When Jaguar’s “copy nothing” brand reboot hit late last year, one self-styled car enthusiast wrote on X: “What the actual hell is this.” Jaguar’s response: “The future.” That remains to be seen, but the ad, unfamiliar and unsettling, does at least work as a portent of what is coming for the global auto industry.

Jaguar, a storied, but struggling, British brand owned by India’s Tata Motors Ltd, shred its existing traditions with a 30-second video long on po-faced models, but with no sign of an actual car. It all heralded a new direction — high-end electric vehicles (EVs) — with a concept, the Type 00, revealed in Miami, Florida, shortly thereafter. If the idea was to draw attention, albeit often apoplectic, it worked. Even Elon Musk reacted.

It is a time for radical moves in the auto industry Just before the Type 00 unveiling, news broke that Stellantis NV’s chief executive and Nissan Motor Co’s chief financial officer were abruptly departing. A few weeks before, Volkswagen AG (VW) had announced the seemingly unthinkable: Closing auto plants in Germany (it later agreed with unions to keep them open, but reduce capacity).

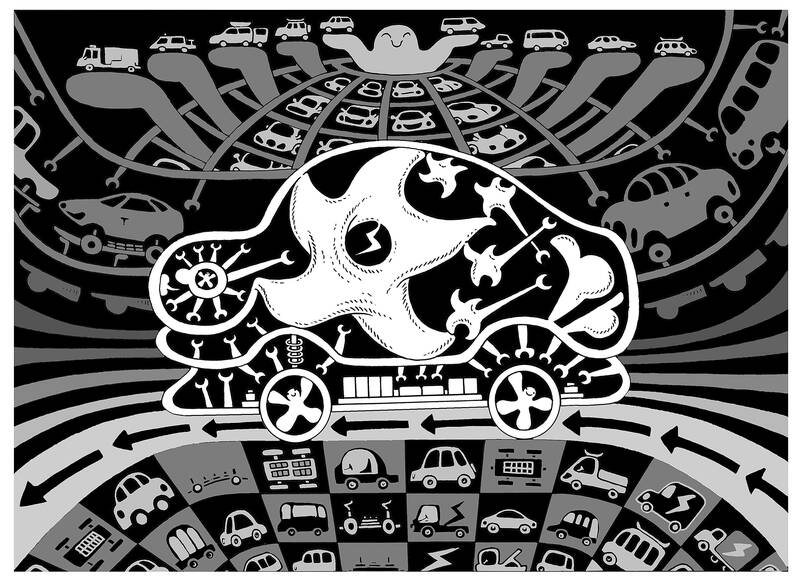

Illustration: Mountain People

A little earlier, Ford Motor Co touted what felt like its millionth pivot on EVs. Not to be outdone, General Motors Co (GM) closed out last year with a trifecta: A US$5 billion write-down in China, the sale of its stake in a US battery factory project, and the sudden closure of its in-house robotaxi arm, Cruise.

The industry has been hit by not one, but two meteorites: Chinese automakers and electrification.

In an echo of how China upended the solar panel industry, it has built a staggering amount of auto manufacturing capacity, enough to make more than 50 million passenger vehicles, of all types, a year. That is about double domestic demand and enough to satisfy more than half of the global market.

Foreign manufacturers who enjoyed growth and profits from China through joint ventures for decades have seen those collapse, as GM’s write-down illustrates. Chinese exports shot up to 6 million vehicles last year, overtaking Japan.

Relatedly, China has made itself the EV heartland, accounting for two-thirds of worldwide sales last year and more than 90 percent of the growth. Even then, domestic sales of 11.2 million EVs equate to only about half of what can be produced there. China also dominates the underlying supply chain.

For the legacy auto industry, electrification is hard enough. Doing it while their existing businesses in China unravel, rising Chinese exports eat into their other markets, all while Chinese manufacturers and suppliers dominate EVs already, is the stuff of crisis.

Now, enter politics. No major power can sit back and watch a strategic industrial sector get eviscerated by cheap imports from a country that has built massive capacity on the back of its own strategic policies and subsidies. The US has already thrown up barriers to Chinese EV imports that would almost certainly rise under the incoming administration of US president-elect Donald Trump.

Europe’s position is more complicated given stronger trade links with China and the German automakers’ ties to the country. Yet even Europe raised tariffs on Chinese EVs last year.

However, protectionism comes at a cost. Ford and GM have retreated from much of the world already to the US, where their profits rest overwhelmingly on serving the local — and, by global tastes, unusual — appetite for pickup trucks and large sport utility vehicles (SUVs). Their forays into EVs and automated driving have been slow and spotty or outright abortive. Trump’s super-charged protectionism and likely easing of fuel-economy standards would offer some respite (albeit not without some pain).

However, it would not change some basic realities. The US is a large, relatively high-margin market, but it is also mature. The post-COVID-19-pandemic surge in average transaction prices (ATPs) to almost US$50,000 has supported revenue growth even as unit sales flatline, but vehicle ownership costs, including financing and insurance, are reaching a natural limit.

“You’re not going to get volume growth and we are close to the end of the runway for ATP growth,” said Kevin Tynan, head of research at Presidio Group, an investment bank specializing in the auto sector.

In addition, his recent analysis points out that the US suffers from excess capacity already, with auto-plant utilization running below 75 percent in 18 of the previous 19 quarters; the second-worst streak in the past 50 years. The worst was between 2006 and 2011, which included the financial crisis and the bankruptcies of GM and Chrysler. The lack of growth and cost overhang is reflected in Detroit’s single-digit earnings multiples.

Higher tariffs seem like a Band-Aid, given the global reordering going on. Even if Europe also turns further toward protectionism, China’s combination of low costs, supply-chain dominance and EV leadership means its companies would continue to make inroads elsewhere, particularly in growth markets such as Southeast Asia.

Intuitively, China’s excessive capacity should foster its own restructuring and its auto sector is already experiencing widespread losses. Still, that reckoning might be years off and even a rationalized Chinese auto sector would remain a formidable global actor.

As Michael Dunne, an industry consultant at Dunne Insights, wrote in a recent blog post, while criticism of unfair competition is understandable, “China is playing a different game, and it’s playing to win. Where do your solar panels come from, again?”

Electrification, led by Chinese manufacturers, is also changing the underlying architecture of vehicles. Besides its brand, the majority of an automaker’s added value traditionally resides in the vehicle’s most complex, and essential, element: the engine. EVs upend that. Battery and electric motors are more easily commoditized, as pricing trends attest.

The arc of EVs bends toward cars becoming more like devices. A new electric SUV designed to take on the likes of BYD Co and Tesla Inc was unveiled in China last month by Xiaomi Corp, the smartphone maker.

Little wonder Jaguar is going for broke with six-figure EVs, androgyny and neon colors. More prosaically, when there are suddenly too many manufacturers with too many factories and too many similar brands and products, it is time to cut costs or maybe even whole companies. “Delete ordinary,” to repurpose Jaguar’s awkward phrasing.

The most immediately challenged company is Nissan, reeling from losses owed partly to low-cost competition from Chinese rivals and facing a bond maturity wall this year. It has already opened talks with compatriot Honda Motor Co about merging — in part, reportedly and notably, as a response to interest from Taiwan’s Hon Hai Precision Industry Co, the iPhone maker known internationally as Foxconn Technology Group.

Stellantis NV, with its 14 brands spread across international markets exposed to Chinese competitors and a US market where it badly misjudged inventory, also looks ripe for restructuring. While brands such as Jeep and Ram look fine, others such as Maserati and Fiat might be more valuable as trophies for an international — probably Chinese — buyer.

The cost-cutting and closures at other firms such as GM, Ford and VW might seem less dramatic, but speak to the same basic challenge. Even Tesla is exposed, at least to the China challenge. Its recent record market cap of US$1.5 trillion captures this, if obliquely, as the vast majority relates to the visions of robotaxis touted by Musk, as well as his newfound political influence — all of which helpfully distract from Tesla’s stalled EV sales and lower margins.

The profound and sustained challenge to auto industry economics will force cost cutting, mergers — and all the political wrangling, labor unrest and trade friction this entails. The future has started already.

Liam Denning is a Bloomberg Opinion columnist covering energy. A former banker, he edited the Wall Street Journal’s Heard on the Street column and wrote the Financial Times’ Lex column. This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

It is almost three years since Chinese President Xi Jinping (習近平) and Russian President Vladimir Putin declared a friendship with “no limits” — weeks before Russia’s invasion of Ukraine in February 2022. Since then, they have retreated from such rhetorical enthusiasm. The “no limits” language was quickly dumped, probably at Beijing’s behest. When Putin visited China in May last year, he said that he and his counterpart were “as close as brothers.” Xi more coolly called the Russian president “a good friend and a good neighbor.” China has conspicuously not reciprocated Putin’s description of it as an ally. Yet the partnership

The ancient Chinese military strategist Sun Tzu (孫子) said “know yourself and know your enemy and you will win a hundred battles.” Applied in our times, Taiwanese should know themselves and know the Chinese Communist Party (CCP) so that Taiwan will win a hundred battles and hopefully, deter the CCP. Taiwanese receive information daily about the People’s Liberation Army’s (PLA) threat from the Ministry of National Defense and news sources. One area that needs better understanding is which forces would the People’s Republic of China (PRC) use to impose martial law and what would be the consequences for living under PRC

Chinese Nationalist Party (KMT) Chairman Eric Chu (朱立倫) said that he expects this year to be a year of “peace.” However, this is ironic given the actions of some KMT legislators and politicians. To push forward several amendments, they went against the principles of legislation such as substantive deliberation, and even tried to remove obstacles with violence during the third readings of the bills. Chu says that the KMT represents the public interest, accusing President William Lai (賴清德) and the Democratic Progressive Party of fighting against the opposition. After pushing through the amendments, the KMT caucus demanded that Legislative Speaker

Although former US secretary of state Mike Pompeo — known for being the most pro-Taiwan official to hold the post — is not in the second administration of US president-elect Donald Trump, he has maintained close ties with the former president and involved himself in think tank activities, giving him firsthand knowledge of the US’ national strategy. On Monday, Pompeo visited Taiwan for the fourth time, attending a Formosa Republican Association’s forum titled “Towards Permanent World Peace: The Shared Mission of the US and Taiwan.” At the event, he reaffirmed his belief in Taiwan’s democracy, liberty, human rights and independence, highlighting a