The frenzy over Chinese artificial intelligence (AI) is turning Alibaba Group Holding Ltd (阿里巴巴) into an investor favorite again, injecting new life into an e-commerce giant that had nearly sunk into obscurity following a years-long regulatory crackdown.

Alibaba’s Hong Kong-listed shares have surged 46 percent since hitting a 2025 low on Jan. 13, expanding its market value by nearly US$87 billion and exceeding the Hang Seng Tech Index’s 25 percent gain in the same period. That makes the stock by far the best performer in China’s Big Tech universe in the new year, outshining rivals Tencent Holdings Ltd (騰訊), Baidu Inc (百度) and JD.com Inc (京東).

It marks a surprise reversal of fortunes for Alibaba, which had fallen out of favor among investors after its business suffered from Beijing’s clampdown on the country’s tech behemoths and a post-COVID-19 consumption slump. Behind the rally is optimism about Alibaba’s efforts to develop its own AI services and platform, which gained traction after Chinese AI start-up DeepSeek (深度求索) unveiled technologies that caused a rout on Wall Street.

Photo: Reuters

Alibaba’s shares got another shot in the arm yesterday, after The Information reported that Apple Inc is working with the e-commerce pioneer to roll out AI features in China.

“The emergence of DeepSeek has sparked a new AI-related catalyst for Chinese tech stocks,” said Andy Wong (黃耀宗), investment and ESG director for Asia Pacific at Solomons Group. “Within this space, we see Alibaba as having more tangible and well-established earnings growth prospects in the medium term.”

Since the advent of ChatGPT in late 2022, Alibaba has invested in a clutch of China’s most promising start-ups, including Moonshot (月之暗面) and Zhipu (智譜). The company prioritized the expansion of the cloud business that underpins AI development, slashing prices to win back the customers that fled to rivals during the turbulent years. It also decided to spend on AI, joining a race led by Baidu at the time.

Last month, that effort yielded initial fruit. Alibaba published benchmark scores showing its Qwen 2.5 Max edition scored better than Meta Platforms Inc’s Llama and DeepSeek’s V3 model in various tests. The company is now considered a leading player in AI alongside big names from Tencent to ByteDance Ltd (字節跳動) and start-ups including MiniMax (稀宇科技) and Zhipu.

But it’s still early days.

A key hurdle facing Chinese AI firms has been the slower adoption and lack of willingness to pay for services among domestic consumers and businesses.

“Many hedge funds and long-only investors see AI as a potential inflection point for Alibaba, with some expressing interest in understanding the valuation of Alibaba’s cloud business and any upside from large language models,” JPMorgan Chase & Co analysts including Alex Yao (姚橙) wrote in a note. “The AI narrative is seen as a driver for potential re-rating, but there are concerns about the monetization of AI capabilities.”

In addition, cloud business growth for Chinese hyperscalers has lagged that of major US peers so far. Analysts estimate cloud revenues for the December quarter rose 9.7 percent from a year ago at Alibaba and 7.7 percent at Baidu, compared with 19 percent at Amazon.com Inc and 31 percent at Microsoft Corp.

Alibaba’s financial results scheduled on Thursday next week are expected to offer investors a fresh opportunity to learn about the company’s progress on its AI models and outlook for its cloud services.

Hon Hai Precision Industry Co (鴻海精密) yesterday said that its research institute has launched its first advanced artificial intelligence (AI) large language model (LLM) using traditional Chinese, with technology assistance from Nvidia Corp. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), said the LLM, FoxBrain, is expected to improve its data analysis capabilities for smart manufacturing, and electric vehicle and smart city development. An LLM is a type of AI trained on vast amounts of text data and uses deep learning techniques, particularly neural networks, to process and generate language. They are essential for building and improving AI-powered servers. Nvidia provided assistance

DOMESTIC SUPPLY: The probe comes as Donald Trump has called for the repeal of the US$52.7 billion CHIPS and Science Act, which the US Congress passed in 2022 The Office of the US Trade Representative is to hold a hearing tomorrow into older Chinese-made “legacy” semiconductors that could heap more US tariffs on chips from China that power everyday goods from cars to washing machines to telecoms equipment. The probe, which began during former US president Joe Biden’s tenure in December last year, aims to protect US and other semiconductor producers from China’s massive state-driven buildup of domestic chip supply. A 50 percent US tariff on Chinese semiconductors began on Jan. 1. Legacy chips use older manufacturing processes introduced more than a decade ago and are often far simpler than

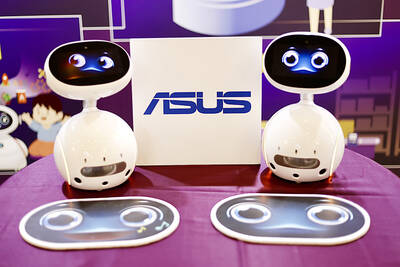

STILL HOPEFUL: Delayed payment of NT$5.35 billion from an Indian server client sent its earnings plunging last year, but the firm expects a gradual pickup ahead Asustek Computer Inc (華碩), the world’s No. 5 PC vendor, yesterday reported an 87 percent slump in net profit for last year, dragged by a massive overdue payment from an Indian cloud service provider. The Indian customer has delayed payment totaling NT$5.35 billion (US$162.7 million), Asustek chief financial officer Nick Wu (吳長榮) told an online earnings conference. Asustek shipped servers to India between April and June last year. The customer told Asustek that it is launching multiple fundraising projects and expected to repay the debt in the short term, Wu said. The Indian customer accounted for less than 10 percent to Asustek’s

Gasoline and diesel prices this week are to decrease NT$0.5 and NT$1 per liter respectively as international crude prices continued to fall last week, CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. Effective today, gasoline prices at CPC and Formosa stations are to decrease to NT$29.2, NT$30.7 and NT$32.7 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to cost NT$27.9 per liter at CPC stations and NT$27.7 at Formosa pumps, the companies said in separate statements. Global crude oil prices dropped last week after the eight OPEC+ members said they would