Alibaba Group Holding Ltd (阿里巴巴) chairman Joe Tsai (蔡崇信) yesterday warned of a potential bubble forming in data center construction, arguing that the pace of that buildout might outstrip initial demand for artificial intelligence (AI) services.

A rush by big tech firms, investment funds and other entities to erect server bases from the US to Asia is starting to look indiscriminate, Tsai told the HSBC Global Investment Summit in Hong Kong.

Many of those projects are built without clear customers in mind, Tsai said.

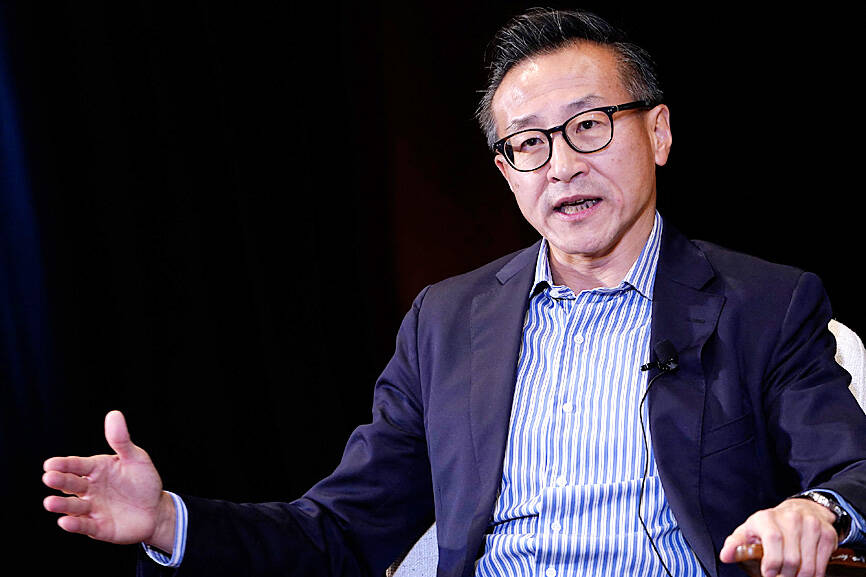

Photo: AFP

From Microsoft Corp to Softbank Group Corp, tech firms on both sides of the Pacific Ocean are spending billions of dollars buying the Nvidia Corp and SK Hynix Inc chips crucial to AI development.

Alibaba itself — which last month said that it was going all-in on AI — plans to invest more than 380 billion yuan (US$52 billion) over the next three years.

Server farms are springing up from India to Malaysia, while US President Donald Trump is touting a Stargate project that envisions an outlay of US$500 billion dollars.

Many on Wall Street have begun to question that spending, especially after Chinese firm DeepSeek (深度求索) released an open-source AI model that it claims rivals US technology, but was built at a fraction of the cost.

Critics have also pointed out the persistent dearth of practical, real-world applications for AI.

“I start to see the beginning of some kind of bubble,” Tsai told delegates.

Some of the envisioned projects commenced raising funds without having secured “uptake” agreements, he added.

“I start to get worried when people are building data centers on spec. There are a number of people coming up, funds coming out, to raise billions or millions of capital,” he said.

Tsai talked about how Alibaba was undergoing a “reboot” and rehiring after years of regulatory scrutiny that crimped growth.

The firm has initiated programs to acquire the AI talent it needs to further its stated ambition of exploring artificial general intelligence.

At the same time, Tsai had choice words for his US rivals, particularly with their spending.

Just this year, Amazon.com Inc, Alphabet Inc and Meta Platforms Inc pledged to spend US$100 billion, US$75 billion and up to US$65 billion respectively on AI infrastructure.

Microsoft has said it expects to spend US$80 billion this fiscal year on AI data centers, but that pace of spending growth should begin to slow in the year starting July.

“I’m still astounded by the type of numbers that’s being thrown around in the United States about investing into AI,” Tsai told the audience. “People are talking, literally talking about US$500 billion, several 100 billion dollars. I don’t think that’s entirely necessary. I think in a way, people are investing ahead of the demand that they’re seeing today, but they are projecting much bigger demand.”

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced