Chennai and Bengaluru, two important hubs of economic activity in southern India, are 285km apart. The fastest train journey between them takes four hours and 20 minutes. In the same time, you could cover the 1,070km from Beijing to Shanghai by high-speed rail (HSR). In this comparison of domestic travel lies something unexpected: the two countries’ divergent success in tapping global export markets.

Starting with the inaugural Beijing-Tianjin line in 2008, China’s high-speed rail is now a 41,843km network and supports a top speed of 354kph. Meanwhile, the Vande Bharat Express, India’s newest and fastest passenger locomotive, is unable to accelerate to its full potential — most parts of the existing tracks do not even allow 129kph.

A Japanese-backed bullet train project is under construction, but it is running late. The first route, which would cut down the travel time between Mumbai and Ahmedabad in Indian Prime Minster Narendra Modi’s home state of Gujarat to under three hours, from more than five at present, would be operational only by August 2026. By then, China’s HSR is on track to swell to more than 48,280km.

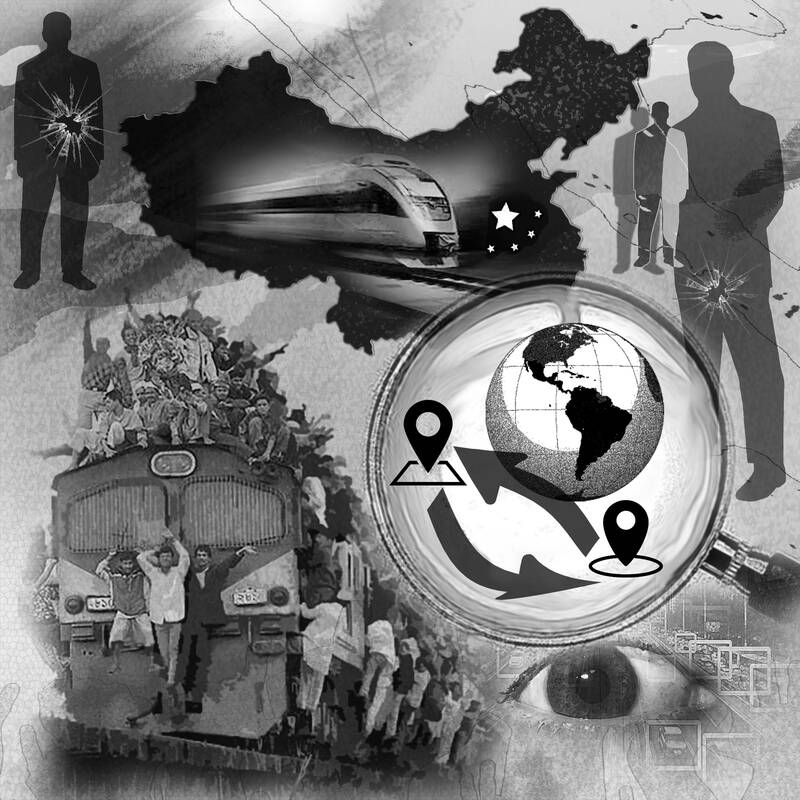

Illustration: Kevin Sheu

So what has local train travel got to do with exports? A lot, according to Lin Tian (林田) at INSEAD in Singapore and Yue Yu (悅宇) at the University of Toronto. The economics professors looked carefully at the staggered opening of new high-speed rail stations in China between 2008 and 2013 and asked a simple question: Is there a relationship between a firm’s domestic geographic integration and its embrace of international markets? Their analysis suggests that there is indeed a strong link. A one-standard-deviation increase in geographic integration leads to a 4 percent rise in a firm’s export revenue, driven by a 5 percent reduction in the unit price of exported products and a 9 percent increase in export volume.

“The evidence was clear: Firms were not just exporting more, but they were exporting better,” the researchers wrote.

India’s notorious red tape and shortage of good-quality infrastructure usually get the rap for its merchandise exports not taking off the way they did in China. Cities like Bengaluru did well in software outsourcing because services exporters did not need roads or ports; they could even live with long and frequent power-grid outages.

While this analysis is broadly correct, it does not give enough attention to transport as a tool for knowledge sharing. In their paper, Lin and Yue cited anecdotal testimony from 2013. The New York Times interviewed the sales manager of a garment export company based in Changsha, the capital of south-central China’s Hunan Province, who had increased his business trips to Guangzhou in the Pearl River Delta to once a month from twice a year to “pick up on fashion changes in style and color more quickly.” The bullet train, which covers the 563km journey in a little over two hours, had boosted his orders by 50 percent.

It is here that India has fallen behind. In services exports, skilled engineers relocated from smaller cities to Bengaluru and Hyderabad in the south and the national capital region around Delhi in the north. In finance and entertainment, they gravitated toward Mumbai. However, in goods trade, the know-how was with owner-managers. They were not always to be found in large exporting clusters, either.

Take Meerut, once a decently sized hub of component makers in India’s landlocked north. That was before Maruti Suzuki India Ltd created a new center of gravity around its factory on the outskirts of New Delhi in the 1990s. Meerut to Delhi was still a short train ride, but over the past two decades, the spatial contours of the industry have changed once more. Thanks to Hyundai Motor Co and Toyota Motor Corp, the locus has moved southward, to peninsular India. Going to Chennai from Meerut by train takes 39 hours. The Beijing-Guangzhou HSR link, covering roughly the same 1,770km distance, squeezed travel time to eight hours — a decade ago. Nowadays, the journey takes 7 hours and 38 minutes.

No surprise then that the small and mid-sized industries of Meerut and other older production hubs in the northern state of Uttar Pradesh are fading. More generally, the contribution of the manufacturing sector to India’s economy has shrunk to just 13 percent, the lowest in more than 50 years.

Contrast this hollowing out with Taiwan, whose own high-speed rail began service in early 2007 with a 354km line connecting Taipei in the north to Kaohsiung in the south. Its real benefit, though, lay in the fast link it provided to stops along the route, allowing the chip sector to expand beyond Hsinchu in the northwest, home to Taiwan Semiconductor Manufacturing Co (TSMC). Faster connectivity has done wonders for Taichung and Tainan, in the center and south of the island, respectively. TSMC’s Tainan factory, for example, hosts its most advanced technology and has become the base for making Apple Inc chips used in iPhones and Macs.

India’s missed opportunity might have a bearing on its future. Coming up from when it could make and sell only very simple things, China has steadily climbed the ladder of sophistication, according to the Observatory of Economic Complexity, which produces annual statistics on the topic. India’s rise has been more muted. Imagine a situation where the smaller economy is trying to catch up by putting more of its youth to work in new factories. Meanwhile, China expands the spread of its manufacturing skill via its HSR network to the rust belt in the northeast of the country and to the hinterlands in the west, where labor costs are still low.

Who comes out ahead in 2030? Or 2050? China’s decline as a manufacturing powerhouse is not as inevitable as the consensus among analysts believes it to be.

Maglev, or magnetic levitation, has crunched the 30.6km distance from Shanghai’s airport to the city to eight minutes. The technology’s cost disadvantage — a four to nine-fold increase over high-speed rail — put off the US. That was nearly 20 years ago. From 2027, Japan is set to offer passengers the option of floating over the tracks between Tokyo and Nagoya at a maximum speed of 505kph; in 10 years, the shinkansen’s maglev version is slated to stretch beyond to Osaka.

By extending the technology to intercity travel, China might be able to connect its financial center with its political capital in 2.5 hours. China’s superior productivity might trump India’s demographic advantage.

New Delhi has gotten a few things right. At least for large firms that could keep up with onerous filing requirements, a nationwide consumption tax has made the flow of goods from one state to another smoother than before the introduction of the levy in 2017. Many new highways have been built; airlines are to add 100 planes a year to their fleets in the foreseeable future. The country is meeting record peak power demand of 240GW without debilitating shortages. Smartphones and cheap data have allowed people to connect half a world away over Zoom.

Yet all fledgling exporters intuitively know that 90 percent of their future wealth might come from a single serendipitous encounter. In a continent-sized economy where the first railway line arrived in 1853, trains remain the most affordable way for entrepreneurs in peripheral cities and towns to dip in and out of production centers in search of those opportunities, without sacrificing their wafer-thin margins.

Give people the option of skipping expensive hotel stays, and you would find them going long distances to meet prospective customers, suppliers, employees, partners — anyone who could fill a capability gap, open a new market, find a unique product or source a promising technology. Air travel is for when the outcome of a meeting is in the bag. The train is for moonshots. The first country in the world to land a spacecraft near the lunar south pole should not be taking this long to crunch intercity travel.

Andy Mukherjee is a Bloomberg Opinion columnist covering industrial companies and financial services in Asia. Previously, he worked for Reuters, the Straits Times and Bloomberg News. This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Trying to force a partnership between Taiwan Semiconductor Manufacturing Co (TSMC) and Intel Corp would be a wildly complex ordeal. Already, the reported request from the Trump administration for TSMC to take a controlling stake in Intel’s US factories is facing valid questions about feasibility from all sides. Washington would likely not support a foreign company operating Intel’s domestic factories, Reuters reported — just look at how that is going over in the steel sector. Meanwhile, many in Taiwan are concerned about the company being forced to transfer its bleeding-edge tech capabilities and give up its strategic advantage. This is especially

US President Donald Trump last week announced plans to impose reciprocal tariffs on eight countries. As Taiwan, a key hub for semiconductor manufacturing, is among them, the policy would significantly affect the country. In response, Minister of Economic Affairs J.W. Kuo (郭智輝) dispatched two officials to the US for negotiations, and Taiwan Semiconductor Manufacturing Co’s (TSMC) board of directors convened its first-ever meeting in the US. Those developments highlight how the US’ unstable trade policies are posing a growing threat to Taiwan. Can the US truly gain an advantage in chip manufacturing by reversing trade liberalization? Is it realistic to

The US Department of State has removed the phrase “we do not support Taiwan independence” in its updated Taiwan-US relations fact sheet, which instead iterates that “we expect cross-strait differences to be resolved by peaceful means, free from coercion, in a manner acceptable to the people on both sides of the Strait.” This shows a tougher stance rejecting China’s false claims of sovereignty over Taiwan. Since switching formal diplomatic recognition from the Republic of China to the People’s Republic of China in 1979, the US government has continually indicated that it “does not support Taiwan independence.” The phrase was removed in 2022

US President Donald Trump, US Secretary of State Marco Rubio and US Secretary of Defense Pete Hegseth have each given their thoughts on Russia’s war with Ukraine. There are a few proponents of US skepticism in Taiwan taking advantage of developments to write articles claiming that the US would arbitrarily abandon Ukraine. The reality is that when one understands Trump’s negotiating habits, one sees that he brings up all variables of a situation prior to discussion, using broad negotiations to take charge. As for his ultimate goals and the aces up his sleeve, he wants to keep things vague for