Manz Taiwan Ltd (亞智科技), a supplier of equipment for advanced chip packaging, yesterday said it is scouting sites for a US sales office, following in the footsteps of its key customers.

The move would be Manz’s latest global expansion, following the establishment of service offices in Malaysia, India and Japan. The Taoyuan-based company currently operates manufacturing facilities in Taiwan and Suzhou, China.

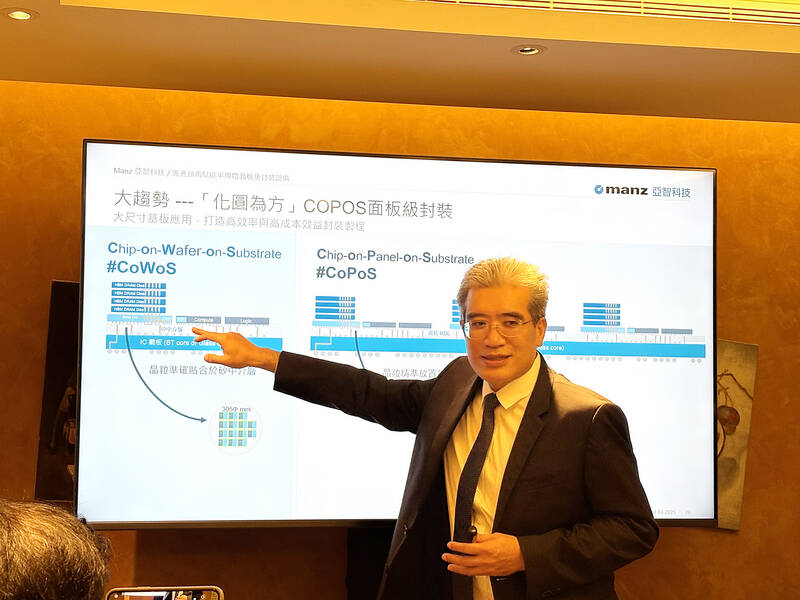

“If our customers build factories there [the US], we certainly have to set up service offices there as well. It is almost a rule for equipment suppliers, and we have to provide after-sales services such as maintenance and upgrades,” Manz Taiwan president Robert Lin (林峻生) said at a media gathering in Taipei.

Photo: Lisa Wang, Taipei Times

The company has no plans to build a manufacturing facility in the US due to high operating costs, as it would be at least 50 percent more expensive to run a factory there, the company said.

Last month, the company opened a new semiconductor research and development (R&D) center in Taoyuan as part of a strategic shift toward developing equipment for advanced chip packaging technology known as chip-on-panel-on-substrate (CoPoS), which is regarded as a more cost-efficient than chip-on-wafer-on-substrate technology.

The new R&D center is also expected to enhance real-time support for five customers working on CoPoS development and help meet their supply chain localization goals, Lin said.

To date, the company has delivered 8,000 units of semiconductor and display equipment to leading global chip packaging firms, IC substrate manufacturers and flat-panel display makers. Its key customers include Lam Research Corp, ASE Technology Holding Co (日月光), Powertech Technology Inc (力成) and Innolux Corp (群創).

Manz Taiwan generates about half of its revenue from semiconductor equipment — primarily for advanced chip packaging — while the other half comes from display equipment sales.

The company has signed an agreement with its German parent company, Manz AG, to become an independent entity through a management buyout, with the transaction expected to close this quarter, it said, without disclosing financial details.

The company also plans to launch an initial public offering within the next three years, likely on the Taipei Exchange, with an initial capital of NT$200 million (US$6.15 million), it added.

STEEP DECLINE: Yesterday’s drop was the third-steepest in its history, the steepest being Monday’s drop in the wake of the tariff announcement on Wednesday last week Taiwanese stocks continued their heavy sell-off yesterday, as concerns over US tariffs and unwinding of leveraged bets weighed on the market. The benchmark TAIEX plunged 1,068.19 points, or 5.79 percent, to 17,391.76, notching the biggest drop among Asian peers as it hit a 15-month low. The decline came even after the government on late Tuesday authorized the NT$500 billion (US$15.2 billion) National Stabilization Fund (國安基金) to step in to buoy the market amid investors’ worries over tariffs imposed by US President Donald Trump. Yesterday’s decline was the third-steepest in its history, trailing only the declines of 2,065.87 points on Monday and

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not

TARIFF CONCERNS: The chipmaker cited global uncertainty from US tariffs and a weakening economic outlook, but said its Singapore expansion remains on track Vanguard International Semiconductor Corp (世界先進), a foundry service provider specializing in producing power management and display driver chips, yesterday withdrew its full-year revenue projection of moderate growth for this year, as escalating US tariff tensions raised uncertainty and concern about a potential economic recession. The Hsinchu-based chipmaker in February said revenues this year would grow mildly from last year based on improving supply chain inventory levels and market demand. At the time, it also anticipated gradual quarter revenue growth. However, the US’ sweeping tariff policy has upended the industry’s supply chains and weakened economic prospects for the world economy, it said. “Now