As Thai politicians jockey for positions ahead of elections that must be called by March next year, focus is turning to how the next leadership will manage risks including sky-high prices, a bloated budget deficit and the highest level of household debt in the region.

The tepid pace of recovery in Southeast Asia’s second-largest economy will be front and center for voters as authorities grapple with the fastest inflation in 14 years, the baht’s plunge to the lowest since 2006 and household debt at 88 percent of GDP.

“While the recovery in tourism will help support growth over the next two to three years, an aging population and high household debt places Thailand as the laggard in the region,” said Lee Ju Ye (李居業), an economist at Maybank Investment Banking Group. “These are challenges that will not be easily resolved even with a new prime minister.”

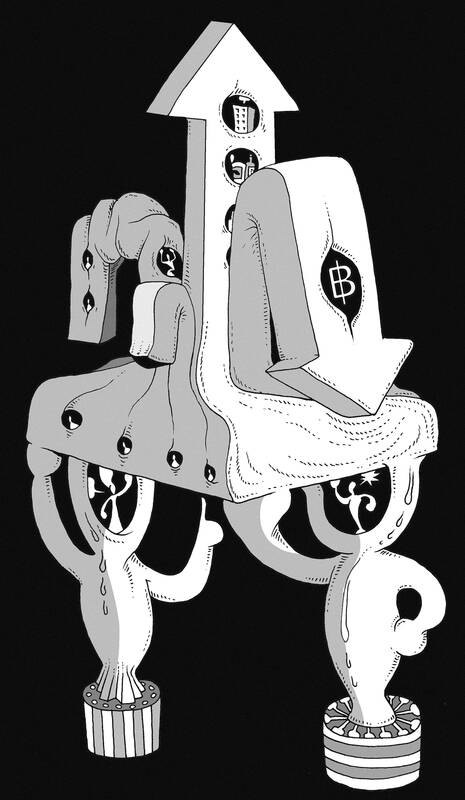

Illustration: Mountain People

Tourism makes up 12 percent of GDP.

Thai Prime Minister Prayuth Chan-ocha, who last week won a favorable court ruling on a tenure dispute, has seen his popularity slide, reflecting the growing public disappointment with his government’s efforts to rebuild an economy that is still reeling from the COVID-19 pandemic and lagging peers in the region.

Paetongtarn Shinawatra, daughter of former Thai prime minister Thaksin Shinawatra, and Thai lawmaker Pita Limjaroenrat from the opposition Move Forward Party are top choices for prime minister in recent opinion polls.

Here are some of the economic challenges the next administration are likely to inherit:

RISING COSTS

Thailand’s recovery has been uneven, with those in export industries bouncing back faster while low-earners and tourism workers struggle amid inflation of more than 7 percent, triggering the first price hike in a decade among noodle makers and the first increase in minimum wage since 2020. Lately, the nation has to worry about the impact of floods, too.

The Bank of Thailand is expected to keep tightening rates although at a gradual pace compared with peers in the region. Lenders also have subsequently raised rates. The central bank has said price gains should cool to within its target by the middle of next year.

Net-oil importer Thailand continues to subsidize diesel, electricity and cooking gas. The Cabinet extended some of the support until Nov. 20, mindful of the pain on consumers, which is also exacerbating household debt.

ELEVATED DEBT

Household debt has jumped by 1.1 trillion baht (US$29.5 billion) to almost 90 percent of GDP from 80 percent before the pandemic. Although the ratio eased slightly in the second quarter, it remains the highest in Southeast Asia, making it tougher for the government to stimulate the economy. In the past, frustration with debt has sparked protests among farmers.

“Slower growth and higher inflation are exacerbating household debt and inequality,” said Pipat Luengnaruemitchai, chief economist at Bangkok-based Kiatnakin Phatra Securities.

These problems, if unresolved, could unleash more political and economic woes, he said.

Record Deficit

The government has spent about US$5.5 billion to subsidize energy prices, and the latest extension is expected to increase the bill by another 20 billion baht.

The budget gap ballooned to a record 700 billion baht in the fiscal year that ended last month, compared with 450 billion baht in 2019.

“We have exhausted all the fiscal ammunition during COVID with relief schemes and cash handouts,” said Kiatanantha Lounkaew, a lecturer of economics at Thammasat University.

On the brighter side, borrowing for the fiscal year that started this month was set at 1.05 trillion baht, substantially lower than the record 1.8 trillion baht in fiscal 2021.

BAHT VOLATILITY

The baht has lost 20 percent since the end of 2020. While this might be good for exports and tourism, the volatility hits investors and consumers.

There had been calls on the central bank to reconsider a hands-off stance as the baht depreciates. The Federation of Thai Industries, the nation’s top business group, said companies want a stable baht to prevent inflation from squeezing their profit margins.

Concerns that the US might abandon Taiwan are often overstated. While US President Donald Trump’s handling of Ukraine raised unease in Taiwan, it is crucial to recognize that Taiwan is not Ukraine. Under Trump, the US views Ukraine largely as a European problem, whereas the Indo-Pacific region remains its primary geopolitical focus. Taipei holds immense strategic value for Washington and is unlikely to be treated as a bargaining chip in US-China relations. Trump’s vision of “making America great again” would be directly undermined by any move to abandon Taiwan. Despite the rhetoric of “America First,” the Trump administration understands the necessity of

US President Donald Trump’s challenge to domestic American economic-political priorities, and abroad to the global balance of power, are not a threat to the security of Taiwan. Trump’s success can go far to contain the real threat — the Chinese Communist Party’s (CCP) surge to hegemony — while offering expanded defensive opportunities for Taiwan. In a stunning affirmation of the CCP policy of “forceful reunification,” an obscene euphemism for the invasion of Taiwan and the destruction of its democracy, on March 13, 2024, the People’s Liberation Army’s (PLA) used Chinese social media platforms to show the first-time linkage of three new

If you had a vision of the future where China did not dominate the global car industry, you can kiss those dreams goodbye. That is because US President Donald Trump’s promised 25 percent tariff on auto imports takes an ax to the only bits of the emerging electric vehicle (EV) supply chain that are not already dominated by Beijing. The biggest losers when the levies take effect this week would be Japan and South Korea. They account for one-third of the cars imported into the US, and as much as two-thirds of those imported from outside North America. (Mexico and Canada, while

I have heard people equate the government’s stance on resisting forced unification with China or the conditional reinstatement of the military court system with the rise of the Nazis before World War II. The comparison is absurd. There is no meaningful parallel between the government and Nazi Germany, nor does such a mindset exist within the general public in Taiwan. It is important to remember that the German public bore some responsibility for the horrors of the Holocaust. Post-World War II Germany’s transitional justice efforts were rooted in a national reckoning and introspection. Many Jews were sent to concentration camps not