Billionaires are not accustomed to waiting in line, especially not in scorching heat, but Art Basel, the world’s most influential art fair, often triggers a feeding frenzy at 11am on opening day as the most substantial and eager buyers vie to purchase rare works or discover an elusive piece missing from their collections. This year’s edition, recently concluded, featured 284 galleries from 36 countries showing works by 3,200 contemporary artists.

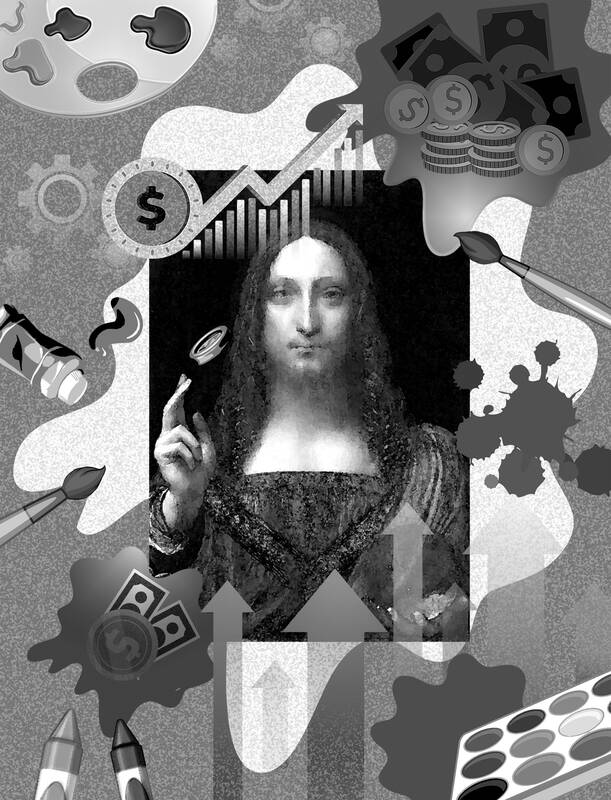

The Sotheby’s Mei Moses Index, the most authoritative measure of art prices, has increased eightfold over the past five decades since Art Basel was launched in 1970. In 2017, Saudi Crown Prince Mohammed bin Salman made global headlines by paying US$450 million for Leonardo da Vinci’s Salvator Mundi, the most expensive painting ever sold.

The law of supply and demand suggests that art prices should continue to increase. On the supply side, the fact that most of the world’s pre-eminent artists are dead and that museums and long-term collectors acquire the finest artworks means that the available stock is constantly shrinking. Moreover, each artwork is essentially a monopoly, owing to its inherent uniqueness.

Illustration: Louise Ting

On the demand side, owning a prized piece by a renowned artist has become the ultimate status symbol. After all, purchasing a Patek Philippe watch, a Bentley, or even a swanky Hamptons estate is nothing compared with buying a Picasso. By spending US$100 million on a painting, collectors are signaling their ability to devote a colossal sum of money to an object that would never generate dividends or rent. Their pleasure is complete when a rival buys a piece off them at a higher price.

However, there are signs that the market might be turning. Since the 2008 financial crisis, Art Basel has become a leading indicator of the state of the super-rich and, consequently, of rising global wealth inequality. As billionaires’ fortunes grew by more than 380 percent since 2009, art sales have surged as well, with sales exceeding US$10 million increasing by nearly 700 percent.

Just over a decade ago, Benjamin Mandel, then an economist at the Federal Reserve Bank of New York, began studying the art market. Initially, he thought that the market was expanding at an unsustainable pace, because prices were growing faster than global GDP, but having dug deeper, Mandel determined that the fine art market does not reflect the state of the broader global economy, only part of it. Simply put, it is a market created by and for the super-rich, and billionaires play by different rules than the rest of the world.

Mandel’s logic was straightforward. With the population of ultra-wealthy buyers and their fortunes growing much faster than the available supply, the art market mirrors the increase in wealth inequality. It is hardly surprising that some of the world’s most prominent collectors are also some of its wealthiest investors, such as Citadel CEO Ken Griffin, TPG founding partner David Bonderman and Point72 CEO Steve Cohen.

However, recent trends have called into question Mandel’s thesis. Despite the surge in the number of billionaires, art purchases and prices have plateaued. The prevailing mood at this year’s Art Basel was one of anxiety, as dealers roamed the halls searching for answers. Some speculate that the state of the art market indicates declining confidence among the world’s richest people. When the economy is booming, collectors are more inclined to invest in art and take on leverage, especially when borrowing costs are low.

However, these dynamics can shift quickly during downturns. For example, the 2008 crisis caused art prices to fall by 60 percent.

The art market is notoriously illiquid. Given that a handful of remote buyers set the prices, contractions tend to be sharp and abrupt. The same collectors who were eager to buy when prices were rising are suddenly reluctant to bid when prices are falling. The art-market crash of the early 1990s, which was preceded by the stock-market crash of 1987 and the collapse of the Japanese asset-price bubble, is a case in point.

Rising prices require the entry of new buyers, leading some established dealers to worry that the market has reached the point of exhaustion. As one respected gallerist told me “The higher the prices, the thinner the air.” This is not due to a lack of effort. The global gallery Gagosian has expanded to 21 locations, and rival Hauser and Wirth has 18 spaces, including remote lifestyle facilities in Somerset and Menorca designed to lure wealthy collectors. Both galleries employ large sales teams and actively promote their artists, but potential new clients travel less and are more costly to acquire.

Meanwhile, the Chinese, historically significant marginal buyers, have retrenched amid a shift toward deglobalization.

Investors tend to construct reassuring narratives such as “the Powell pivot” and the “Greenspan put.” As Nobel laureate economist Robert J. Shiller observed, market prices are often influenced by such narratives and can diverge significantly from fundamental values, giving rise to speculative bubbles.

However, assessing the fundamental value of art presents a unique challenge, as it does not generate dividends and lacks functional utility. So, participants find themselves placing too much weight on price trends. Rising prices, as Shiller suggested, can fuel positive sentiment and create a self-reinforcing cycle that contributes to the formation of speculative bubbles.

Nonetheless, others argue that the true value of art is not financial, but “positional” — in other words, it confers status.

To be sure, status is subjective. For example, during Art Basel’s first VIP day, Hauser & Wirth proudly announced the sale of Louise Bourgeois’s bronze sculpture Spider IV for US$22.5 million. For some, paying millions of dollars for an ominous metal spider suggests wealth and sophisticated taste. For others, it is as gauche as wearing a Louis Vuitton T-shirt or paying for a Twitter blue checkmark. Rather than signifying status, it might imply impressionability and insecurity.

R. James Breiding is the author of Swiss Made: The Untold Story Behind Switzerland’s Success (Profile Books, 2013) and Too Small to Fail: Why Some Small Nations Outperform Larger Ones and How They Are Reshaping the World (Harper Business, 2019).

Copyright: Project Syndicate

Trying to force a partnership between Taiwan Semiconductor Manufacturing Co (TSMC) and Intel Corp would be a wildly complex ordeal. Already, the reported request from the Trump administration for TSMC to take a controlling stake in Intel’s US factories is facing valid questions about feasibility from all sides. Washington would likely not support a foreign company operating Intel’s domestic factories, Reuters reported — just look at how that is going over in the steel sector. Meanwhile, many in Taiwan are concerned about the company being forced to transfer its bleeding-edge tech capabilities and give up its strategic advantage. This is especially

US President Donald Trump last week announced plans to impose reciprocal tariffs on eight countries. As Taiwan, a key hub for semiconductor manufacturing, is among them, the policy would significantly affect the country. In response, Minister of Economic Affairs J.W. Kuo (郭智輝) dispatched two officials to the US for negotiations, and Taiwan Semiconductor Manufacturing Co’s (TSMC) board of directors convened its first-ever meeting in the US. Those developments highlight how the US’ unstable trade policies are posing a growing threat to Taiwan. Can the US truly gain an advantage in chip manufacturing by reversing trade liberalization? Is it realistic to

The US Department of State has removed the phrase “we do not support Taiwan independence” in its updated Taiwan-US relations fact sheet, which instead iterates that “we expect cross-strait differences to be resolved by peaceful means, free from coercion, in a manner acceptable to the people on both sides of the Strait.” This shows a tougher stance rejecting China’s false claims of sovereignty over Taiwan. Since switching formal diplomatic recognition from the Republic of China to the People’s Republic of China in 1979, the US government has continually indicated that it “does not support Taiwan independence.” The phrase was removed in 2022

US President Donald Trump, US Secretary of State Marco Rubio and US Secretary of Defense Pete Hegseth have each given their thoughts on Russia’s war with Ukraine. There are a few proponents of US skepticism in Taiwan taking advantage of developments to write articles claiming that the US would arbitrarily abandon Ukraine. The reality is that when one understands Trump’s negotiating habits, one sees that he brings up all variables of a situation prior to discussion, using broad negotiations to take charge. As for his ultimate goals and the aces up his sleeve, he wants to keep things vague for