn’t know how to operate there,” he says. “It takes some of the state-owned enterprise factories two weeks to get their output from factory to port. It’s ridiculous.”

Just this month talks between CPC Corp (台灣中油) and its Indonesian partner to relocate its Kaoshiung naptha cracker to Indonesia fell through. Last week the head of the oil giant Tai Chein (戴謙), who spoke at length at the forum about its prospects in South Asia, announced plans for a refinery have been put on hold citing complications in deciding on a location, while Indian investment partner Adani has opted out of the project.

SELECTIVE STRATEGY A MUST

Jefferson Chien (簡文祥), an agent who represents numerous Taiwanese enterprises including ProGreens, says to win the confidence of Taiwanese investors, TAITRA needs to stop talking up market growth potential and start getting selective in their India strategy.

“India is so vast,” he says after the forum. “They (TAITRA) need to choose whether Taiwan should focus either on licensing, tech research and development, design subcontract manufacturing or pure trade.”

Hu says that while TAITRA has done well in connecting Taiwanese companies to supply chains in India, he recommends the organization employ more locals with a business rather than administrative background as they’d be more familiar with investors’ needs.

“All in all there are too many risks there [in the region],” says Tao, citing anecdotes of other companies who never received payment after corrupt authorities withheld their product in customs indefinitely.

“Unless the government can provide export insurance, why should we take such huge gambles?” he says.

When told that export insurance for Southbound target markets is on offer through Taiwan’s export-import bank, Tao says he hasn’t heard about it.

Raising awareness among the business community about the financial incentives on offer through the initiative, from export insurance to special loans for small to medium-sized enterprises, is critical to getting Taiwanese enterprises on board as well as demonstrating how organizations like TAITRA can assist them on the ground in target markets.

While bilateral trade between Taiwan and target countries rose last year to over US$100 billion, most of that growth was imports from the region rather than exports from Taiwan. If Taiwanese companies hope to make real gains from expanding trade with the region, they must fully commit to the countries where they are doing business, and that means localization.

Bountiful South is a fortnightly column that covers Taiwan’s cultural, diplomatic, business and tourism connections with New Southbound Policy nations. Liam Gibson is a freelance reporter based in Taipei, where he researches regionalism as a postgraduate student at National Taiwan University’s Graduate Institute of National Development. You can reach him at liamtaipei@gmail.com

Taiwan can often feel woefully behind on global trends, from fashion to food, and influences can sometimes feel like the last on the metaphorical bandwagon. In the West, suddenly every burger is being smashed and honey has become “hot” and we’re all drinking orange wine. But it took a good while for a smash burger in Taipei to come across my radar. For the uninitiated, a smash burger is, well, a normal burger patty but smashed flat. Originally, I didn’t understand. Surely the best part of a burger is the thick patty with all the juiciness of the beef, the

The ultimate goal of the Chinese Communist Party (CCP) is the total and overwhelming domination of everything within the sphere of what it considers China and deems as theirs. All decision-making by the CCP must be understood through that lens. Any decision made is to entrench — or ideally expand that power. They are fiercely hostile to anything that weakens or compromises their control of “China.” By design, they will stop at nothing to ensure that there is no distinction between the CCP and the Chinese nation, people, culture, civilization, religion, economy, property, military or government — they are all subsidiary

Nov.10 to Nov.16 As he moved a large stone that had fallen from a truck near his field, 65-year-old Lin Yuan (林淵) felt a sudden urge. He fetched his tools and began to carve. The recently retired farmer had been feeling restless after a lifetime of hard labor in Yuchi Township (魚池), Nantou County. His first piece, Stone Fairy Maiden (石仙姑), completed in 1977, was reportedly a representation of his late wife. This version of how Lin began his late-life art career is recorded in Nantou County historian Teng Hsiang-yang’s (鄧相揚) 2009 biography of him. His expressive work eventually caught the attention

This year’s Miss Universe in Thailand has been marred by ugly drama, with allegations of an insult to a beauty queen’s intellect, a walkout by pageant contestants and a tearful tantrum by the host. More than 120 women from across the world have gathered in Thailand, vying to be crowned Miss Universe in a contest considered one of the “big four” of global beauty pageants. But the runup has been dominated by the off-stage antics of the coiffed contestants and their Thai hosts, escalating into a feminist firestorm drawing the attention of Mexico’s president. On Tuesday, Mexican delegate Fatima Bosch staged a