US President Donald Trump has threatened to impose up to 100 percent tariffs on Taiwan’s semiconductor exports to the US to encourage chip manufacturers to move their production facilities to the US, but experts are questioning his strategy, warning it could harm industries on both sides.

“I’m very confused and surprised that the Trump administration would try and do this,” Bob O’Donnell, chief analyst and founder of TECHnalysis Research in California, said in an interview with the Central News Agency on Wednesday.

“It seems to reflect the fact that they don’t understand how the semiconductor industry really works,” O’Donnell said.

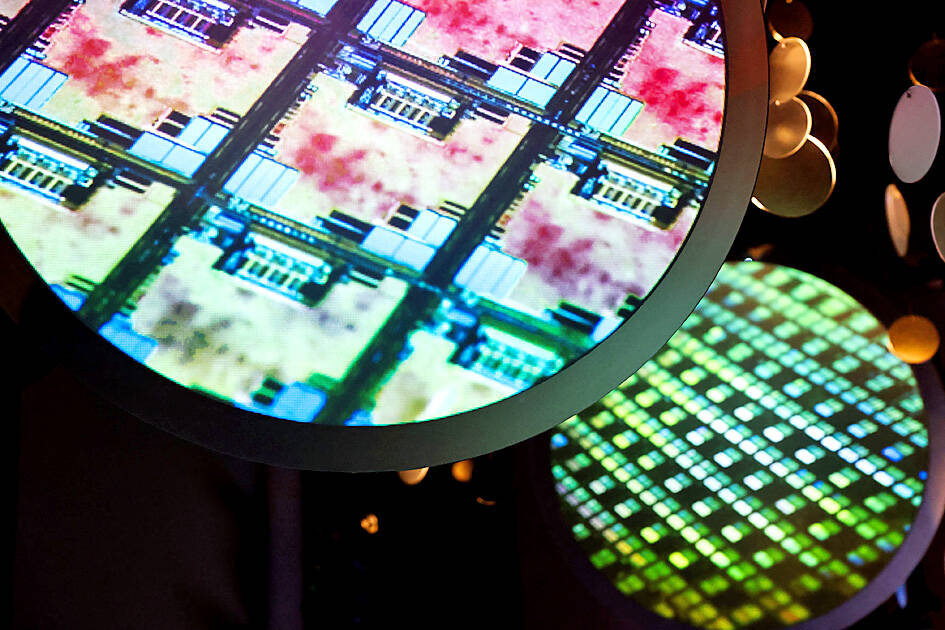

Photo: Cheng I-hwa, AFP

Economic sanctions would not boost chip manufacturing in the US overnight, because building a chip fab requires billions of dollars and many years of construction, he said.

He described Trump’s economic policies as “shortsighted,” adding that they would not diminish Taiwan’s leading position in advanced chip manufacturing, but rather would drive up the cost of chips made in Taiwan.

“It will have a huge negative impact on every tech-related industry,” O’Donnell said.

The proposed tariffs would harm Taiwanese chipmakers, as well as US tech companies that depend heavily on their chip supplies, including Apple Inc, Nvidia Corp, Qualcomm Inc, Intel Corp and Advanced Micro Devices Inc, he said.

Brian Peck, a former official at the Office of the US Trade Representative, told CNA in a separate interview that the US tech industry, which relies on Taiwanese chips, would face higher prices in the short term.

Those increased costs ultimately would be passed on to American consumers, said Peck, who is an assistant professor at the University of Southern California Gould School of Law.

In the long term, tariffs would put pressure on Taiwan’s semiconductor producers, he said in an interview.

Suppliers of semiconductors based in Taiwan would probably face a decline in sales, because US companies “would be forced either to move manufacturing to the US or find other suppliers that are not subject to the same level of tariffs,” Peck said.

Trump is likely to follow through on the tariff threats, if his goal is to bring chipmaking back to the US, but the US president’s actions have been “somewhat unpredictable,” he said.

Trump might be using the tariff issue as leverage to push Taipei to increase defense spending or make other concessions, as seen in his dealings with Mexico and Canada, Peck said.

In that case, “I think, those would be some of the issues that need to be discussed and worked out” between Taiwan and the US, he said.

TARIFFS: The global ‘panic atmosphere remains strong,’ and foreign investors have continued to sell their holdings since the start of the year, the Ministry of Finance said The government yesterday authorized the activation of its NT$500 billion (US$15.15 billion) National Stabilization Fund (NSF) to prop up the local stock market after two days of sharp falls in reaction to US President Donald Trump’s new import tariffs. The Ministry of Finance said in a statement after the market close that the steering committee of the fund had been given the go-ahead to intervene in the market to bolster Taiwanese shares in a time of crisis. The fund has been authorized to use its assets “to carry out market stabilization tasks as appropriate to maintain the stability of Taiwan’s

STEEP DECLINE: Yesterday’s drop was the third-steepest in its history, the steepest being Monday’s drop in the wake of the tariff announcement on Wednesday last week Taiwanese stocks continued their heavy sell-off yesterday, as concerns over US tariffs and unwinding of leveraged bets weighed on the market. The benchmark TAIEX plunged 1,068.19 points, or 5.79 percent, to 17,391.76, notching the biggest drop among Asian peers as it hit a 15-month low. The decline came even after the government on late Tuesday authorized the NT$500 billion (US$15.2 billion) National Stabilization Fund (國安基金) to step in to buoy the market amid investors’ worries over tariffs imposed by US President Donald Trump. Yesterday’s decline was the third-steepest in its history, trailing only the declines of 2,065.87 points on Monday and

TARIFF CONCERNS: The chipmaker cited global uncertainty from US tariffs and a weakening economic outlook, but said its Singapore expansion remains on track Vanguard International Semiconductor Corp (世界先進), a foundry service provider specializing in producing power management and display driver chips, yesterday withdrew its full-year revenue projection of moderate growth for this year, as escalating US tariff tensions raised uncertainty and concern about a potential economic recession. The Hsinchu-based chipmaker in February said revenues this year would grow mildly from last year based on improving supply chain inventory levels and market demand. At the time, it also anticipated gradual quarter revenue growth. However, the US’ sweeping tariff policy has upended the industry’s supply chains and weakened economic prospects for the world economy, it said. “Now

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not