With a series of high-level summits culminating in a visit to Germany in the fall by Chinese President Xi Jinping (習近平), this was supposed to be the year of Europe-China diplomacy. Instead, Europeans are warning of a damaging rift.

Diplomats talk of mounting anger over China’s behavior during the COVID-19 pandemic, including claims of price gouging by Chinese suppliers of medical equipment and a blindness to how its actions are perceived.

The upshot is that Beijing’s handling of the crisis has eroded trust just when it had a chance to demonstrate global leadership.

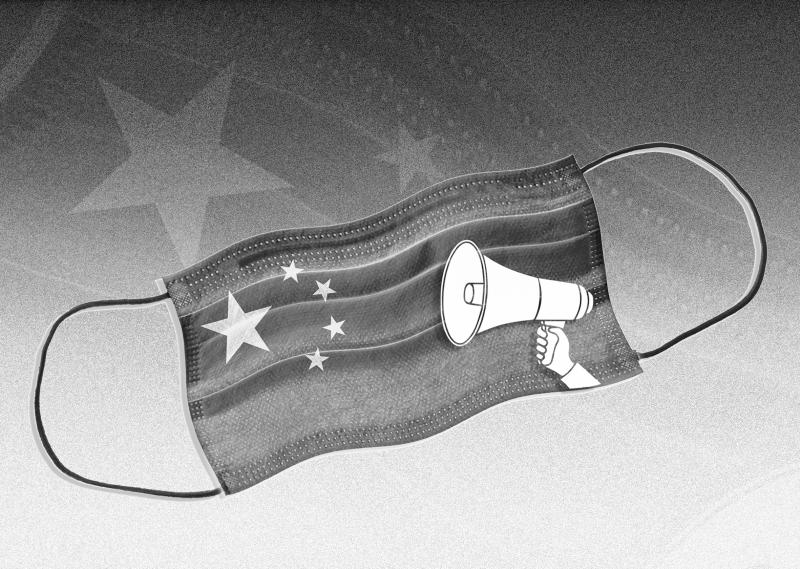

Illustration: June Hsu

“Over these months China has lost Europe,” said Reinhard Buetikofer, a German Green party lawmaker who chairs the European Parliament’s delegation for relations with China.

He cited concerns from China’s “truth management” in the early stages of the virus to an “extremely aggressive” stance by the Chinese Ministry of Foreign Affairs and “hard-line propaganda” that champions the superiority of Chinese Communist Party rule over democracy.

Rather than any single act responsible for the breakdown, he said that “it’s the pervasiveness of an attitude that does not purvey the will to create partnerships, but the will to tell people what to do.”

While US President Donald Trump’s administration has resumed its swipes at China, European officials are traditionally less willing to be openly critical, in part for fear of retribution. That politicians in Berlin, Paris, London and Brussels are expressing concern over Beijing’s narrative on COVID-19 hints at a deeper resentment with wide-ranging consequences.

Already some EU members are pursuing policies to reduce their dependence on China and keep potential predatory investments in check, defensive measures that risk hurting China-EU trade worth almost US$750 billion last year.

It is a turnaround from just a few weeks ago, when China emerged from the worst of its own outbreak to offer Web seminars on best practice gained from tackling the virus where it first emerged.

It also airlifted medical supplies including protective equipment, testing kits and ventilators to the worst-hit countries in Europe and elsewhere, in a show of aid-giving that contrasted with the US’ international absence.

The pandemic offered a chance for mutual solidarity, but it did not last.

“Now the atmosphere in Europe is rather toxic when it comes to China,” said Joerg Wuttke, president of the EU Chamber of Commerce in China.

Concerns were aired during a March 25 call of G7 foreign ministers about how China would proceed during the crisis and once it subsided.

Ministers were told that Europe and the G7 must be on guard as Beijing was likely to move “more self confidently, more powerfully” and in a way that exploits its leverage when other nations were still in lockdown, a European official familiar with the call said.

In public, Chinese officials have struck a conciliatory tone.

“When people’s lives are at stake, nothing matters more than saving lives. It is useless to argue over the merits of different social systems or models,” Chinese Ministry of Foreign Affairs spokesman Zhao Lijian (趙立堅) said at a regular news conference on April 17.

China, he said, is ready to work with the international community, including European countries, to “jointly safeguard the health and safety of all mankind.”

Yet Beijing’s means of going about it has backfired in much of Europe.

An anonymously authored text posted on the Web site of the Chinese embassy in France this month falsely accused French retirement home staff of leaving old people to die.

It was “an incredible accusation on one of the most sensitive and tragic aspects” of the crisis in France, Mathieu Duchatel, director of the Asia program at the Institut Montaigne wrote on Twitter.

The embassy Web site comments rang alarm bells for the needless offense caused.

China underestimated the reaction to its conspiracy theories amplified by propaganda outlets, two European officials in Beijing said.

What is more, China’s insistence that aid be accompanied by public thanks and praise has undercut the goodwill it might otherwise have gained, they said.

European governments have become more wary of China over the past two years as Xi’s Belt and Road Initiative on trade and infrastructure expanded across the continent, snapping up strategic assets including ports, power utilities and robotics firms from the Mediterranean to the Baltic Sea.

While some nations, including Italy and Portugal, have been enthusiastic backers of the initiative, another program known as Made in China 2025, whereby Beijing seeks to become the world leader in key technologies, is seen in many quarters as a further threat to European industry.

With stock prices tumbling on the coronavirus crisis, countries including Germany that have investment screening regulations have tightened them and extended their scope in response to concerns that China, among others, could take controlling stakes in companies suddenly made vulnerable.

EU Commissioner for Competition Margrethe Vestager said in a Financial Times interview that governments go further and buy stakes in companies themselves to stave off the threat of Chinese takeovers.

More far-reaching still are proposals to curb dependence on China, not just for medical supplies but in areas such as battery technology for electric vehicles.

EU Commissioner for Trade Phil Hogan last week said that there is a need for a discussion “on what it means to be strategically autonomous,” including building “resilient supply chains, based on diversification, acknowledging the simple fact that we will not be able to manufacture everything locally.”

Japan has already earmarked US$2.2 billion from its US$1 trillion stimulus package to help its manufacturers shift production away from China.

Without mentioning China, EU trade ministers agreed in a call on Thursday last week that it is important to diversify to “reduce the reliance on individual countries of supply.”

As a first step, Berlin plans state funds and purchase guarantees to start industrial production of millions of masks by late summer. China currently exports 25 percent of the world’s masks.

Wuttke said the discussion on supply chains began when Beijing shut its ports earlier this year, prompting fears that pharmaceutical ingredients produced in China would not reach Europe, and causing policymakers to realize that strategic products had to be secured.

Another European official said even official suppliers were breaking contracts for items such as ventilators and scamming people, burning bridges along the way.

“People want to have their eggs in more baskets,” Wuttke said.

Certainly, the tenor of the political debate in Europe has shifted since.

German Minister of Foreign Affairs Heiko Maas told Bild newspaper that China’s revising up of the death toll last week was “alarming,” while French President Emmanuel Macron said in a Financial Times interview that there were “clearly things that have happened that we don’t know about.”

British Secretary of Foreign and Commonwealth Affairs Dominic Raab said it cannot be “business as usual” with China once the pandemic is over.

The Spanish Ministry of Health has canceled an order of antigen test kits from Chinese company Bioeasy after sending back a previous batch, the country’s El Pais reported.

Health authorities found that both sets of kits were faulty, it said.

As a result of the COVID-19 crisis, pressure is growing on the UK to reverse its decision to allow Huawei Technologies a limited role in its 5G mobile networks, while France might be less inclined to give Huawei a chunk of its 5G contracts after the embassy spat. Germany must make a decision by about midyear on Chinese involvement in its 5G networks.

In the battle of narratives, Germany is key, said Janka Oertel, director of the Asia program at the European Council on Foreign Relations in Berlin.

As well as Europe’s dominant economy, its trade ties to China dwarf those of its neighbors: German exports to China last year were higher than the UK, France, Italy, Spain and the Netherlands combined.

It is to assume the EU’s rotating presidency on July 1, giving it the chance to turn the debate in Europe.

China could still win back favor and help secure a greater global role by acceding to demands to open up its markets and introduce a more level playing field for international business, Oertel said.

“That would be something that the Europeans would very much appreciate,” she said.

However, she added: “I don’t think it’s very likely.”

Taiwan is a small, humble place. There is no Eiffel Tower, no pyramids — no singular attraction that draws the world’s attention. If it makes headlines, it is because China wants to invade. Yet, those who find their way here by some twist of fate often fall in love. If you ask them why, some cite numbers showing it is one of the freest and safest countries in the world. Others talk about something harder to name: The quiet order of queues, the shared umbrellas for anyone caught in the rain, the way people stand so elderly riders can sit, the

Taiwan’s fall would be “a disaster for American interests,” US President Donald Trump’s nominee for undersecretary of defense for policy Elbridge Colby said at his Senate confirmation hearing on Tuesday last week, as he warned of the “dramatic deterioration of military balance” in the western Pacific. The Republic of China (Taiwan) is indeed facing a unique and acute threat from the Chinese Communist Party’s rising military adventurism, which is why Taiwan has been bolstering its defenses. As US Senator Tom Cotton rightly pointed out in the same hearing, “[although] Taiwan’s defense spending is still inadequate ... [it] has been trending upwards

After the coup in Burma in 2021, the country’s decades-long armed conflict escalated into a full-scale war. On one side was the Burmese army; large, well-equipped, and funded by China, supported with weapons, including airplanes and helicopters from China and Russia. On the other side were the pro-democracy forces, composed of countless small ethnic resistance armies. The military junta cut off electricity, phone and cell service, and the Internet in most of the country, leaving resistance forces isolated from the outside world and making it difficult for the various armies to coordinate with one another. Despite being severely outnumbered and

Small and medium enterprises make up the backbone of Taiwan’s economy, yet large corporations such as Taiwan Semiconductor Manufacturing Co (TSMC) play a crucial role in shaping its industrial structure, economic development and global standing. The company reported a record net profit of NT$374.68 billion (US$11.41 billion) for the fourth quarter last year, a 57 percent year-on-year increase, with revenue reaching NT$868.46 billion, a 39 percent increase. Taiwan’s GDP last year was about NT$24.62 trillion, according to the Directorate-General of Budget, Accounting and Statistics, meaning TSMC’s quarterly revenue alone accounted for about 3.5 percent of Taiwan’s GDP last year, with the company’s