Taiwan’s official manufacturing purchasing managers’ index (PMI) last month gained 5.3 points to 54, the best performance in six months, as local firms benefitted from a sustained artificial intelligence boom and China’s stimulus measures for consumption, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday.

However, the non-manufacturing index slipped into contraction mode for the first time in 27 months, signaling a slowdown in domestic demand and consumer spending, the institute said.

“Improving new orders and production activity accounted for the pickup in the latest PMI data,” CIER president Lien Hsien-ming (連賢明) told a media briefing in Taipei.

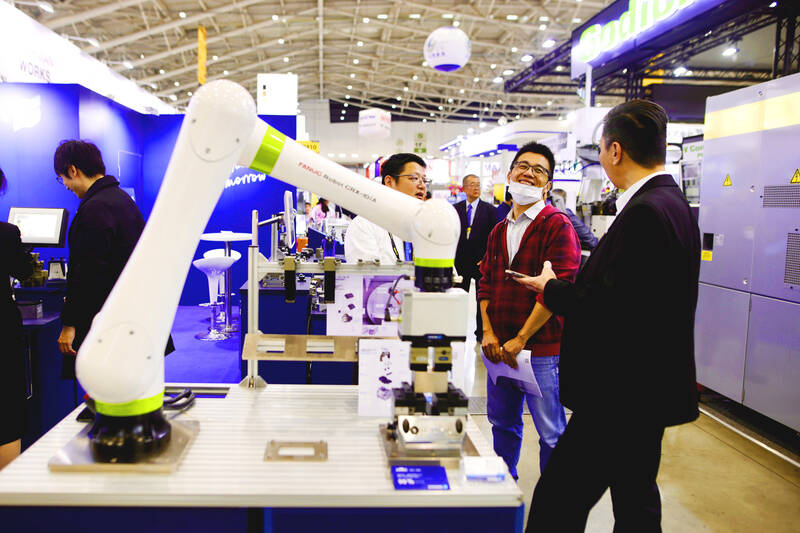

Photo: Ritchie B. Tongo, EPA-EFE

PMI seeks to capture the health of the manufacturing industry, with values of more than 50 indicating expansion and points below the threshold suggesting contraction.

Taiwanese firms reported rush orders intended to cope with potential tariff hikes under US President Donald Trump, and China’s subsidy for replacing consumer electronic gadgets including smartphones and notebook computers lent further support, Lien said.

The gauge for new orders picked up 4.7 points to 54.4, while industrial output rose 14.9 points to 59.9, both emerging from the woods seen one month earlier, the institute said.

The readings on employment rose 1.2 points to 52 and suppliers’ delivery times lengthened to 50.8, while the measure on inventories climbed 6.2 points to 52.7, the first time it moved into positive territory since September 2022, it added.

Academia Sinica fellow Kamhon Kan (簡錦漢) warned against being overly optimistic about the results, saying that uncertainty is heightening over global trade after the US’ new tariffs on Canada, Mexico and China went into effect.

In response, Canada and China raised tariffs on US imports, with Mexico also pledging retaliatory measures, making the flow of goods more expensive and curtailing demand, Kan said.

Furthermore, more local firms could take cues from Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and move their production to the US to dodge tariffs, and weaken Taiwan’s technology advantages and its export-focused economy, Kan said.

Lien said there is little else TSMC can do to appease Trump and its US investment plans could put pressure on major rival Samsung Electronics Co in negotiating trade terms with the White House.

On the services side, the non-manufacturing index shed 5.8 pints to 49.2, the first contraction since July 2022, the institute said.

Local restaurants and hotels fared weaker-than-expected over the Lunar New Year holiday, as Taiwanese opted to vacation abroad, Lien said.

That explained why the nation’s tourism deficit exceeded NT$600 billion (US$18.28 billion), Lien said.

Policymakers and service providers should work to keep consumer spending in Taiwan, he added.

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not

TARIFF CONCERNS: The chipmaker cited global uncertainty from US tariffs and a weakening economic outlook, but said its Singapore expansion remains on track Vanguard International Semiconductor Corp (世界先進), a foundry service provider specializing in producing power management and display driver chips, yesterday withdrew its full-year revenue projection of moderate growth for this year, as escalating US tariff tensions raised uncertainty and concern about a potential economic recession. The Hsinchu-based chipmaker in February said revenues this year would grow mildly from last year based on improving supply chain inventory levels and market demand. At the time, it also anticipated gradual quarter revenue growth. However, the US’ sweeping tariff policy has upended the industry’s supply chains and weakened economic prospects for the world economy, it said. “Now

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced