South Korea’s location — placing it under pressure from both North Korea and China — has driven it to assume a more powerful defense posture. Previously focused on cars and chips, the nation has also harnessed its manufacturing prowess to become the world’s ninth-largest weapons supplier. Seoul should press its case for becoming an even larger part of the international arms market, while ensuring it does not lose sight of its own tech expertise.

Russia’s invasion of Ukraine is adding momentum to global demand, with neighbors bolstering their defenses as a counter to Moscow’s aggressive stance. That is helping South Korean suppliers, including Hanwha Aerospace Co, which makes land-based artillery for a growing list of European customers. Escalating tensions closer to home — with North Korea and in the Taiwan Strait — as well as conflicts such as Israel’s war in Gaza, drove global military spending 9 percent higher last year to US$2.2 trillion.

Poland is one of Hanwha’s most important customers with Estonia, Finland and Norway also buyers of the company’s K9 self-propelled howitzers capable of hitting targets 60km away. These relationships date back well before Russian troops crossed into Ukraine in 2022, with many European nations boosting defensive procurement following Moscow’s 2014 annexation of Crimea.

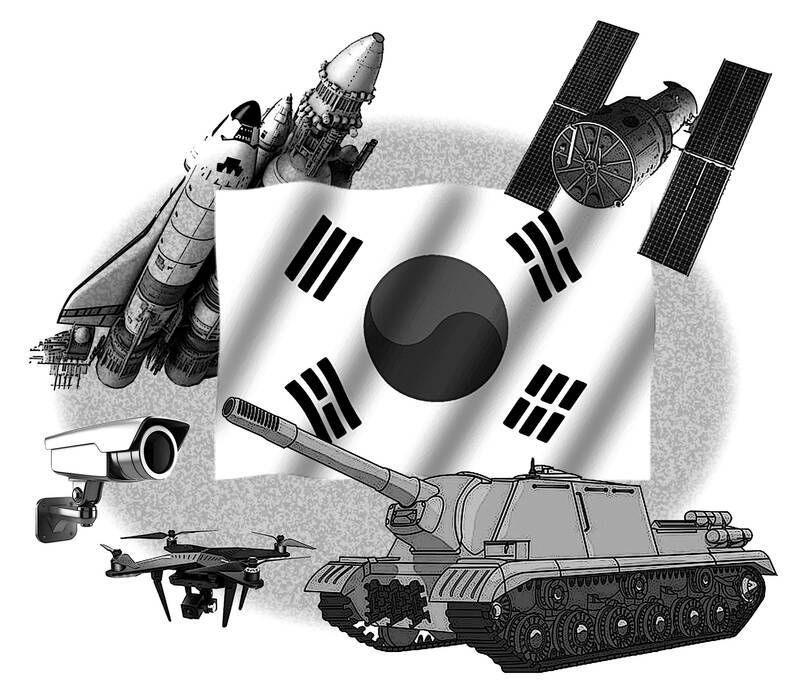

Illustration: Constance Chou

Romania, shaken by Russia’s attack on its northern neighbor, might be next in line to buy artillery from South Korea. Bucharest is in talks to buy 54 K9s at a cost of more than 1 trillion won (US$759.3 million), the company said in a filing last month.

Years of product development, foreign relationship-building, and Russia’s expansionism have driven Hanwha’s sales of land-based systems, which include tanks and rocket launchers. Revenue for that division doubled to 4.1 trillion won last year.

While those figures were boosted by domestic orders and a merger with its munitions affiliate, overseas sales are set to continue growing.

Its backlog of export orders jumped 10-fold from 1.7 trillion won in 2021 to 20 trillion won at the end of last year, a February financial presentation showed.

Hanwha also makes space launch vehicles, satellites, aircraft and surveillance cameras.

Yet it is the land systems that drive profit, accounting for 42 percent of sales and 81 percent of operating income. Poland is crucial to that long-term growth and last year signed deals totaling more than 30 trillion won with South Korean suppliers, including Hanwha and Hyundai Rotem Co.

However, the commercial relationship between Warsaw and Seoul has hit some snags in the past few months.

First, there are concerns that Poland’s new government under Prime Minister Donald Tusk, which took office on Dec. 13, might cancel or even roll back foreign procurement deals signed by its predecessor. Just prior to Tusk’s swearing-in, the outgoing administration signed a 3.45 trillion won deal to purchase K9 self-propelled howitzers over eight years.

The new government has signaled it would honor earlier contracts, but will look to more local procurement to feed its defense needs, industry publication Defense News reported.

The other hiccup is funding. The weapons were to be bought with the help of loans from state-backed Export-Import Bank of Korea.

However, the bank hit its statutory limit in lending to a single borrower (Poland), curbing further purchases.

That problem was finally solved last week with South Korea’s parliament raising Kexim’s capital limit, providing a boost to arms exporters.

Even amid the political and financial uncertainties, the trend toward buying more weapons, including ammunition, from South Korea is likely to continue.

North Korea might have already become involved in the Ukraine war, shipping containers to Russia that could hold millions of military shells, a South Korean official said last week. That should embolden Seoul to further boost production for domestic and foreign use.

In November, Hanwha announced a US$134 million deal to supply charges — the propellant used to send an artillery shell — to the UK. Significantly, those supplies meet NATO standards for 155mm shells, opening the prospect of Hanwha providing much-needed ammunition to Ukraine via NATO and its member states.

However, those weapons will not go there directly. South Korean law prohibits arms sales to a conflict zone. The workaround is for companies to sell to allies such as the US, which send their own ammunition to Ukraine and use the South Korean supplies to replenish their stock.

That approach was demonstrated again in January when NATO announced a 1.1 billion euro (US$1.2 billion) contract to purchase 155mm shells to aid Ukraine in its defense.

In this case, Belgium, Lithuania and Spain pooled money to buy from French and German weaponsmakers, Reuters reported. Yet a global shortage of ammunition-production capacity, and no sign of a let-up in the Ukraine war, makes it likely South Korea would be called upon to help meet demand.

Yet Seoul’s strength in the arms sector is largely based on price, an advantage that might not last if tensions cool. Beyond the military, the nation’s upper hand lies in its technological prowess and an ability to marry manufacturing with precision electronics. That should be the basis on which the country pivots its weapons industry, including toward dual-use items such as surveillance systems, drones and ships.

If the conflict continues to drag on, South Korea’s expanding production capacity and growing reputation as a reliable supplier would likely elevate its position in the global weapons trade, but it must also prepare for peace, and ensure it has developed a sector that can persist without war.

Tim Culpan is a Bloomberg Opinion columnist covering technology in Asia. Previously, he was a technology reporter for Bloomberg News.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

The Chinese government on March 29 sent shock waves through the Tibetan Buddhist community by announcing the untimely death of one of its most revered spiritual figures, Hungkar Dorje Rinpoche. His sudden passing in Vietnam raised widespread suspicion and concern among his followers, who demanded an investigation. International human rights organization Human Rights Watch joined their call and urged a thorough investigation into his death, highlighting the potential involvement of the Chinese government. At just 56 years old, Rinpoche was influential not only as a spiritual leader, but also for his steadfast efforts to preserve and promote Tibetan identity and cultural

Former minister of culture Lung Ying-tai (龍應台) has long wielded influence through the power of words. Her articles once served as a moral compass for a society in transition. However, as her April 1 guest article in the New York Times, “The Clock Is Ticking for Taiwan,” makes all too clear, even celebrated prose can mislead when romanticism clouds political judgement. Lung crafts a narrative that is less an analysis of Taiwan’s geopolitical reality than an exercise in wistful nostalgia. As political scientists and international relations academics, we believe it is crucial to correct the misconceptions embedded in her article,

Sung Chien-liang (宋建樑), the leader of the Chinese Nationalist Party’s (KMT) efforts to recall Democratic Progressive Party (DPP) Legislator Lee Kun-cheng (李坤城), caused a national outrage and drew diplomatic condemnation on Tuesday after he arrived at the New Taipei City District Prosecutors’ Office dressed in a Nazi uniform. Sung performed a Nazi salute and carried a copy of Adolf Hitler’s Mein Kampf as he arrived to be questioned over allegations of signature forgery in the recall petition. The KMT’s response to the incident has shown a striking lack of contrition and decency. Rather than apologizing and distancing itself from Sung’s actions,

US President Trump weighed into the state of America’s semiconductor manufacturing when he declared, “They [Taiwan] stole it from us. They took it from us, and I don’t blame them. I give them credit.” At a prior White House event President Trump hosted TSMC chairman C.C. Wei (魏哲家), head of the world’s largest and most advanced chip manufacturer, to announce a commitment to invest US$100 billion in America. The president then shifted his previously critical rhetoric on Taiwan and put off tariffs on its chips. Now we learn that the Trump Administration is conducting a “trade investigation” on semiconductors which