Nytex Composites Co (耐特科技), which makes specialty plastic compounds, expects revenue contribution from semiconductor materials to rise to more than 23 percent this year due to growing demand for artificial intelligence (AI) and advanced chips.

That would represent a big jump from 16.25 percent of total revenue last year and a mere 4.36 percent in 2023.

The Changhua County-based company tapped into the semiconductor sector in 2020, as it sought to transform itself into a supplier of high-value materials amid intensifying market competition.

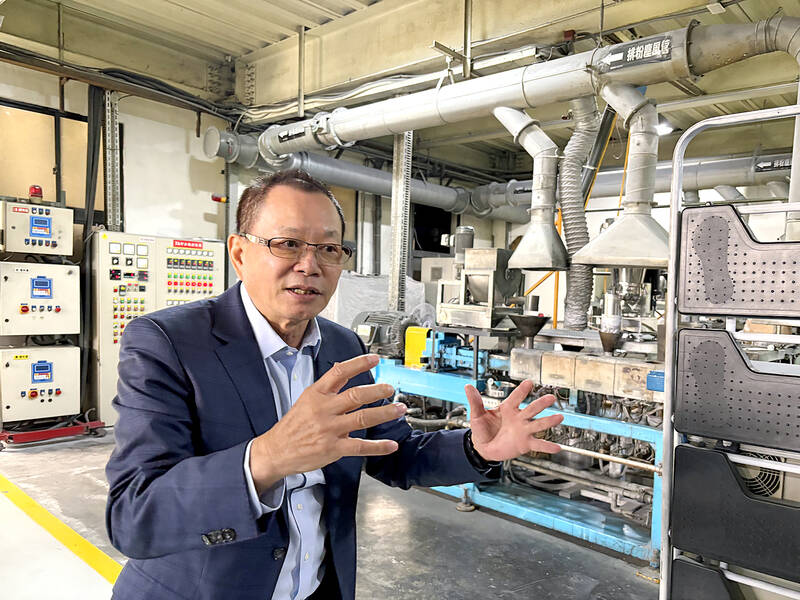

Photo: Lisa Wang, Taipei Times

Revenue expanded 19.24 percent last year to NT$2.54 billion (US$77.57 million) from NT$2.13 billion in 2023, company data showed.

Nytex’s biggest revenue sources come from specialty plastics used in everyday life goods, such as office furniture, office automation, suitcases and mechanical parts, making up about 33 percent.

“Semiconductor materials are our new revenue driver, adding to the company’s already very diversified revenue sources,” Nytex chairman Jason Chen (陳勳森) told reporters during a factory tour on Thursday, adding that he was positive about this year’s growth.

Established in 1988, Nytex started supplying specialty plastic compounds in 2020 to Gudeng Precision Industrial Co (家登精密), which at the time was scrambling to find a domestic supplier due to supply disruptions from overseas, Chen said.

Gudeng makes extreme ultraviolet pods, advanced front-opening unified pods and wafer cassettes for Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Intel Corp, Chinese and South Korean chipmakers.

Nytex has spent NT$100 million to build two production lines in Changhua County to produce specialty plastic compounds, doubling the capacity from two years ago, to cope with rapidly growing demand for semiconductor materials used in advanced wafer pods and cassettes, which transport wafers during the chip manufacturing process, it said.

“We started looking into the premium material business about six years ago, as we found that Chinese manufacturers were ready to ramp up mass production of [mid-end] materials. A majority of premium materials are for semiconductors, which was totally new to us,” Nytex president Henry Chen (陳宇涵) said.

In China, Nytex plans to ramp up its first production line in Shanghai to supply semiconductor materials used in less advanced wafer pods for Chinese chipmakers, which make chips on less advanced process technologies such as 28 nanometer technology, it said.

Nytex is also set to supply plastic compounds used in IC trays, which are used in advanced packaging technology, chip-on-wafer-on-substrate (CoWoS) technology, next quarter, Jason Chen said.

Nytex’s plastic compounds are also used in back-up battery units, which are equipped within AI servers to prevent data losses and equipment damage during power outages, it said.

The company operates six production lines to supply plastic compounds used in electronics and other products, in addition to 10 production lines in Taiwan to supply plastic compounds to make heat sinks for Wi-Fi routers, vehicle parts, connectors and bicycle parts among others.

The company plans to submit an application for an initial public offering this year.

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

Taiwan will prioritize the development of silicon photonics by taking advantage of its strength in the semiconductor industry to build another shield to protect the local economy, National Development Council (NDC) Minister Paul Liu (劉鏡清) said yesterday. Speaking at a meeting of the legislature’s Economics Committee, Liu said Taiwan already has the artificial intelligence (AI) industry as a shield, after the semiconductor industry, to safeguard the country, and is looking at new unique fields to build more economic shields. While Taiwan will further strengthen its existing shields, over the longer term, the country is determined to focus on such potential segments as

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced