China would continue to invest more in new computer chipmaking equipment than any other geographical region this year, despite a significant year-over-year decline, followed by South Korea and Taiwan, industry group SEMI said in a report yesterday.

In its fabrication plant spending forecast, SEMI said global investments in gear would rise 2 percent this year to US$110 billion, the sixth consecutive year in a row of growth, due to investment in tools needed to make chips for artificial intelligence (AI).

The impact of AI would likely be even stronger next year, SEMI added, when investment is expected to grow by another 18 percent.

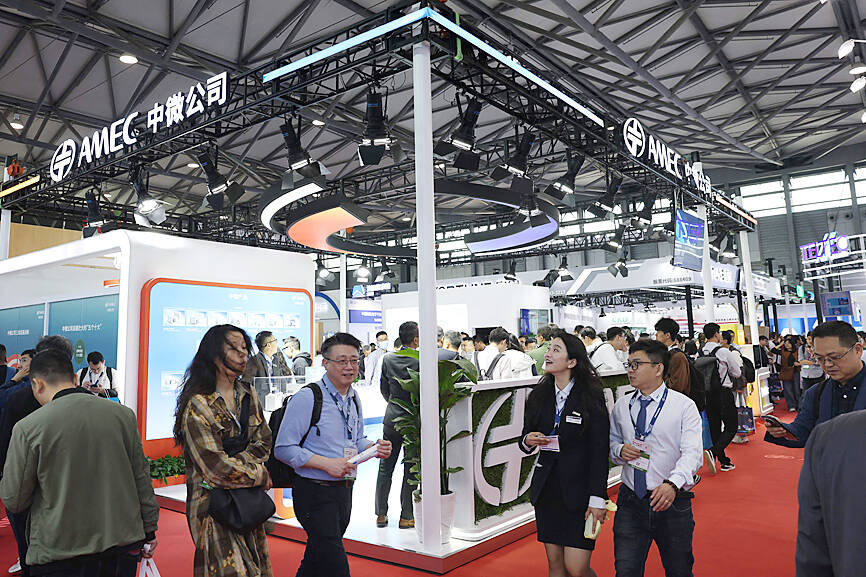

Photo: AFP

China is the largest consumer of chips, and firms there have been expanding chipmaking capacity for years, but they began a huge sprint in mid-2023 and last year with government support, as part of a drive to lessen dependence on imported chips in response to restrictions imposed by the US government.

ASML Holding NV, the largest chip equipment manufacturer, forecasts sales of 32 billion to 38 billion euros (US$34.5 billion to US$40.9 billion) for this year, implying market share of more than 25 percent for its sub-sector, lithography, where it enjoys a dominant position.

Other top equipment firms include Applied Materials Inc, KLA Corp, LAM Research Corp and Tokyo Electron Ltd, though Chinese equipment makers such as Naura Technology Group Co (北方華創), Advanced Micro-Fabrication Equipment Inc (AMEC, 中微半導體) and Huawei Technologies Co (華為) affiliate SiCarrier Technologies Co (新凱來) are growing fast.

Photo: AFP

Chinese spending is expected to fall to US$38 billion this year, down 24 percent from US$50 billion last year, but still ahead of US$21.5 billion in South Korea, where SK Hynix Inc and Samsung Electronics Co are expanding capacity for memory chips.

Spending in Taiwan, where leading foundry Taiwan Semiconductor Manufacturing Co (台積電) manufactures AI chips for Nvidia Corp and others, is projected at US$21 billion.

Among other regions, the Americas and Japan are each expected to spend US$14 billion this yaer, while Europe would spend US$9 billion, SEMI said.

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not