Brian Niccol is cleaning the grounds out of the coffee machines.

On Tuesday, the new Starbucks Corp chief executive officer suspended guidance for next year after sales plunged.

Like his counterpart at Nike Inc, where new CEO Elliott Hill also withdrew the company’s outlook for its fiscal year, Niccol is in effect carrying out the classic corporate “kitchen sinking.”

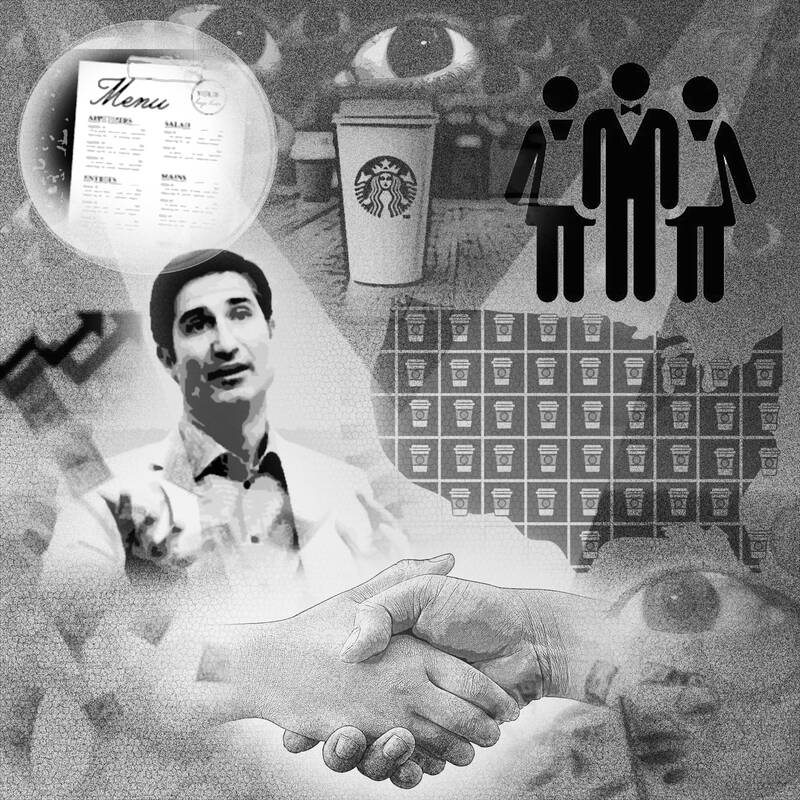

Illustration: Kevin Sheu

This involves getting all of the bad news out of the way early to create a low base from which to rebuild.

Like Hill, he should go further.

In Niccol’s case, that means ditching the aggressive targets that Starbucks patriarch Howard Schultz set two years ago to expand global same store-sales by 7 to 9 percent through next year and increase earnings by 15 to 20 percent per annum over the same period.

Given that Starbucks reported a 7 percent decline in same-store sales in the quarter ended Sept. 29 and that Niccol has suspended the current guidance, falling short of Schultz’s growth ambitions looks a foregone conclusion.

However, formally replacing Starbucks’ long-term goals with something achievable is still wise. It would wipe the coffee counter clean for what is shaping up to be Niccol’s “Back to Starbucks” strategic blueprint. Crucially, it would also set him apart from former CEO Laxman Narasimhan, who held onto Schultz’s targets and was forced to lower them several times.

The 6 percent decline in US same-store sales in the fiscal fourth quarter underlines the extent of the turnaround.

This is not a case of a corporate breakup or hiving off underperforming divisions to create value — although Nicol should look at options for its underperforming China business such as a full or partial sale or franchising.

Instead, fixing Starbucks is about doing lots of things better to ensure customers leave its cafes clutching their morning brews feeling delighted, not disappointed.

Niccol, who became CEO last month after reviving fast-casual dining chain Chipotle Mexican Grill Inc, appears to be aware of this requirement.

He said in a video message on Tuesday, echoing an open letter to staff last month, that he planned to restore Starbucks’ historic coffee shop vibe. He will also sensibly focus on the domestic business. More details will be revealed when Starbucks announces earnings.

However, we have gotten some clues. Niccol is revisiting its stores to ensure they have the amenities that customers expect — this could mean the return of self-service milk and sugar for example — and appropriate staffing.

Bloomberg News last week reported that only 33 percent of workers who responded to a survey of the chain’s 10,000 US company-owned locations said stores consistently had sufficient staffing.

Niccol said he would remove bottlenecks in cafes and simplify its overly complex menu. To help this along, he aims to refine its mobile ordering system, so that it does not overwhelm physical locations. Here he could emulate a strategy at Chipotle, where he established a separate assembly line for digital orders.

And he plans to overhaul marketing so that it is addressed to all customers, not just the narrow subset who are members of its loyalty program. He recently hired Tressie Lieberman, who previously worked at Chipotle as its chief brand officer.

Another focus: Pricing. Niccol recently cut back on promotions and discounts. The chain had increasingly leaned on these tools to drive demand, but they can lead to a spike in customers, exacerbating the long lines that have pushed some customers away.

Niccol should address the regular cost of a cup of coffee. While the chain has always had a premium positioning, prices have drifted up. Starbucks is an affordable luxury, but for many customers it has become increasingly unaffordable.

Restoring Starbucks’ local-coffeehouse feel also means upgrading stores. While new models are already being rolled out, many locations look tired. These two areas should be a priority.

The extent of the sales decline and Niccol’s long to-do list underline that, like at Nike, turning around Starbucks will not be quick or easy.

The shares have risen 26 percent since he was appointed in August. Given the scale of Niccol’s task, a dose of reality was needed. Investors should sip on a cold brew, not a frothy cappuccino.

Andrea Felsted is a Bloomberg Opinion columnist covering consumer goods and the retail industry. Previously, she was a reporter for the Financial Times. This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

In their recent op-ed “Trump Should Rein In Taiwan” in Foreign Policy magazine, Christopher Chivvis and Stephen Wertheim argued that the US should pressure President William Lai (賴清德) to “tone it down” to de-escalate tensions in the Taiwan Strait — as if Taiwan’s words are more of a threat to peace than Beijing’s actions. It is an old argument dressed up in new concern: that Washington must rein in Taipei to avoid war. However, this narrative gets it backward. Taiwan is not the problem; China is. Calls for a so-called “grand bargain” with Beijing — where the US pressures Taiwan into concessions

The term “assassin’s mace” originates from Chinese folklore, describing a concealed weapon used by a weaker hero to defeat a stronger adversary with an unexpected strike. In more general military parlance, the concept refers to an asymmetric capability that targets a critical vulnerability of an adversary. China has found its modern equivalent of the assassin’s mace with its high-altitude electromagnetic pulse (HEMP) weapons, which are nuclear warheads detonated at a high altitude, emitting intense electromagnetic radiation capable of disabling and destroying electronics. An assassin’s mace weapon possesses two essential characteristics: strategic surprise and the ability to neutralize a core dependency.

Chinese President and Chinese Communist Party (CCP) Chairman Xi Jinping (習近平) said in a politburo speech late last month that his party must protect the “bottom line” to prevent systemic threats. The tone of his address was grave, revealing deep anxieties about China’s current state of affairs. Essentially, what he worries most about is systemic threats to China’s normal development as a country. The US-China trade war has turned white hot: China’s export orders have plummeted, Chinese firms and enterprises are shutting up shop, and local debt risks are mounting daily, causing China’s economy to flag externally and hemorrhage internally. China’s

During the “426 rally” organized by the Chinese Nationalist Party (KMT) and the Taiwan People’s Party under the slogan “fight green communism, resist dictatorship,” leaders from the two opposition parties framed it as a battle against an allegedly authoritarian administration led by President William Lai (賴清德). While criticism of the government can be a healthy expression of a vibrant, pluralistic society, and protests are quite common in Taiwan, the discourse of the 426 rally nonetheless betrayed troubling signs of collective amnesia. Specifically, the KMT, which imposed 38 years of martial law in Taiwan from 1949 to 1987, has never fully faced its