Tech billionaires such as Bill Gates, Mark Zuckerberg and Elon Musk are not just among the richest people in human history. They also are exceptionally powerful — socially, culturally and politically. While this is partly a reflection of the social status that our society attaches to wealth in general, that is not the whole story.

What matters even more than simple wealth is that these particular billionaires are viewed as entrepreneurial geniuses who exhibit unique levels of creativity, daring, foresight and expertise on a wide range of topics. Add the fact that many of them control major means of communication — namely, the key social media platforms — and you have something almost unparalleled in recent history.

The image of the rich, brave businessman who transforms the world can be traced back at least to the robber barons of the Gilded Age. One of the main sources of its contemporary popular appeal is Ayn Rand’s novel Atlas Shrugged, whose protagonist, John Galt, strives to recreate capitalism through the sheer force of his idealism and will.

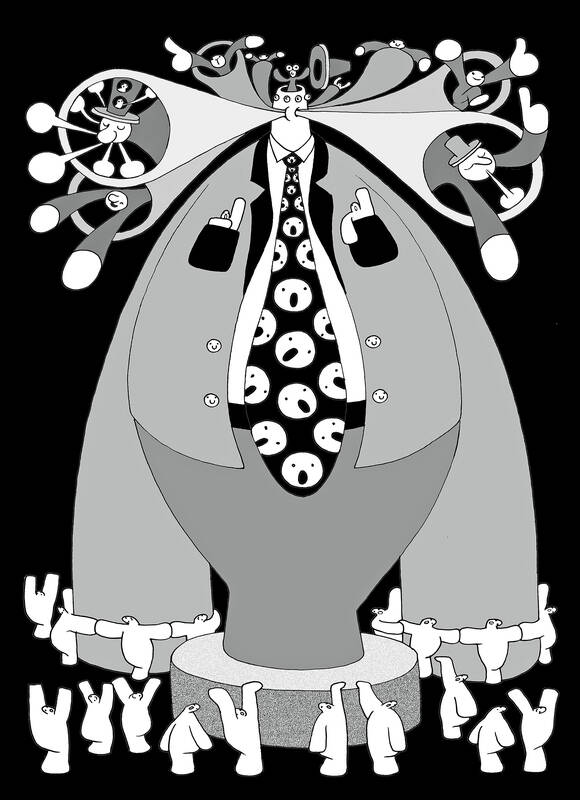

Illustration: Mountain People

While Rand’s novel has long held canonical status in the minds of Silicon Valley entrepreneurs and libertarian-leaning politicians, the influence of its central archetype is hardly confined to those circles. From Bruce Wayne (Batman) and Tony Stark (Iron Man) to Darius Tanz in the TV series Salvation, rich, technologically savvy innovators who save the world from impending disaster are a staple of our popular culture.

Some individuals would always have more power than others, but how much power is too much? Once upon a time, power was linked to physical strength or military prowess, whereas now its perquisites usually stem from “persuasion power,” which, as explained in the book Power and Progress, is rooted in status or prestige. The greater your status, the more easily you can persuade others.

The sources of status vary greatly across societies, as does the extent to which it is unequally distributed. In the US, status became firmly linked to money and wealth during the Industrial Revolution, and income and wealth inequality skyrocketed as a result. While there have been periods in which government intervention sought to reverse the trend, US society has always been structured around a steep status hierarchy.

This structure is problematic for several reasons. For starters, the constant competition for status — and the persuasion power it confers — is largely a zero-sum affair, because status is a “positional good.” More status for you means less status for your neighbor, and a steeper status hierarchy implies that some people would be happy while many others are unhappy and dissatisfied.

Moreover, investments in zero-sum activities tend to be inefficient and excessive compared with investments in non-zero-sum activities. Is it better to spend a million dollars on gold Rolex watches or on learning new skills?

Both might have intrinsic value — the beauty of the watch versus the pride of acquiring new knowledge — but the first investment merely signals that you are richer and more capable of conspicuous consumption than others. The second, by contrast, increases your human capital and might also contribute to society. The first is largely zero-sum, and the second is largely non-zero-sum. Worse, the first can easily get out of hand as everyone spends even more on conspicuous consumption to stay ahead of others. Commentators often ask why someone with hundreds of millions of dollars would ever need hundreds of millions more. There are few things that you cannot afford if you already have US$500 million, so why long for US$1 billion? Because “billionaire” is a rank of status. What matters is not the spending power, but the prestige and power that it confers relative to one’s peers. Under a “wealth is status” equilibrium, a mad dash by the ultra wealthy to amass ever more wealth becomes inevitable.

There are evolutionary and social bases for linking persuasion power to status and prestige. After all, it is individually rational to learn from people who have expertise, and it is reasonable to link expertise to success.

Moreover, this form of learning is good for communities, because it facilitates coordination and a convergence toward best practices. However, when status is linked to wealth and wealth inequality grows very large, the foundation underpinning expertise starts to crumble.

Consider the following thought experiment. Who has greater expertise on carpentry — a good, master carpenter or a hedge fund billionaire? It seems natural to choose the former; but the more that wealth confers status, the greater the weight attached to hedge fund billionaires’ views, even on carpentry. Or consider a more relevant contemporary example. Whose views on freedom of speech carry more weight today, a tech billionaire or a philosopher who has long grappled with the issue, and whose evidence and arguments have been subjected to scrutiny by other qualified experts? Millions of people on X have implicitly chosen the former.

The deeper we are drawn into the “wealth is status” equilibrium, the more we might come to accept the supremacy of tech billionaires. Yet it is difficult to believe that wealth could be a perfect measure of merit or wisdom, let alone a useful proxy for authority on carpentry or freedom of speech. Moreover, wealth is always somewhat arbitrary. We can argue endlessly about whether LeBron James is better than Wilt Chamberlain was at the peak of his basketball career, but in terms of wealth, there is no contest. While Chamberlain had an estimated net worth of US$10 million at the time of his death in 1999, James’ net worth is estimated at US$1.2 billion.

These different outcomes are not about each player’s respective talent or work ethic. Rather, Chamberlain happened to live at a time when sports stars were not compensated as much as they are today. This is partly about technology (everybody can watch James today thanks to TV and digital media), partly about norms (paying hundreds of millions to cultural superstars has become more acceptable), and partly about taxes (if the US still had a top marginal income tax rate above 90 percent, James would have less money and the country would have less wealth inequality).

Similarly, if the tech sector had not become so central to the economy and if it was not driven by such strong winner-take-all dynamics (which is partly a matter of choice about how we organize certain markets), today’s tech tycoons would not have become so rich. The fact that Gates and Musk have been taxed less does not make them any wiser, but it certainly has made them wealthier and thus more influential under the prevailing “wealth is status” equilibrium.

Such figures also benefit from an even more pernicious dynamic explored in Power and Progress, using the example of French diplomat Ferdinand de Lesseps. Lesseps gained tremendous status in late 19th-century France, where he was known as “Le Grand Francais,” owing to his success in completing the construction of the Suez Canal in the face of longstanding British opposition to the project.

Lesseps had foresight, and he demonstrated great skill in convincing politicians in Egypt and France that maritime international trade would become very important. He was also tremendously lucky: The hoped-for technologies that he needed to build the canal without locks (which was initially impossible, because of the amount of excavation and digging involved) were developed just in time to save the project.

With his Suez victory, Lesseps gained great prestige. However, what he did with his new status is instructive. He became reckless, unhinged and cocky, pushing the Panama Canal project in an unworkable direction that ultimately led to the deaths of more than 20,000 people and the financial ruin of many more (including his own family). Like all forms of power, persuasion power can make one hubristic, unrestrained, disruptive and socially obnoxious.

Lesseps’ story remains relevant, because it clearly has echoes in the behavior of many billionaires today. While some of the US’ wealthiest individuals do not use their wealth-derived status to influence critical public debates (think businessman Warren Buffett), many do. Gates, Musk, businessman George Soros and others do not hesitate to weigh in on matters that are important to them, and while it is easy to welcome such contributions from those whom we agree with, we should resist this temptation. It makes a lot of sense for society to tap into the knowledge and wisdom of those with expertise on a given topic, but it is counterproductive to amplify the status of those who already have plenty of status (and are working very hard to increase it). Of course, it is not entirely billionaires’ fault that US policy is fueling massive inequality (although they certainly lobby for policies that have this effect). However, they should bear responsibility if they misuse the immense status that wealth affords them under conditions of rising inequality. That is especially true when they leverage their status to advance their own economic interest at the expense of others’, or to polarize an already divided society with provocative rhetoric or status-seeking behavior.

If unaccountable billionaires already wield too much undue social, cultural and political influence, the last thing we should want is to give them even bigger public forums — for example, in the form of their own social network, as Musk now has through his ownership of X. Instead, we should pursue stronger institutional means of limiting the power and influence of those who are already privileged, as well as reconsider the tax, regulatory and spending policies that created such massive disparities in the first place.

The most important step would also be the most difficult. We need to start having a serious conversation about what we should value, and how we can recognize and reward the contributions of those who do not command vast fortunes. While most people would agree that there are many ways to contribute to society, and that excelling in one’s chosen vocation ought to be a source of individual satisfaction and the esteem of others, we have disregarded this principle and are at risk of forgetting it altogether. That, too, is a symptom of the problem.

Daron Acemoglu, institute professor of economics at MIT, is coauthor (with Simon Johnson) of Power and Progress: Our Thousand-Year Struggle Over Technology and Prosperity.

Copyright: Project Syndicate

US political scientist Francis Fukuyama, during an interview with the UK’s Times Radio, reacted to US President Donald Trump’s overturning of decades of US foreign policy by saying that “the chance for serious instability is very great.” That is something of an understatement. Fukuyama said that Trump’s apparent moves to expand US territory and that he “seems to be actively siding with” authoritarian states is concerning, not just for Europe, but also for Taiwan. He said that “if I were China I would see this as a golden opportunity” to annex Taiwan, and that every European country needs to think

Why is Chinese President Xi Jinping (習近平) not a “happy camper” these days regarding Taiwan? Taiwanese have not become more “CCP friendly” in response to the Chinese Communist Party’s (CCP) use of spies and graft by the United Front Work Department, intimidation conducted by the People’s Liberation Army (PLA) and the Armed Police/Coast Guard, and endless subversive political warfare measures, including cyber-attacks, economic coercion, and diplomatic isolation. The percentage of Taiwanese that prefer the status quo or prefer moving towards independence continues to rise — 76 percent as of December last year. According to National Chengchi University (NCCU) polling, the Taiwanese

Today is Feb. 28, a day that Taiwan associates with two tragic historical memories. The 228 Incident, which started on Feb. 28, 1947, began from protests sparked by a cigarette seizure that took place the day before in front of the Tianma Tea House in Taipei’s Datong District (大同). It turned into a mass movement that spread across Taiwan. Local gentry asked then-governor general Chen Yi (陳儀) to intervene, but he received contradictory orders. In early March, after Chiang Kai-shek (蔣介石) dispatched troops to Keelung, a nationwide massacre took place and lasted until May 16, during which many important intellectuals

US President Donald Trump’s return to the White House has brought renewed scrutiny to the Taiwan-US semiconductor relationship with his claim that Taiwan “stole” the US chip business and threats of 100 percent tariffs on foreign-made processors. For Taiwanese and industry leaders, understanding those developments in their full context is crucial while maintaining a clear vision of Taiwan’s role in the global technology ecosystem. The assertion that Taiwan “stole” the US’ semiconductor industry fundamentally misunderstands the evolution of global technology manufacturing. Over the past four decades, Taiwan’s semiconductor industry, led by Taiwan Semiconductor Manufacturing Co (TSMC), has grown through legitimate means