Artificial intelligence (AI) is set to bring sweeping change to modern life, but at an industrial fair in Germany many companies wonder how they fit into the tech revolution.

“We use ChatGPT a bit,” shrugged one business representative, from a metals processor based in southern Germany, at this week’s Hannover Messe.

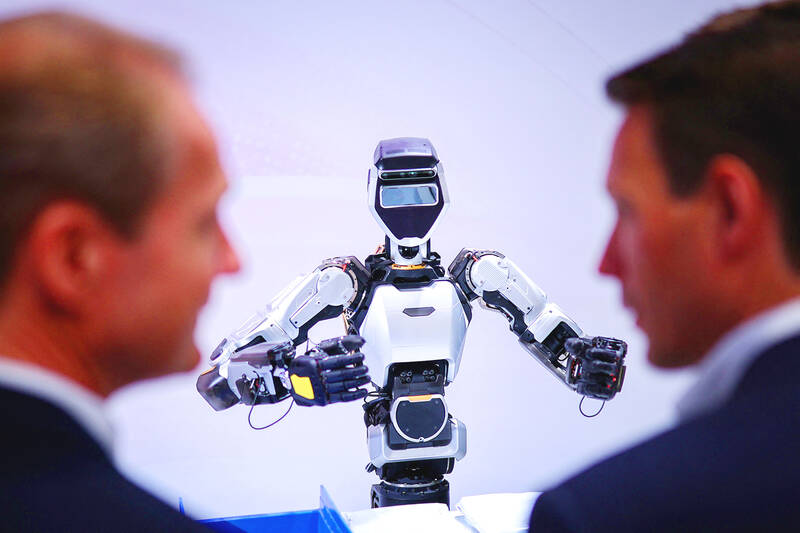

The expo grouping 4,000 firms promised visitors ways to “experience the future” and explore AI’s “practical applications in areas such as production, robotics and energy, all at their own pace.”

Photo: AFP

One eye-catching display — a gigantic Rolls-Royce aircraft engine whose production was optimized by AI from Microsoft and German company Siemens — drew many curious onlookers.

However, on the sidelines, the small and medium-sized enterprises (SMEs) that are the backbone of Germany’s economy — the so-called Mittelstand — often had less to say on the subject.

Andrea Raaf of Herz Aetztechnik, which uses lasers to make vehicle and electronics parts, said AI was not up to the job.

“The parts we manufacture are very individual, so we can’t really see the point of AI,” she said.

Others have been more engaged, including family-owned Koerner Electric, which said it has been using AI for the past three years.

Standing in front of custom-built circuit boards, its technical director Dennis Koerner said AI had helped with the manufacturing process and to analyze optical and electrical measurements.

“We have written a small AI with which we can generate programming much faster,” Koerner said. “It was necessary to get faster and more stable results without needing several employees for the job.”

Once a byword for high technology, German industry knows that it is lagging behind US and Chinese competition when it comes to the digital technologies that would dominate the next century.

Many German firms remain unsure how to use the rapidly evolving technology in the kind of high-end engineering they specialize in.

“It’s important not to shy away from introducing AI,” Microsoft Germany managing director Agnes Heftberger said. “Otherwise, Germany will find itself lagging behind in the face of international competition.”

Also featured at the fair were so-called “AI agents,” systems which autonomously perform tasks from writing code to assisting with conversations.

Microsoft offers systems to put machine data into simple language and identify maintenance needs in advance.

However, Loke Olsen, an automation engineer at Confirm A/S, a Danish subcontractor to the pharmaceutical industry, was somewhat skeptical about AI’s potential errors and ability to correct itself.

“We have to be sure that AI works 100 percent, because we have to comply with very strict health regulations,” he said.

For some, cost is an issue. Koerner said that it seems like “we can hardly afford” some of the AI products being showcased at the fair.

Almost half of German industrial firms use AI for some business functions, a Microsoft survey found, but most are far more reluctant to use it to develop their products. Only 7 percent of machine builders plan to adopt generative AI to help with product design, said a study by the machinists’ association VDMA.

“There are some initial attempts, but investment is still too low,” said Guido Reimann, VDMA’s deputy managing director of software and digitalization.

The study found that GenAI, by optimizing efficiency and boosting sales, could raise the sector’s annual profits by many billions of euros.

However, although 52 percent of managers saw AI as a potential “game changer,” it said that “its use has so far often been limited to experimental or proof-of-concept projects.”

The top concerns listed were a lack of data quality, shortages of AI specialists and technical challenges.

Germany’s Fraunhofer research institute has been touring Germany since 2023, showing manufacturers concrete AI applications from carpentry to healthcare.

“It often helps to network smaller companies with each other, because AI always works with data,” institute spokeswoman Juliane Segedi said. “The more data you have, the better an AI can become, and if you have a similar problem that needs to be solved, you can pool the data to come up with a solution that is good for everyone.”

Other challenges remain. Many people fear AI would one day steal their job.

An important step, would be convincing labour unions to not “see AI as a threat, but as something that can contribute to their ideas,” Segedi said.

SELL-OFF: Investors expect tariff-driven volatility as the local boarse reopens today, while analysts say government support and solid fundamentals would steady sentiment Local investors are bracing for a sharp market downturn today as the nation’s financial markets resume trading following a two-day closure for national holidays before the weekend, with sentiment rattled by US President Donald Trump’s sweeping tariff announcement. Trump’s unveiling of new “reciprocal tariffs” on Wednesday triggered a sell-off in global markets, with the FTSE Taiwan Index Futures — a benchmark for Taiwanese equities traded in Singapore — tumbling 9.2 percent over the past two sessions. Meanwhile, the American depositary receipts (ADRs) of Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the most heavily weighted stock on the TAIEX, plunged 13.8 percent in

A wave of stop-loss selling and panic selling hit Taiwan's stock market at its opening today, with the weighted index plunging 2,086 points — a drop of more than 9.7 percent — marking the largest intraday point and percentage loss on record. The index bottomed out at 19,212.02, while futures were locked limit-down, with more than 1,000 stocks hitting their daily drop limit. Three heavyweight stocks — Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Hon Hai Precision Industry Co (Foxconn, 鴻海精密) and MediaTek (聯發科) — hit their limit-down prices as soon as the market opened, falling to NT$848 (US$25.54), NT$138.5 and NT$1,295 respectively. TSMC's

TARIFFS: The global ‘panic atmosphere remains strong,’ and foreign investors have continued to sell their holdings since the start of the year, the Ministry of Finance said The government yesterday authorized the activation of its NT$500 billion (US$15.15 billion) National Stabilization Fund (NSF) to prop up the local stock market after two days of sharp falls in reaction to US President Donald Trump’s new import tariffs. The Ministry of Finance said in a statement after the market close that the steering committee of the fund had been given the go-ahead to intervene in the market to bolster Taiwanese shares in a time of crisis. The fund has been authorized to use its assets “to carry out market stabilization tasks as appropriate to maintain the stability of Taiwan’s

STEEP DECLINE: Yesterday’s drop was the third-steepest in its history, the steepest being Monday’s drop in the wake of the tariff announcement on Wednesday last week Taiwanese stocks continued their heavy sell-off yesterday, as concerns over US tariffs and unwinding of leveraged bets weighed on the market. The benchmark TAIEX plunged 1,068.19 points, or 5.79 percent, to 17,391.76, notching the biggest drop among Asian peers as it hit a 15-month low. The decline came even after the government on late Tuesday authorized the NT$500 billion (US$15.2 billion) National Stabilization Fund (國安基金) to step in to buoy the market amid investors’ worries over tariffs imposed by US President Donald Trump. Yesterday’s decline was the third-steepest in its history, trailing only the declines of 2,065.87 points on Monday and