An emerging debate about the definition of infrastructure suggests that Western democracies are starting to shift their priorities. The renewed focus on infrastructure and what it includes is to be welcomed — not least because it rebuts the claim that the West has lost faith in the future.

Many argue that investment in traditional physical infrastructure — such as electricity grids, water distribution and transportation networks — is no longer enough. There is now a push to fund social and cultural infrastructure — community assets such as libraries, schools, hospitals and care systems that were not previously categorized in this way.

Meanwhile, the growing power of Big Tech has prompted discussions about the need for digital public infrastructure.

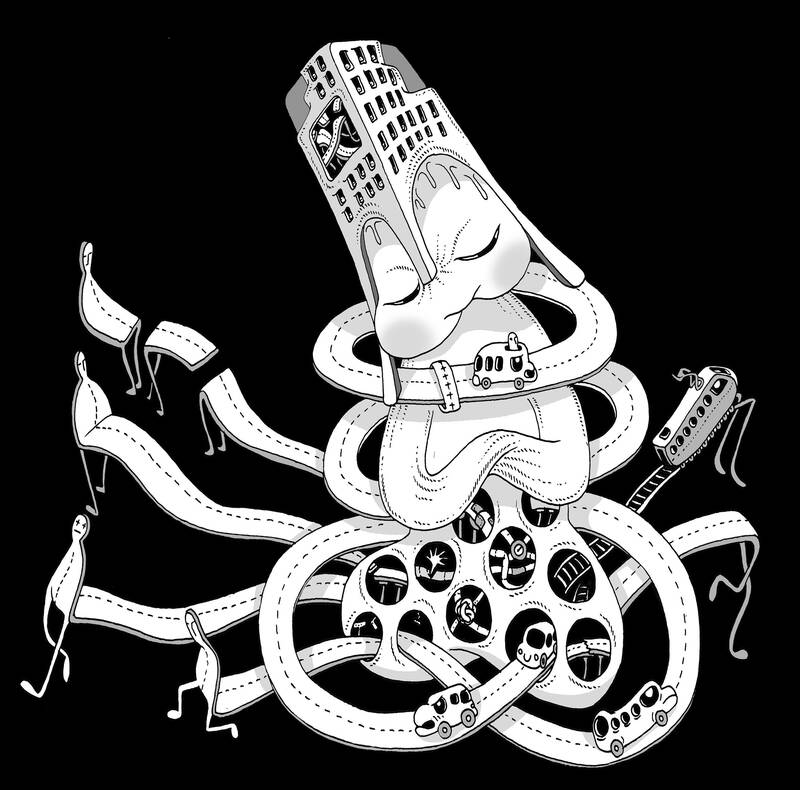

Illustration: Mountain People

The word infrastructure, coined by French railroad engineers in the late 19th century, refers to a complex set of systems that enable a society’s functioning. This complexity is exemplified by the tangle of pipes and cables buried beneath city streets that construction crews occasionally unearth. The new gets layered onto the old: British drivers are still using roads first built by the Romans, and tunnels and bridges constructed by the Victorians. Such durability points to the forward-looking nature of investment in infrastructure, which might exist for a very long time indeed.

It is surprisingly difficult to find data on the extent and condition of existing infrastructure. This is because infrastructure projects vary enormously. While it is possible to count, say, the number of bridges, these are hardly standard units. To be sure, the scale and scope of some networks are easier to measure in physical terms — such as megawatts per hour for generating capacity or the distance of fiber-optic cables — but the costs of installation and the value created by each unit will differ significantly depending on the context. It is harder still to measure the quality and resilience of infrastructure.

What is clear, though, is that Western democracies have under-invested in the maintenance of this “traditional” infrastructure. Look no further than the decrepit state of German railways, bridges in the US, and British water and sewage services. Unsurprisingly, citizens are increasingly concerned about the implications of deteriorating infrastructure for their daily lives and the economy as a whole.

Now add to this the Western world’s growing understanding of infrastructure as encompassing social and cultural spaces, and structures as well. The rationale for this expanded definition is straightforward: public goods and services that produce healthy and well-educated citizens are essential components of the foundation for the business and individual activities that allow the economy and society to function.

In his 2012 book, Infrastructure: The Social Value of Shared Resources, Brett Frischmann identifies three characteristics that unite infrastructure assets:

First, they are non-rival in use (that is, many people can use them simultaneously).

Second, demand for them is derivative — for example, people do not consume electricity for its own sake, but because of what it enables them to do.

Third, they can be used as inputs for a wide range of other activities.

To that I would add three other essential qualities. As Frischmann notes, infrastructure functions as a sort of public commons, implying that access to these assets should be universal, or at least not dependent on an individual’s personal connections or status. It is thus a progressive form of investment, delivering inclusive and sustainable prosperity.

Moreover, infrastructure often has positive spillovers or network effects, with benefits multiplying once use reaches a sufficient scale. For example, broadband’s economic impact increased more than in proportion to the number of people connected when density of use made new business models feasible.

However, the opposite is also true: as the rail network deteriorates, there will come a point when using it to transport goods becomes uneconomic.

Lastly, infrastructure generally involves upfront investment, resulting in low marginal supply costs. While this might seem obvious, it is worth emphasizing because it raises two classic public-goods problems: how to finance as much infrastructure as society needs and how to regulate privately provided assets when the increasing returns to scale make them natural monopolies.

Even more important, at least in today’s context, is the long time horizon of these assets.

When engineer Joseph Bazalgette built the London sewage system starting in 1859, he ensured that its capacity vastly exceeded the expected need. This foresight has allowed the network to function for more than 150 years, over which time the city’s population has tripled, to more than 9 million. Only now is the financially embattled Thames Water expanding the system, after many years of under-investment led to a scandalous increase in sewage spills.

A dim future awaits any society that allows its existing infrastructure to degrade and under-invests in new needs. Bridges and cables might seem unglamorous, but these common assets will form the basis of economic growth for years to come and the countries investing in them are creating the conditions they need to thrive.

As the conversation about broadening the scope of infrastructure grows louder in the West, there are glimmers of hope that these societies are finally waking up to the need to invest in the common good.

Diane Coyle is a professor of public policy at the University of Cambridge.

Copyright: Project Syndicate

Taiwan is a small, humble place. There is no Eiffel Tower, no pyramids — no singular attraction that draws the world’s attention. If it makes headlines, it is because China wants to invade. Yet, those who find their way here by some twist of fate often fall in love. If you ask them why, some cite numbers showing it is one of the freest and safest countries in the world. Others talk about something harder to name: The quiet order of queues, the shared umbrellas for anyone caught in the rain, the way people stand so elderly riders can sit, the

Taiwan’s fall would be “a disaster for American interests,” US President Donald Trump’s nominee for undersecretary of defense for policy Elbridge Colby said at his Senate confirmation hearing on Tuesday last week, as he warned of the “dramatic deterioration of military balance” in the western Pacific. The Republic of China (Taiwan) is indeed facing a unique and acute threat from the Chinese Communist Party’s rising military adventurism, which is why Taiwan has been bolstering its defenses. As US Senator Tom Cotton rightly pointed out in the same hearing, “[although] Taiwan’s defense spending is still inadequate ... [it] has been trending upwards

After the coup in Burma in 2021, the country’s decades-long armed conflict escalated into a full-scale war. On one side was the Burmese army; large, well-equipped, and funded by China, supported with weapons, including airplanes and helicopters from China and Russia. On the other side were the pro-democracy forces, composed of countless small ethnic resistance armies. The military junta cut off electricity, phone and cell service, and the Internet in most of the country, leaving resistance forces isolated from the outside world and making it difficult for the various armies to coordinate with one another. Despite being severely outnumbered and

Small and medium enterprises make up the backbone of Taiwan’s economy, yet large corporations such as Taiwan Semiconductor Manufacturing Co (TSMC) play a crucial role in shaping its industrial structure, economic development and global standing. The company reported a record net profit of NT$374.68 billion (US$11.41 billion) for the fourth quarter last year, a 57 percent year-on-year increase, with revenue reaching NT$868.46 billion, a 39 percent increase. Taiwan’s GDP last year was about NT$24.62 trillion, according to the Directorate-General of Budget, Accounting and Statistics, meaning TSMC’s quarterly revenue alone accounted for about 3.5 percent of Taiwan’s GDP last year, with the company’s