From his desk in midtown Manhattan, Tariq Fancy once oversaw the beginning of arguably the biggest, most ambitious effort ever to turn Wall Street “green.” Now, as environmentally friendly investing grows at an exponential rate, Fancy has come to a stark conclusion: “This is definitely not going to work.”

As the former chief investment officer for sustainable investing at BlackRock, the world’s largest asset manager, Fancy was charged with embedding environmental, social and governance corporate policies across the investment giant’s portfolio.

Fancy was a leader in a movement that has given many people, including investors, environmental advocates and academics, hope that after years of backing polluters, Wall Street was finally stepping up to confront the climate crisis.

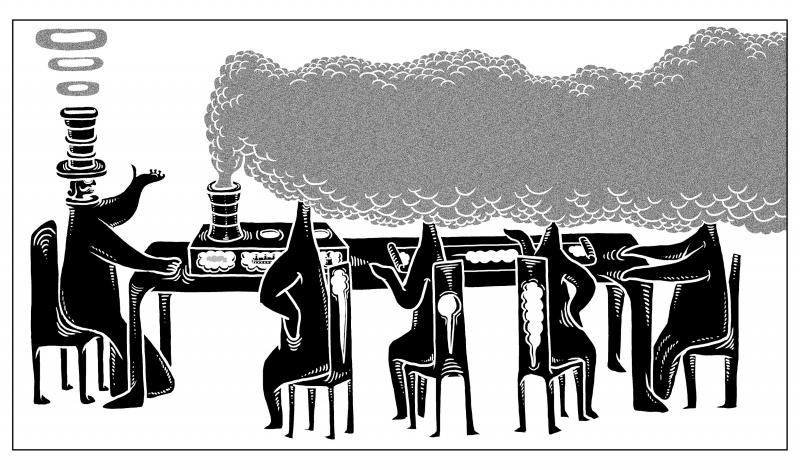

Illustration: Mountain People

“I have looked inside the machine and I can tell you business does not have this,” Fancy said. “Not because these are bad people, but because they run for-profit machines that will operate exactly as you would expect them to do.”

Fancy, 42, worked for BlackRock from 2018 to 2019 and was responsible for sustainable investing at a time when BlackRock was preparing to announce a major shift in strategy.

“The evidence on climate risk is compelling investors to reassess core assumptions about modern finance,” BlackRock chairman Larry Fink wrote in his highly influential annual letter to CEOs last year, shortly after Fancy’s departure. “In the near future — and sooner than most anticipate — there will be a significant reallocation of capital.”

BlackRock would transition away from investments in firms that “present a high sustainability-related risk,” Fink said.

BlackRock manages about US$7 trillion in assets and, with one of Wall Street’s biggest voices sounding the alarm about the need to deal with the climate crisis, the news was viewed as a pivotal moment for the financial community.

However, for Fancy, who now runs the digital learning nonprofit organization Rumie in Toronto, BlackRock’s move, and the ones it has inspired, contain a fundamental flaw: The climate crisis can never be solved by today’s free markets.

“It’s not because they are evil, it’s because the system is built to extract profits,” he said.

Investors have a fiduciary duty to maximize returns to their clients and as long as there is money to be made in activities that contribute to global warming, no amount of rhetoric about the need for sustainable investing would change that, he said.

“In many cases it’s cheaper and easier to market yourself as green rather than do the long tail work of actually improving your sustainability profile. That’s expensive, and if there is no penalty from the government, in the form of a carbon tax or anything else, then this market failure is going to persist,” said Fancy, whose organization aims to bring affordable digital education to underserved communities worldwide.

The amount of money that poured into sustainable investment through vehicles like exchange traded funds (ETFs) hit record levels last year.

It is a trend Fancy believes could continue for years and still have zero impact on climate change because “there is no connection between the two things.”

In many cases it is cheaper and easier to market yourself as green. Moving money to green investments does not mean that polluters would no longer find backers. The argument is similar to that of divestment, another strategy Fancy says does not work.

“If you sell your stock in a company that has a high emissions footprint, it doesn’t matter. The company still exists, the only difference is that you don’t own them. The company is going to keep on going the way they were, and there are 20 hedge funds who will buy that stock overnight. The market is the market,” he said.

“I don’t think the public realizes we are not talking about stopping climate change. We are literally talking about selling assets so we don’t get caught up in the damage when it hits,” Fancy said.

Business knows this, and it also knows the solution — it just does not like it, Fancy said.

He compared the business community’s reaction to the COVID-19 pandemic to its views on climate change.

“Science shows us that COVID-19 is a systemic problem for which we all need to bend down a curve, the infections curve,” Fancy said.

As the crisis escalated, business leaders were immediately supportive of government-led initiatives to restrict travel, close venues and shutter the economy.

“The Business Roundtable [the US’ most powerful business lobby] said we should make mask-wearing mandatory. They were right about all those things,” he said.

The world needed government to use its extraordinary powers “because if you left it to the free market, everything would have been open in the US,” Fancy said. “We would have lost millions of people, it wouldn’t have been half a million.”

Climate change is also a problem science says is systemic and one where we have to bend down the curve, he said.

“The difference is the incubation period. It’s not a few weeks, it’s a few decades. For that they are still saying we should rely on the free market,” Fancy said. “That’s where I have a problem.”

A survey of 250 senior executives supports Fancy’s point.

About 64 percent of the executives surveyed in a poll commissioned by British lender Standard Chartered said that they “believe the economics of operating as a net-zero [carbon emissions] organization do not stack up for their company.”

Seventy-nine percent of them said that short-term CEO tenure made it harder for companies to transition to net zero.

Under the current system, the costs are simply too high and the benefits of conducting business as usual are too great, Fancy said.

A 2019 Morgan Stanley study found that getting to net zero by 2050 would cost US$50 trillion.

“The reality is that their incentives are very short-term,” Fancy said. “My concern is that when it comes to climate change, it’s actually expensive. It’s like saying when it comes for COVID-19, that’s a crisis and an opportunity. Well yeah, it’s an opportunity for Zoom, it’s not an opportunity for society.”

There is a solution, and it is the one that business leaders embraced in the COVID-19 crisis: government intervention, he said.

However, given the long time line for climate change, it is one that business leaders do not like, Fancy said.

What would work is a change in government policy that made it more expensive to pollute, such as a carbon tax, because that would change the corporate world and Wall Street’s incentives, he said.

“If you put a tax on carbon, every single portfolio manager would adjust their portfolio,” he said.

BlackRock disputes Fancy’s analysis.

In a statement, the company said: “Sustainable investing can deliver strong investment returns while also helping to address urgent social and environmental concerns.”

The company added that it believes that greenwashing “is a risk to investors and detrimental to the asset management industry’s credibility, which is why we strongly support regulatory initiatives to set consistent standards and increase transparency for sustainable portfolios.”

However, for Fancy, the overarching point is that real change must be led by government, not Wall Street.

“If I was on a panel and someone asked me what’s the best way to tackle climate change? Should I buy an ETF or should I call my congressperson, and demand legislation and a price on carbon? The truth is someone is better off calling their congressperson,” he said.

The saga of Sarah Dzafce, the disgraced former Miss Finland, is far more significant than a mere beauty pageant controversy. It serves as a potent and painful contemporary lesson in global cultural ethics and the absolute necessity of racial respect. Her public career was instantly pulverized not by a lapse in judgement, but by a deliberate act of racial hostility, the flames of which swiftly encircled the globe. The offensive action was simple, yet profoundly provocative: a 15-second video in which Dzafce performed the infamous “slanted eyes” gesture — a crude, historically loaded caricature of East Asian features used in Western

Is a new foreign partner for Taiwan emerging in the Middle East? Last week, Taiwanese media reported that Deputy Minister of Foreign Affairs Francois Wu (吳志中) secretly visited Israel, a country with whom Taiwan has long shared unofficial relations but which has approached those relations cautiously. In the wake of China’s implicit but clear support for Hamas and Iran in the wake of the October 2023 assault on Israel, Jerusalem’s calculus may be changing. Both small countries facing literal existential threats, Israel and Taiwan have much to gain from closer ties. In his recent op-ed for the Washington Post, President William

A stabbing attack inside and near two busy Taipei MRT stations on Friday evening shocked the nation and made headlines in many foreign and local news media, as such indiscriminate attacks are rare in Taiwan. Four people died, including the 27-year-old suspect, and 11 people sustained injuries. At Taipei Main Station, the suspect threw smoke grenades near two exits and fatally stabbed one person who tried to stop him. He later made his way to Eslite Spectrum Nanxi department store near Zhongshan MRT Station, where he threw more smoke grenades and fatally stabbed a person on a scooter by the roadside.

Taiwan-India relations appear to have been put on the back burner this year, including on Taiwan’s side. Geopolitical pressures have compelled both countries to recalibrate their priorities, even as their core security challenges remain unchanged. However, what is striking is the visible decline in the attention India once received from Taiwan. The absence of the annual Diwali celebrations for the Indian community and the lack of a commemoration marking the 30-year anniversary of the representative offices, the India Taipei Association and the Taipei Economic and Cultural Center, speak volumes and raise serious questions about whether Taiwan still has a coherent India