For years, climate scientists have warned about the ferocious wildfires and hurricanes that are now overwhelming many communities. Today, alarms are ringing about a related financial danger: risks lurking within government bonds, the biggest part of the global debt market.

A growing number of investors, academics, policymakers and regulators are questioning whether credit ratings — the ubiquitous scores that underpin much of the financial system — are accounting for the impact that extreme weather events and policy changes related to global warming will have on borrowers. Once those risks materialize, they threaten to trigger the kind of sudden, chaotic asset collapse described by the late economist Hyman Minsky. The effects would sweep through pension funds, and the balance sheets of central and commercial banks.

“A lot of this looks like it’s years and decades ahead, but when you look at the financial implications, you run into risks of Minsky-type moments and rapid devaluations,” said Steven Feit, an attorney at the Center for International Environmental Law in Washington who focuses on climate liability and finance. “The climate time scale is decades or a century long. The financial timeline is right now.”

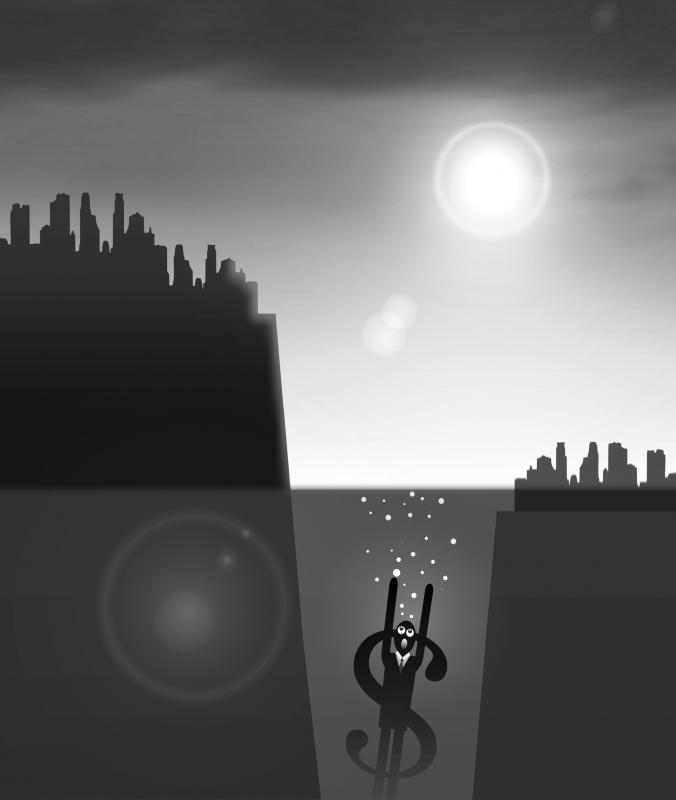

Illustration: Yusha

The big three credit rating companies — Moody’s Investors Service, S&P Global Ratings and Fitch Ratings — all say they take climate-related factors into account when assessing government borrowers and defend their methodology as robust. However, investors remember the 2008 credit crisis, when structured products with “AAA” ratings suffered significant losses. Now studies are highlighting potential long-term risks to government debt that are not showing up in today’s ratings.

For instance, 10 of the 26 members of the FTSE World Government Bond Index, including Japan, Mexico, South Africa and Spain, would default on their sovereign debt by 2050 if there is a “disorderly transition” — that is, if governments’ attempts to reduce carbon emissions are late, abrupt and economically damaging. That is according to research by FTSE Russell, an index provider owned by London Stock Exchange Group PLC.

“We have these really well-understood structural challenges coming our way over the time horizon of two, three, four decades, and that is in no way reflected” in credit ratings, said Moritz Kraemer, who oversaw sovereign debt ratings at S&P until 2018. “Some countries issue much longer-dated bonds — 50 or 100-year bonds — and they’re all rated the same as a two-year bond. And I think that’s not appropriate.”

Earlier this year, Kraemer — who is now chief economist for CountryRisk.io — and a team of academics used artificial intelligence to simulate the effect of rising temperatures on sovereign credit ratings in research for the University of Cambridge. They ound that 63 out of 108 sovereign debt issuers, including Canada, Germany, Sweden and the US, would experience climate-induced downgrades by 2030 under a scenario in which emissions reductions failed to meet global targets. The research showed that climate-induced downgrades could cost national treasuries from US$137 billion to US$205 billion.

Sovereign debt is “the backstop. It’s the thing everybody retreats to in a time of calamity and conflict and turbulence,” said Matthew Agarwala, an environmental economist at the Bennett Institute for Public Policy at Cambridge and one of the authors of the research.

Rating companies “were catastrophically wrong on corporate and financial institution risk for the financial crisis, and now they’re lining up, defensively, to be just as catastrophically wrong when it comes to climate and sovereign risk,” he said.

Consider Australia, Canada and Russia, countries with economies tied to fossil fuels and other natural resources. All would face challenges even in the best-case scenario for the planet, where the transition to lower-carbon economies is carried out in an orderly fashion, said Lee Clements, head of sustainable investment solutions at FTSE Russell.

Under a high-emissions scenario, Australia’s credit — currently carrying the top rating from each of the big three — would likely drop about one notch by 2030 and four notches by 2100, the Cambridge research says.

“Given the high level of CO2 emissions and lack of decline in these emissions, Australian government bonds will be evaluated more critically, notwithstanding its AAA rating,” said Rikkert Scholten, global fixed-income portfolio manager at Robeco Asset Management.

Scholten does not invest in Australian bonds in the firm’s climate bonds strategy, a portfolio aligned with the UN’s Paris Agreement on climate change, a 2015 international treaty to reduce harmful emissions.

In Europe, policymakers and regulators are starting to get involved. The European Central Bank (ECB) in July said that it would assess whether rating companies are providing enough information about how they factor climate-related credit risks into ratings.

The ECB, which uses ratings from the big three and Morningstar Inc’s DBRS to help assess assets, could introduce its own requirements on climate if it deems the rating companies are not doing enough, said Irene Heemskerk, head of the ECB’s climate change center.

The European Securities and Markets Authority, the region’s financial markets regulator, plans to report on how environmental, social and governance (ESG) factors are incorporated into credit ratings, and the European Commission might take action based on the findings.

Emerging-market government bond investors such as Jens Nystedt, a fund manager in New York at Emso Asset Management, are paying specialist ESG data providers to get a better picture of the risks. Robeco uses a ranking tool incorporating ESG data including climate-related factors. Lombard Odier Group has its own “portfolio temperature alignment tool,” one of the main resources it uses to accompany credit ratings when determining assets’ vulnerability to climate risks.

“We still need to do our own work,” said Christopher Kaminker, head of sustainable investment research and strategy at Lombard Odier. “Everyone understood that in the financial crisis — they [the rating companies] don’t always get it right.”

The big three have rapidly expanded the ESG side of their businesses. Fitch and Moody’s have developed ESG scores to help show the impact of climate risk on ratings. S&P says the company “includes the impact of ESG credit factors, such as climate transition risks related to carbon dioxide and other greenhouse gas emission costs, if our analysts deem these material to our analysis of creditworthiness, and if we have sufficient visibility on how those factors will evolve or manifest.”

Fitch’s ESG relevance scores are a core ratings product and climate considerations are fully integrated into the credit research process, said David McNeil, director of sustainable finance at the company.

The strategy at Moody’s is similar. Moody’s Environmental Issuer Profile Scores — which indicate exposure to environmental risks — factor directly into ratings and “climate considerations have always been an input,” said Swami Venkataraman, the company’s senior vice president for ESG.

Half of the sovereigns that Moody’s examines are rated differently today than they would be in the absence of ESG considerations, Venkataraman said.

The recent wildfires in Greece highlight credit risk posed by climate change, the company said in research published last month.

Critics say these efforts do not go far enough. Rating companies use commentary and ESG scores to avoid making potentially unpopular downgrades, said Bill Harrington, a former senior vice president at Moody’s who is now a senior fellow at the nonprofit Croatan Institute in Durham, North Carolina. He has submitted technical comments to US and European regulators on the issue, as well as to the big three directly.

“This proliferation of non-credit-rating actions is one of the ways in which credit rating agencies avoid doing their job,” Harrington said. “Rather than taking credit rating actions, they issue commentary saying: ‘We’re watching these things.’”

Agarwala said that “credit ratings companies are simply providing the same old rating, plus an ESG garnish made up of ‘scientific’ indicators of varying relevance and credibility.”

“We need them to start factoring climate-economic projections into today’s mainstream rating,” Agarwala said. “It’s the difference between getting a diagnosis from a doctor beforehand vs from a coroner at the autopsy.”

However, some types of climate-related risks are easier to factor into ratings than others, S&P global criteria officer Peter Kernan said.

“It is inherently very difficult to be precise about the physical effects of weather on credit,” he said.

Transition risk is more straightforward, because it “relates to public-policy decisions by global policymakers — for example, regarding carbon taxes,” he said.

The big three have taken steps to reflect growing climate risks in some sectors and regions. Fitch adjusted its ratings model for Jamaica because of the increasing probability of natural disasters on the Caribbean nation.

S&P said it has reduced its ratings on Caribbean countries’ debt because of growing natural disaster risk.

Roberto Sifon-Arevalo, S&P’s chief analytical officer for sovereigns, added that a country’s susceptibility to physical climate risks alone does not always translate to downgrades.

Japan, for instance, experiences frequent natural disasters, but is better able to withstand them because it is a wealthier nation, he said.

The financial risks posed by climate change are felt most acutely by developing economies, especially those that are ill-prepared to address climate-related shocks, the IMF said.

Downgrading countries that are least prepared for climate change would only make it more expensive for them to raise the capital needed to propel the transition to lower-carbon economies. That theme is already playing out in green bond markets, where emerging-market companies and countries find it increasingly difficult to attract funding, a report from London’s Imperial College Business School said.

Kraemer said that business models at credit rating companies create a conflict of interest. Because they are paid by the entities they rate, they might be reluctant to downgrade an important client, he said.

The companies say commercial considerations do not influence their ratings.

For some investors, the solution could be in providing ratings that change for different maturities.

“If I have a bond that matures in the next five years, do climate change considerations really affect the repayment probability of the security? Probably not. If I have a 50-year bond, yes it does,” said Nystedt at Emso, the emerging-market bond firm, which oversees about US$7 billion.

Rating firms “don’t typically divide it up by maturity — I think ultimately that’s the revolution that’s going to happen,” he said.

The Chinese government on March 29 sent shock waves through the Tibetan Buddhist community by announcing the untimely death of one of its most revered spiritual figures, Hungkar Dorje Rinpoche. His sudden passing in Vietnam raised widespread suspicion and concern among his followers, who demanded an investigation. International human rights organization Human Rights Watch joined their call and urged a thorough investigation into his death, highlighting the potential involvement of the Chinese government. At just 56 years old, Rinpoche was influential not only as a spiritual leader, but also for his steadfast efforts to preserve and promote Tibetan identity and cultural

The gutting of Voice of America (VOA) and Radio Free Asia (RFA) by US President Donald Trump’s administration poses a serious threat to the global voice of freedom, particularly for those living under authoritarian regimes such as China. The US — hailed as the model of liberal democracy — has the moral responsibility to uphold the values it champions. In undermining these institutions, the US risks diminishing its “soft power,” a pivotal pillar of its global influence. VOA Tibetan and RFA Tibetan played an enormous role in promoting the strong image of the US in and outside Tibet. On VOA Tibetan,

Former minister of culture Lung Ying-tai (龍應台) has long wielded influence through the power of words. Her articles once served as a moral compass for a society in transition. However, as her April 1 guest article in the New York Times, “The Clock Is Ticking for Taiwan,” makes all too clear, even celebrated prose can mislead when romanticism clouds political judgement. Lung crafts a narrative that is less an analysis of Taiwan’s geopolitical reality than an exercise in wistful nostalgia. As political scientists and international relations academics, we believe it is crucial to correct the misconceptions embedded in her article,

Sung Chien-liang (宋建樑), the leader of the Chinese Nationalist Party’s (KMT) efforts to recall Democratic Progressive Party (DPP) Legislator Lee Kun-cheng (李坤城), caused a national outrage and drew diplomatic condemnation on Tuesday after he arrived at the New Taipei City District Prosecutors’ Office dressed in a Nazi uniform. Sung performed a Nazi salute and carried a copy of Adolf Hitler’s Mein Kampf as he arrived to be questioned over allegations of signature forgery in the recall petition. The KMT’s response to the incident has shown a striking lack of contrition and decency. Rather than apologizing and distancing itself from Sung’s actions,