Hong Kong and Singapore are the front-runners in a push by Asian governments to become cryptocurrency hubs as they look to capitalize on the global resurgence of the sector thanks to the support of US President Donald Trump.

Bitcoin recently hit a record of close to US$110,000 while others have also rallied on the back of Trump’s pro-crypto promises. With forecasts that they could rise further, governments are keen to get a piece of the action.

Hong Kong regulators said on Wednesday that the city needed to tap “global liquidity” and laid out plans including the possibility of offering riskier crypto products such as derivative trading and margin financing. “The one word that we need to think about always is liquidity,” Hong Kong Securities and Futures Commission (SFC) executive director Eric Yip (葉志衡) said at an industry conference in the financial hub.

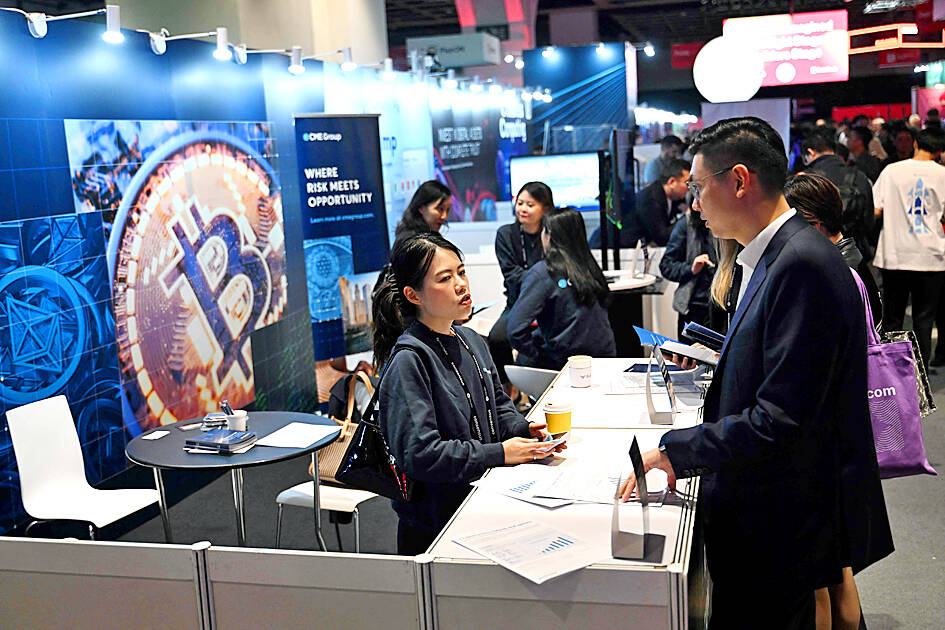

Photo: Peter Parks, AFP

“How do you bring liquidity to this market, hence commercial value, hence ecosystem?”

The collapse of exchange FTX in 2022 took along with it around US$8 billion from customers who used it to buy, sell and store cryptocurrencies.

The funds were later recovered, but regulators around the world are anxious to avoid a repeat, and the sector has since moved away from its freewheeling, anti-establishment origins to embrace regulation.

Officials stress the need for investor protection while still hoping their rules will be business-friendly.

“There was a lot more scrutiny two or three years (ago), right after FTX... (Regulators) want to make sure that they do the proper due diligence,” cryptocurrency exchange OKX (歐易) president Hong Fang (洪方) said.

Officials in Malaysia and Thailand are mulling crypto-related policy shifts, while Japan, South Korea and Cambodia have made incremental moves, according to Bloomberg News.

But Hong Kong and Singapore, along with Middle East standout Dubai, cemented their front-runner status during a period when US regulators under form president Joe Biden’s administration were sceptical toward crypto.

In an executive order last month, Trump — who has pledged to make the US the “crypto capital of the planet” — said he will instead provide “regulatory clarity and certainty” to support blockchain and digital asset innovation.

Animoca Brands group (安擬集團) president Evan Auyang (歐陽杞浚) said the anticipation surrounding a new US playbook is a game changer and will influence regulators worldwide.

The Monetary Authority of Singapore (MAS) has issued “Major Payment Institution” licenses in relation to digital payment tokens to 30 companies, including OKX, which it added last year.

The city-state has had a head start in regulating digital assets, including efforts such as the 2022 Project Guardian that brought regulators together with major global banks to explore asset tokenization.

That project showed Singapore “engaged early on central banks, regulatory bodies, international standards-setting bodies,” MAS deputy managing director Leong Sing Chiong (梁新松) said in November last year.

Hong Kong, which uses a different approach, has granted “Virtual Asset Trading Platform” licenses to 10 companies.

The Chinese finance hub is “number two... behind Singapore” when it comes to crypto regulation, Auyang said.

While Hong Kong has fewer exchanges, they saw a spike last year in terms of value received, according to blockchain research platform Chainalysis.

In the first half of last year, Hong Kong’s centralized exchanges collectively received US$26.6 billion, almost triple the year before and almost double Singapore’s US$13.5 billion.

Hong Kong overhauled its legal framework for crypto exchanges in mid-2023, with the SFC put in charge of vetting and licensing.

China has banned crypto since 2021 and exchanges in the semi-autonomous enclave cannot serve mainland Chinese clients.

But Animoca Brands executive chairperson Yat Siu (蕭逸) said pro-crypto policies have Beijing’s “blessing” and that Hong Kong benefits from being China’s financial gateway.

Aside from exchanges, the SFC on Wednesday said it would explore a range of regulations, including for custody services, staking and over-the-counter trading.

“Hong Kong isn’t sitting back and saying, ‘Look at the US, we’re just going to sort of kick back’,” Siu said. “It actually spurs it more into action.”

However, the city’s regulators have learned that the devil is in the details.

Hong Kong regulatory lawyer Jonathan Crompton said: “Anybody who engages in (exchange licensing) is going to have to commit to a very serious governance regime... It’s not for the faint-hearted.”

Over the past two years, some companies have reportedly found it challenging to hire specialized compliance personnel. The SFC vetting team, too, is understaffed.

The regulator’s Web site lists eight pending candidates, while 13 have withdrawn their applications.

“The SFC has been stuck between a rock and a hard place,” Crompton told AFP. “People have complained that, on one hand, it’s not quick enough to introduce a regulatory regime, and on the other hand, they have not provided enough protection.”

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors