Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners.

Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster.

“I work during the day and stay up all night watching the news. I’ve been following US news until 3am or 4am,” Lo said.

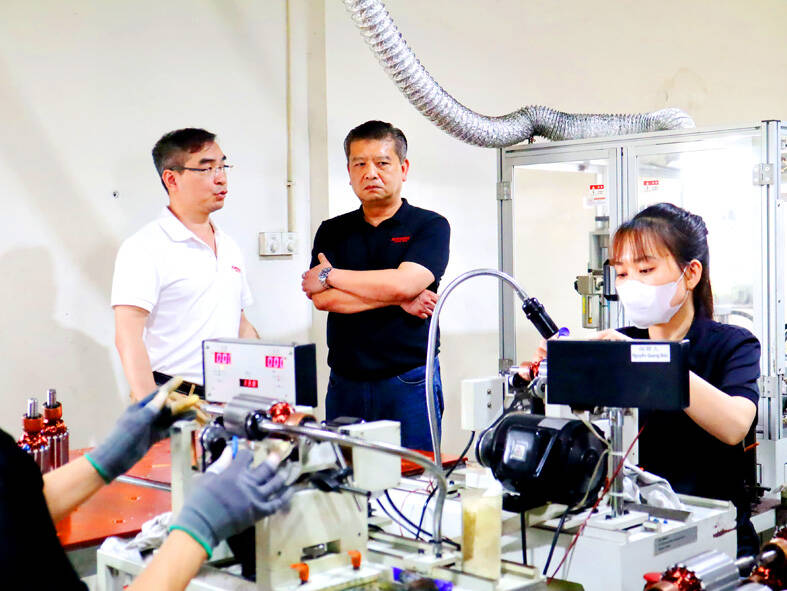

Photo: CNA

Up until recently, he was deeply worried about the 46 percent tariff on Vietnam announced by Trump on April 2 — one of the highest rates among the dozens of targeted countries.

However, Lo said he feels somewhat relieved — although not entirely at ease — after the Trump administration on Wednesday announced a 90-day pause for nearly all of the targeted countries except China.

The company is using the 90-day window to coordinate with clients, urging them to take stock, assess their inventory or place orders early so shipments can reach the US within the pause period, he said.

Photo: CNA

Transferring goods to the company’s warehouses in Mexico could also be an option, which would provide greater flexibility, he added.

The company previously focused on developed countries with strong consumer purchasing power, but its long-term market strategy is shifting, Lo said.

Brico is now targeting mid-tier markets in regions such as the Middle East and Europe, aiming to reduce its reliance on the US market from 45 percent to about 30 percent, he said.

A Johnson Health Tech Co (喬山健康科技) official also said the 46 percent tariff came as a surprise, given that US-Vietnam relations appeared to be healthy.

In the face of uncertainty, the Taiwanese fitness equipment maker does not want to make major adjustments that could affect the stability of production or product quality, especially as customer demand remains steady, said Sun Chi-an (孫其安), general manager of the company’s factory in Vietnam’s Bac Ninh Province.

As a result, production and raw material preparation at the company are continuing as scheduled, and it is making efforts to retain factory staff, Sun said.

Although negotiations between Hanoi and Washington might lead to lower tariffs, it is unlikely that the “reciprocal” tariff would be fully lifted, he said, meaning production costs would inevitably rise.

Sun said his company plans to discuss cost-sharing with suppliers and assess competitors’ strategies, with the latter move aiming to offset the effects of the tariffs by passing some of the additional costs to consumers.

The “reciprocal” tariffs also present an opportunity, as most of Johnson’s competitors rely heavily on supply chains in China, and the tariff on Vietnam, although expected to remain high after negotiations, would likely be lower than the rate imposed on China, he said.

As of Saturday, the US tariffs on imports from China totaled 145 percent.

TARIFFS: The global ‘panic atmosphere remains strong,’ and foreign investors have continued to sell their holdings since the start of the year, the Ministry of Finance said The government yesterday authorized the activation of its NT$500 billion (US$15.15 billion) National Stabilization Fund (NSF) to prop up the local stock market after two days of sharp falls in reaction to US President Donald Trump’s new import tariffs. The Ministry of Finance said in a statement after the market close that the steering committee of the fund had been given the go-ahead to intervene in the market to bolster Taiwanese shares in a time of crisis. The fund has been authorized to use its assets “to carry out market stabilization tasks as appropriate to maintain the stability of Taiwan’s

STEEP DECLINE: Yesterday’s drop was the third-steepest in its history, the steepest being Monday’s drop in the wake of the tariff announcement on Wednesday last week Taiwanese stocks continued their heavy sell-off yesterday, as concerns over US tariffs and unwinding of leveraged bets weighed on the market. The benchmark TAIEX plunged 1,068.19 points, or 5.79 percent, to 17,391.76, notching the biggest drop among Asian peers as it hit a 15-month low. The decline came even after the government on late Tuesday authorized the NT$500 billion (US$15.2 billion) National Stabilization Fund (國安基金) to step in to buoy the market amid investors’ worries over tariffs imposed by US President Donald Trump. Yesterday’s decline was the third-steepest in its history, trailing only the declines of 2,065.87 points on Monday and

TARIFF CONCERNS: The chipmaker cited global uncertainty from US tariffs and a weakening economic outlook, but said its Singapore expansion remains on track Vanguard International Semiconductor Corp (世界先進), a foundry service provider specializing in producing power management and display driver chips, yesterday withdrew its full-year revenue projection of moderate growth for this year, as escalating US tariff tensions raised uncertainty and concern about a potential economic recession. The Hsinchu-based chipmaker in February said revenues this year would grow mildly from last year based on improving supply chain inventory levels and market demand. At the time, it also anticipated gradual quarter revenue growth. However, the US’ sweeping tariff policy has upended the industry’s supply chains and weakened economic prospects for the world economy, it said. “Now

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not