Shares in Nvidia Corp’s Taiwanese suppliers mostly closed higher yesterday on hopes that the US artificial intelligence (AI) chip designer would showcase next-generation technologies at its annual AI conference slated to open later in the day.

The GPU Technology Conference (GTC) in California is to feature developers, engineers, researchers, inventors and information technology professionals, and would focus on AI, computer graphics, data science, machine learning and autonomous machines.

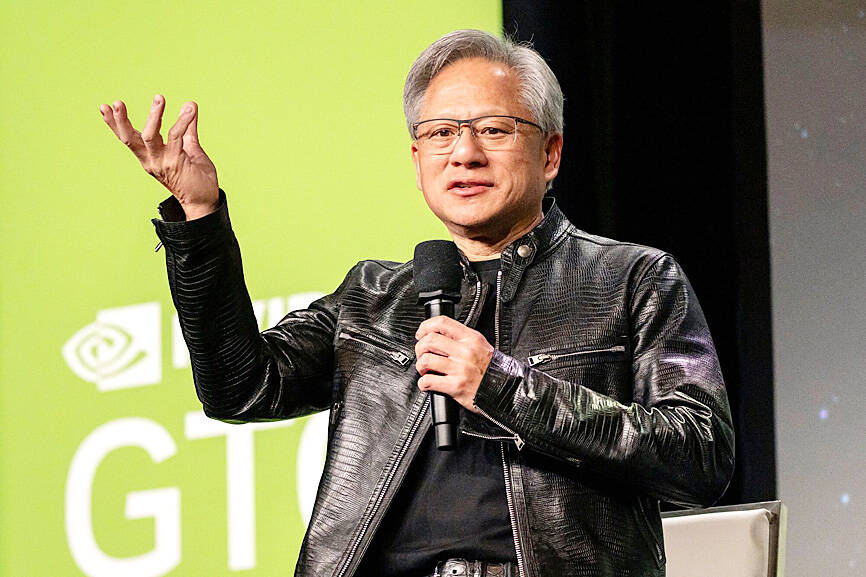

The event comes at a make-or-break moment for the firm, as it heads into the next few quarters, with Nvidia CEO Jensen Huang’s (黃仁勳) keynote speech today seen as having the ability to stave off fears that the chipmaker’s sales boom is peaking.

Photo: David Paul Morris, Bloomberg

Top of mind for investors would be updates on the company’s Blackwell product line, and commentary on gross margins, China, competitors and growth. Huang is also slated to appear with a group of industry executives on a panel on Thursday about the future of quantum computing.

More than 20 Taiwanese companies would be joining the five-day conference this week through Friday, either as exhibitors or sponsors. They include Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Asustek Computer Inc (華碩), Lite-On Technology Corp (光寶), Hon Hai Precision Industry Co (鴻海), Quanta Cloud Technology Inc (雲達), Delta Electronics Inc (台達電) and Advantech Co (研華).

Following Nvidia shares’ 5.3 percent increase on Friday amid a rebound on Wall Street, TSMC gained 1.15 percent, Asustek rose 2.63 percent, Delta increased 4.1 percent, Advantech climbed 0.39 percent and Lite-On moved up 1.42 percent yesterday in Taipei trading. However, iPhone assembler and AI server maker Hon Hai lost 1.18 percent.

The TAIEX closed up 150.58 points, or 0.69 percent, at 22,118.63.

“The local main board rode the wave of expectations about Nvidia’s conference, as many investors have high hopes the AI giant will unveil the next generation AI server GB300, which is likely to benefit its Taiwanese suppliers,” Hua Nan Securities Co (華南永昌證券) analyst Kevin Su (蘇俊宏) said.

Nvidia shares remain down more than 9 percent this year, despite a recent rebound from a March trough. Investors are hoping Huang’s speech can deliver enough optimism to help sustain the stock’s recent rebound.

“The fear of Nvidia is we are at peak earnings right now and that the second half of the year isn’t going to be nearly as good as they outlined,” Wayve Capital Management chief strategist Rhys Williams said. “When he [Huang] goes onstage he may be able to give people some comfort that things are going well and that the wheels aren’t falling off.”

Additional reporting by Bloomberg

TARIFFS: The global ‘panic atmosphere remains strong,’ and foreign investors have continued to sell their holdings since the start of the year, the Ministry of Finance said The government yesterday authorized the activation of its NT$500 billion (US$15.15 billion) National Stabilization Fund (NSF) to prop up the local stock market after two days of sharp falls in reaction to US President Donald Trump’s new import tariffs. The Ministry of Finance said in a statement after the market close that the steering committee of the fund had been given the go-ahead to intervene in the market to bolster Taiwanese shares in a time of crisis. The fund has been authorized to use its assets “to carry out market stabilization tasks as appropriate to maintain the stability of Taiwan’s

STEEP DECLINE: Yesterday’s drop was the third-steepest in its history, the steepest being Monday’s drop in the wake of the tariff announcement on Wednesday last week Taiwanese stocks continued their heavy sell-off yesterday, as concerns over US tariffs and unwinding of leveraged bets weighed on the market. The benchmark TAIEX plunged 1,068.19 points, or 5.79 percent, to 17,391.76, notching the biggest drop among Asian peers as it hit a 15-month low. The decline came even after the government on late Tuesday authorized the NT$500 billion (US$15.2 billion) National Stabilization Fund (國安基金) to step in to buoy the market amid investors’ worries over tariffs imposed by US President Donald Trump. Yesterday’s decline was the third-steepest in its history, trailing only the declines of 2,065.87 points on Monday and

TARIFF CONCERNS: The chipmaker cited global uncertainty from US tariffs and a weakening economic outlook, but said its Singapore expansion remains on track Vanguard International Semiconductor Corp (世界先進), a foundry service provider specializing in producing power management and display driver chips, yesterday withdrew its full-year revenue projection of moderate growth for this year, as escalating US tariff tensions raised uncertainty and concern about a potential economic recession. The Hsinchu-based chipmaker in February said revenues this year would grow mildly from last year based on improving supply chain inventory levels and market demand. At the time, it also anticipated gradual quarter revenue growth. However, the US’ sweeping tariff policy has upended the industry’s supply chains and weakened economic prospects for the world economy, it said. “Now

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not