US President Donald Trump said he could force out US Federal Reserve Chair Jerome Powell, rebuking the notion that the US central bank is independent, and vented frustration that monetary policymakers had not recently cut interest rates.

“If I ask him to, he’ll be out of there,” Trump told reporters in the Oval Office Thursday when asked about an earlier social media post blasting the Fed chair as being too slow to lower rates. “I’m not happy with him. I let him know it.”

The US president in the post said that “Powell’s termination cannot come fast enough!”

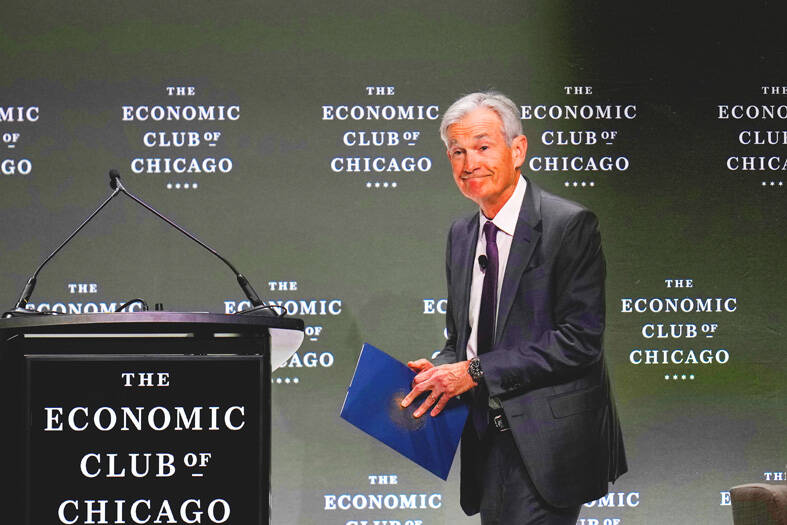

Photo: AP

At the White House, Trump did not respond to a follow-up question from a reporter about whether he was trying to remove the central bank chief.

Powell, who he nominated to take the Fed’s helm during his first term, has been “terrible,” he said, adding that there is “essentially no inflation,” and if the Fed cut its benchmark, borrowing costs would be lower too.

“Other than interest rates, everything’s down,” Trump said, citing items including crude oil and gasoline.

“Because we’ve got a Federal Reserve chairman who’s playing politics,” he said, noting that European rates by contrast have gone down.

There was little sign of a direct reaction to Trump’s remarks on Powell in financial markets on Thursday. Stocks climbed amid optimism about the potential for tariff deals with the EU and Japan, and Treasuries retreated. The S&P 500 Index closed 0.2 percent higher, while two-year yields were up about 3 basis points, at 3.80 percent in late trading.

Powell’s term as Fed chair runs into May next year, while his term as a governor lasts until February 2028. Trump’s comments come a day after Powell, speaking in Chicago, reiterated that the Fed is not in a rush to cut rates and instead is awaiting greater clarity on the economy.

Nathan Sheets, global chief economist at Citigroup Inc, warned of the danger “if we now cross the Rubicon on central bank independence,” on top of adopting steep tariffs and other policies previously considered unusual for the US.

“The market volatility that we’ve seen over the past month or so would merely be the first course to a much, much longer and more challenging kind of downturn,” Sheets said on Bloomberg Television.

The risk is “we start seriously and permanently undermining confidence in the economy and the markets,” he said.

Democratic US Senator Elizabeth Warren said in a Thursday interview that “the president has free speech just like everyone else, but he does not have the power to fire Jerome Powell. And if he tries, he will crash the markets.”

“Even countries with dictators try to create a central bank that is independent of the president of the country in order to attract capital,” Warren said.

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not