When Volkswagen Group last month invested US$5 billion in US electric truck and sports utility vehicle (SUV) maker Rivian, the start-up’s shares soared on the cash infusion.

Volkswagen’s stock dropped 1.6 percent.

Some analysts praised the creation of a Volkswagen-Rivian joint venture to help the German giant with software.

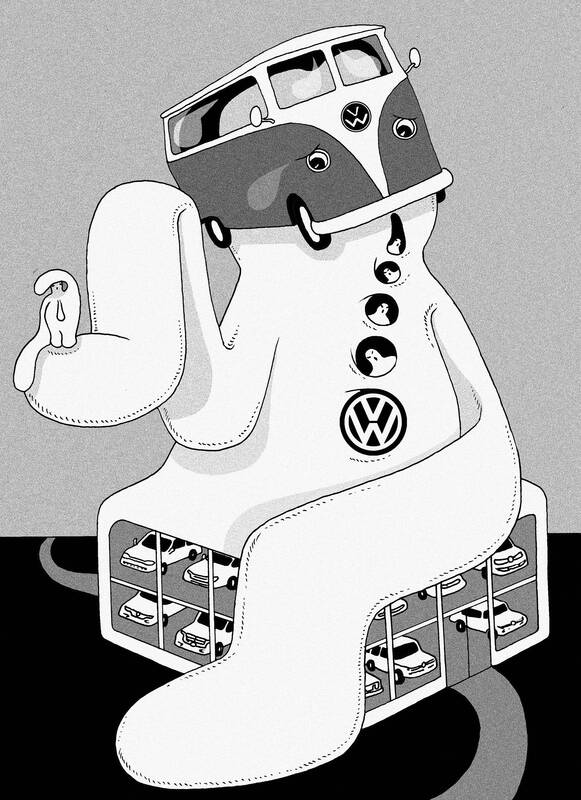

Illustration: Mountain People

However, the investment raised cost concerns and reinforced how Volkswagen’s problems in critical areas undermined its electric vehicle (EV) transition globally.

The world’s second-largest automaker faces a vexing landscape of challenges in Europe, the US and especially China, where domestic EV makers led by BYD are swiping its market share. It has lost more stock value than any major competitor over the past two years.

By 2030, Volkswagen plans to have more than 30 new electric or hybrid models in China and hopes to boost sales from about 3 million today to about 4 million, lifting its market share to 15 percent.

In the near term, the company expects to continue losing China market share and hopes to merely maintain its position in Europe, Volkswagen chief financial officer Arno Antlitz told Reuters.

Volkswagen’s troubles in China underscore bleak prospects for foreign automakers in the country, where homegrown EV makers are dominating the world’s fastest EV transition with high-tech, low-cost models. Volkswagen is particularly vulnerable, because China accounts for about one-third of its sales.

That leaves Volkswagen’s much-smaller US operation shouldering its biggest growth ambitions: The automaker plans to more than double its US market share to 10 percent by 2030.

About a dozen investors and analysts interviewed by Reuters expressed skepticism that the automaker has found the formula to achieve a sales boom.

Volkswagen lacks a distinctive US brand identity or breakthrough product plans in a crowded market that favors larger vehicles and has proven resistant to EVs, they said.

One upside: Volkswagen would not have to compete with Chinese EVs in the US, which in May levied 100 percent tariffs on them.

Volkswagen has launched initiatives to boost its competitiveness in China over the next two years, Antlitz told Reuters in February.

“Until then, we do not expect rising market share — rather the opposite,” he said.

The automaker expects to achieve cost parity with local competitors for compact cars by 2026, and aims to remain the largest international automaker in China and third-largest overall, a Volkswagen spokesperson said in a written response to questions last week.

“Profitability is our top priority,” the spokesperson said. “We will not grow at any price.”

Volkswagen’s China share dropped from 19 percent in 2019 to 14.5 percent last year. It has notched modest sales growth in the US, but would need to supercharge that to meet its market share target.

The Rivian tie-up is part of that US strategy, but would not result in any new models to boost sales. The 50-50 venture would instead develop software and other technology for both automakers.

Still, Volkswagen said it hopes products made with technology produced by the venture would attract new customers.

Rivian declined to comment on how it could influence Volkswagen’s sales.

Volkswagen said it is planning more than 30 battery-electric models for the US market, without providing details. What is known is that Volkswagen would launch two electric models, a pickup and an SUV, in late 2026 under the Scout nameplate, a historic US off-road brand, to be built at a new US$2 billion South Carolina factory with capacity for 200,000 units.

The plant could expand to double that size, Scout CEO Scott Keogh told Reuters, but declined to say what output he expected by 2030.

Continuing on the retro theme, Volkswagen would release an electric version of its iconic Microbus, called the ID. Buzz, later this year. It also plans new gas-powered SUVs and possibly new plug-in hybrids, Volkswagen US chief Pablo di Si said in an April interview with Reuters.

“I know we have aggressive targets,” Di Si said. “Our plans are very solid.”

Investors would need convincing. Volkswagen faces entrenched competitors in hybrids (Toyota and Ford) and SUVs (General Motors, Ford and Toyota). EV demand is waning globally, but especially in the US, where they accounted for 8 percent of all sales last year.

Jeffrey Scharf, a former Volkswagen investor who now owns Mercedes-Benz stock, called Volkswagen’s market share goal “hopelessly optimistic.”

“If they had something like full self-driving or some other unique feature before anyone else did, I’d see it,” he said. “But they don’t have a recognizable niche anymore.”

‘WISHFUL THINKING’

Volkswagen’s predicament reflects an industry shake-up stemming from the breakneck pace of EV development in China, where domestic brands have tapped government subsidies and the nation’s superior battery supply chains.

EVs and hybrids represent about 40 percent of China’s new car sales, the China Passenger Car Association said.

Foreign brands’ China market share has fallen from 62 percent in 2019 to 44 percent in the first four months of this year.

Volkswagen has fared better than some: General Motor’s China sales slumped by more than half this year so far.

Volkswagen is spending heavily to stop the bleeding. It announced in April a US$2.7 billion investment in an EV design and production hub in Anhui Province. That followed a US$700 million investment in Chinese EV maker Xpeng in December last year to develop EV platforms and software, along with two EV models by 2026.

For now, the automaker must accept a diminished role in China’s EV market, six industry analysts told Reuters.

Volkswagen also faces challenges in hitting its US market share target.

Volkswagen needs to make products that spark the kind of enthusiasm as its historic successes — from the Beetle to the Microbus to the Golf, investors and analysts said.

Volkswagen’s current SUV lineup, including the full-sized Atlas, is tailored to US tastes, but the company’s badge is not quite premium, nor economy, said Roger Norberg, director of equity research at Thrivent Financial, a Volkswagen investor.

He called the automaker’s market share target “wishful thinking.”

Keogh said Scout would deliver larger vehicles that appeal to US buyers seeking a car with a US feel.

“To make growth happen, you have to go into these new segments,” Keogh said.

Still, investors highlighted that all-electric trucks and SUVs have attracted relatively few sales despite high-profile offerings from Ford, General Motors, Tesla and Rivian.

Both the Scouts are to start at US$50,000 to US$60,000, Keogh said.

Volkswagen declined to comment on the pricing of the ID. Buzz.

New SUVs would be “critical in terms of volume, share and profit,” Di Si said, but did not provide product details or clarity on where the company sees room for a new volume seller.

Volkswagen already offers small, medium and large SUVs. Its larger Atlas has boosted the automaker’s SUV sales in the US, which rose 23 percent in the second quarter.

Volkswagen is still wavering on plug-in hybrids. Executives once lauded hybrids as a bridge to fully electric cars, but shifted to prioritize EVs after Volkswagen’s 2015 diesel-emissions scandal.

Now, automakers that stuck with hybrids, including Toyota and Ford, are seeing their sales jump.

“Investing money in hybrid versions of selected models would be better spent than in Scout,” said Moritz Kronenberger, portfolio manager at Volkswagen shareholder Union Investment. “I have yet to find anyone who yells ‘hooray’ about the plans for Scout.”

Taiwan is a small, humble place. There is no Eiffel Tower, no pyramids — no singular attraction that draws the world’s attention. If it makes headlines, it is because China wants to invade. Yet, those who find their way here by some twist of fate often fall in love. If you ask them why, some cite numbers showing it is one of the freest and safest countries in the world. Others talk about something harder to name: The quiet order of queues, the shared umbrellas for anyone caught in the rain, the way people stand so elderly riders can sit, the

Taiwan’s fall would be “a disaster for American interests,” US President Donald Trump’s nominee for undersecretary of defense for policy Elbridge Colby said at his Senate confirmation hearing on Tuesday last week, as he warned of the “dramatic deterioration of military balance” in the western Pacific. The Republic of China (Taiwan) is indeed facing a unique and acute threat from the Chinese Communist Party’s rising military adventurism, which is why Taiwan has been bolstering its defenses. As US Senator Tom Cotton rightly pointed out in the same hearing, “[although] Taiwan’s defense spending is still inadequate ... [it] has been trending upwards

After the coup in Burma in 2021, the country’s decades-long armed conflict escalated into a full-scale war. On one side was the Burmese army; large, well-equipped, and funded by China, supported with weapons, including airplanes and helicopters from China and Russia. On the other side were the pro-democracy forces, composed of countless small ethnic resistance armies. The military junta cut off electricity, phone and cell service, and the Internet in most of the country, leaving resistance forces isolated from the outside world and making it difficult for the various armies to coordinate with one another. Despite being severely outnumbered and

Small and medium enterprises make up the backbone of Taiwan’s economy, yet large corporations such as Taiwan Semiconductor Manufacturing Co (TSMC) play a crucial role in shaping its industrial structure, economic development and global standing. The company reported a record net profit of NT$374.68 billion (US$11.41 billion) for the fourth quarter last year, a 57 percent year-on-year increase, with revenue reaching NT$868.46 billion, a 39 percent increase. Taiwan’s GDP last year was about NT$24.62 trillion, according to the Directorate-General of Budget, Accounting and Statistics, meaning TSMC’s quarterly revenue alone accounted for about 3.5 percent of Taiwan’s GDP last year, with the company’s