When the US invaded Afghanistan in 2001, the global economy looked much different. Tesla was not a company, the iPhone did not exist and artificial intelligence was best known as a Steven Spielberg film.

Now all three are at the cutting edge of a modern economy driven by advancements in high-tech chips and high-capacity batteries that are made with a range of minerals, including rare earths.

Afghanistan is sitting on deposits estimated to be worth US$1 trillion or more, including what might be the world’s largest lithium reserves — if anyone can get them out of the ground.

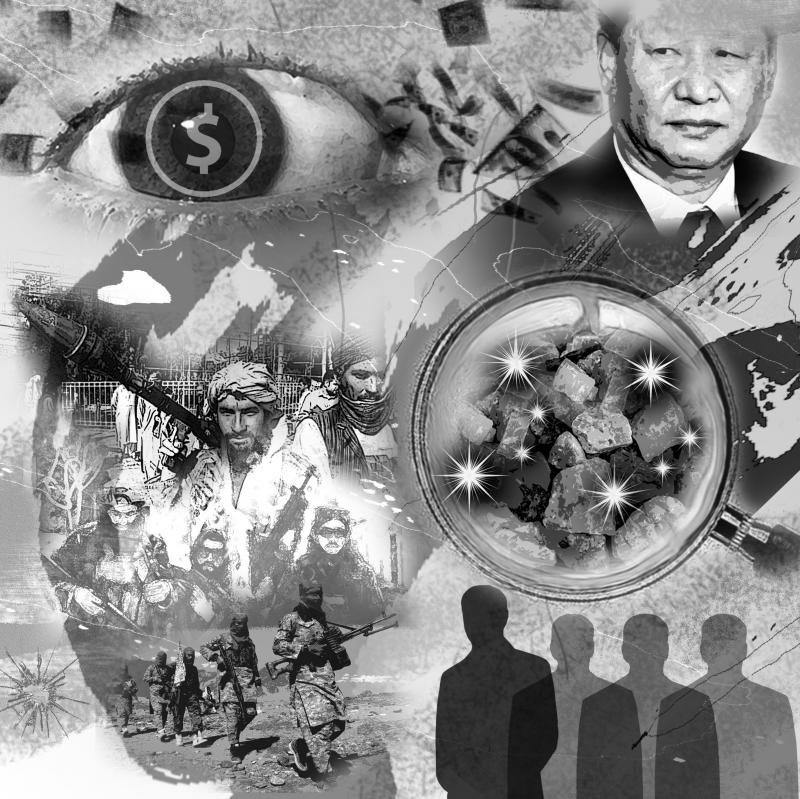

Illustration: Kevin Sheu

Four decades of war — first with the Soviet Union, then between warring tribes, then with the US — prevented that from happening. That is not expected to change anytime soon, with the Taliban already showing signs they want to reimpose a theocracy that turns back the clock on women’s rights and other basic freedoms rather than lead Afghanistan to a prosperous future.

However, there is also an optimistic outlook, now being pushed by Beijing, that goes like this: The Taliban forms an “inclusive” government with warlords of competing ethnic groups, allows a minimal level of basic human rights for women and minorities, and fights terrorist elements that want to strike the US, China, India or any other country.

“With the US withdrawal, Beijing can offer what Kabul needs most: political impartiality and economic investment,” Zhou Bo (周波), who was a senior colonel in the People’s Liberation Army from 2003 to 2020, wrote in the New York Times on Friday last week. “Afghanistan in turn has what China most prizes: opportunities in infrastructure and industry building — areas in which China’s capabilities are arguably unmatched — and access to US$1 trillion in untapped mineral deposits.”

For that scenario to have even a remote possibility, much depends on what happens in the next few weeks. Although the US is racing to evacuate thousands of Americans and vulnerable Afghans after a rushed troop withdrawal ending 20 years of war, US President Joe Biden still has the power to isolate any new Taliban-led government on the world stage and stop most companies from doing business in the country.

In a statement on Tuesday, the G7 said the legitimacy of any Afghan government hinges on its adherence to international obligations, including ensuring human rights for women and minorities.

“We will judge the Afghan parties by their actions, not words,” the group said after a virtual leaders meeting.

The US maintains sanctions on the Taliban as an entity, and it can veto any moves by China and Russia to ease UN Security Council restrictions on the militant group. Washington has already frozen nearly US$9.5 billion in Afghanistan’s reserves, and the IMF has cut off financing for Afghanistan, including nearly US$500 million that was scheduled to be disbursed at the time when the Taliban took control.

To have any hope of accessing those funds, it is crucial for the Taliban to facilitate a smooth evacuation of foreigners and vulnerable Afghans, negotiate with warlords to prevent another civil war and halt a range of human rights abuses. Tensions are growing over an Aug. 31 deadline for troops to withdraw, with the Taliban warning the US not to cross what it called a “red line.”

Still, the Taliban has several reasons to exercise restraint. Kabul faces a growing economic crisis, with prices of staples such as flour and oil surging, pharmacies running short on drugs and ATMs depleted of cash. The militant group this week appointed a new central bank chief to address those problems, just as his exiled predecessor warned of shocks that could lead to a weaker currency, faster inflation and capital controls.

The Taliban also wants sanctions lifted, with spokesman Suhail Shahee telling China’s state-owned broadcaster CGTN this week that financial penalties would hurt efforts to rebuild the economy.

“The push for more sanctions will be a biased decision,” he said. “It will be against the will of the people of Afghanistan.”

Leaders of the militant group have said they want good international relations, particularly with China. Late on Tuesday, a Taliban spokesman wrote on Twitter that a senior official from the group met with the Chinese ambassador in Kabul and “discussed the security of the Chinese embassy and diplomats, the current situation in Afghanistan, bilateral relations and China’s humanitarian assistance.”

NOTHING LASTS FOREVER

Officials and state-run media in Beijing have softened the ground for closer ties, with the Beijing-backed Global Times reporting that Chinese investment is likely to be “widely accepted” in Afghanistan. Another report said that “the US is in no position to meddle with any potential cooperation between China and Afghanistan, including on rare earths.”

“Some people stress their distrust for the Afghan Taliban. We want to say that nothing is unchanged forever,” Chinese Ministry of Foreign Affairs spokeswoman Hua Chunying (華春瑩) said last week. “We need to see the past and present. We need to listen to words and watch actions.”

For China, Afghanistan holds economic and strategic value. Leaders in Beijing have repeatedly called on the Taliban to prevent terrorists from plotting attacks against China, and view strong economic ties as key to ensuring stability. They also see an opportunity to invest in the country’s mineral sector, which can then be transported back on Chinese-financed infrastructure, which includes about US$60 billion of projects in neighboring Pakistan.

US officials estimated in 2010 that Afghanistan had US$1 trillion of unexplored mineral deposits, and the Afghan government has said they are worth three times as much. They include vast reserves of lithium, rare earths and copper — materials critical to the global green-energy transition.

However, flimsy infrastructure in the landlocked country, along with poor security, have hampered efforts to mine and profit off the reserves.

The Taliban takeover comes at a critical time for the battery-materials supply chain. Producers are looking to invest in more upstream assets to secure lithium supply ahead of what Macquarie has called a “perpetual deficit.”

The US, Japan and Europe have been seeking to cut their dependence on China for rare earths, which are used in items such as permanent magnets, although the moves are expected to take years and require millions of dollars of government support.

One major problem for the Taliban is a lack of skilled policymakers, Former Afghan Ministry of Defense economic adviser Nematullah Bizhan said.

“In the past, they appointed unqualified people into key specialized positions, such as the finance ministry and central bank,” said Bizhan, who is now a lecturer in public policy at Australian National University. “If they do the same, that will have negative implications for the economy and for growth in Afghanistan.”

CHINA BURNED

Officially, Afghanistan’s economy has seen rapid growth in recent years, as billions in aid flooded the country. Yet that expansion has fluctuated with donor assistance, showing “how artificial and thus unsustainable the growth has been,” a report from the US Special Inspector General for Afghanistan Reconstruction said.

China has been burned before. In the mid-2000s, investors led by state-owned Metallurgical Corp of China won an almost US$3 billion bid to mine copper at Mes Aynak, near Kabul. It still has not seen any output due to a series of delays ranging from security concerns to the discovery of historical artifacts, and there is still no rail or power plant. The corporation said in its annual report last year that it was negotiating with the Afghan government about the mining contract after earlier saying it was economically unviable.

The Taliban is trying to show the world that it has changed from its oppressive rule in the 1990s, saying it welcomes foreign investment from all countries and will not allow terrorists to use Afghanistan as a base.

Janan Mosazai, a former Afghan ambassador to Pakistan and China who joined the private sector in 2018, sees “tremendous opportunities for the Afghan economy to take off” if the Taliban prove they are serious about “walking the talk.”

However, not many are optimistic. Reports have emerged of targeted killings, a massacre of ethnic minorities, violent suppression of protests and Taliban soldiers demanding to marry local women.

“Everyone is just in crisis mode,” said Sarah Wahedi, a 26-year-old tech entrepreneur from Afghanistan who fled the country. “I don’t see the entrepreneurs getting back to business unless there’s a huge overhaul in the Taliban’s behavior, and there’s nothing I’ve seen that makes me think that’s going to happen.”

There are moments in history when America has turned its back on its principles and withdrawn from past commitments in service of higher goals. For example, US-Soviet Cold War competition compelled America to make a range of deals with unsavory and undemocratic figures across Latin America and Africa in service of geostrategic aims. The United States overlooked mass atrocities against the Bengali population in modern-day Bangladesh in the early 1970s in service of its tilt toward Pakistan, a relationship the Nixon administration deemed critical to its larger aims in developing relations with China. Then, of course, America switched diplomatic recognition

The international women’s soccer match between Taiwan and New Zealand at the Kaohsiung Nanzih Football Stadium, scheduled for Tuesday last week, was canceled at the last minute amid safety concerns over poor field conditions raised by the visiting team. The Football Ferns, as New Zealand’s women’s soccer team are known, had arrived in Taiwan one week earlier to prepare and soon raised their concerns. Efforts were made to improve the field, but the replacement patches of grass could not grow fast enough. The Football Ferns canceled the closed-door training match and then days later, the main event against Team Taiwan. The safety

The Chinese government on March 29 sent shock waves through the Tibetan Buddhist community by announcing the untimely death of one of its most revered spiritual figures, Hungkar Dorje Rinpoche. His sudden passing in Vietnam raised widespread suspicion and concern among his followers, who demanded an investigation. International human rights organization Human Rights Watch joined their call and urged a thorough investigation into his death, highlighting the potential involvement of the Chinese government. At just 56 years old, Rinpoche was influential not only as a spiritual leader, but also for his steadfast efforts to preserve and promote Tibetan identity and cultural

Strategic thinker Carl von Clausewitz has said that “war is politics by other means,” while investment guru Warren Buffett has said that “tariffs are an act of war.” Both aphorisms apply to China, which has long been engaged in a multifront political, economic and informational war against the US and the rest of the West. Kinetically also, China has launched the early stages of actual global conflict with its threats and aggressive moves against Taiwan, the Philippines and Japan, and its support for North Korea’s reckless actions against South Korea that could reignite the Korean War. Former US presidents Barack Obama