When Powerchip Technology Corp (力晶科技) entered a deal with the eastern Chinese city of Hefei in 2015 to set up a new chip foundry, it hoped the move would help provide better access to the promising Chinese market.

However, nine years later, that Chinese foundry, Nexchip Semiconductor Corp (合晶集成), has become one of its biggest rivals in the legacy chip space, leveraging steep discounts after Beijing’s localization call forced Powerchip to give up the once-lucrative business making integrated circuits for Chinese flat panels.

Nexchip is among Chinese foundries quickly winning market share in the crucial US$56.3 billion industry of so-called legacy or mature node chips made on 28-nanometer process technology and larger, a trend that prompted former US president Joe Biden’s administration to initiate an investigation and is alarming Taiwanese industry.

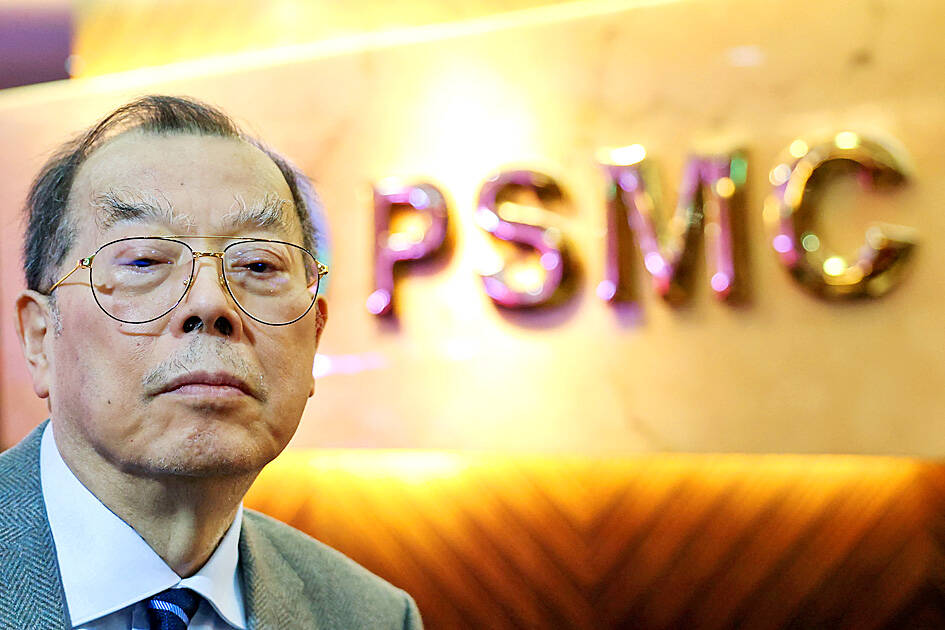

Photo: Ann Wang, Reuters

These Chinese foundries, which include Hua Hong Semiconductor Ltd (華虹半導體) and Semiconductor Manufacturing International Corp (SMIC, 中芯國際), are threatening the long-held dominance of Powerchip, United Microelectronics Corp (UMC, 聯電) and Vanguard International Semiconductor Corp (世界先進) in the market for chips used in cars and display panels by slashing prices and embarking on aggressive capacity expansion plans.

Taiwanese foundries are then forced to retreat or pursue more advanced and specialty processes, executives in Taiwan said.

“Mature-node foundries like us must transform; otherwise, Chinese price cuts will mess us up even further,” said Frank Huang (黃崇仁), chairman of Powerchip Investment Holding Corp (力晶創新投資控股) and its listed unit Powerchip Manufacturing Semiconductor Corp (力積電), which the company was reorganized into in 2019.

UMC said that the expansion of capacity globally had created “severe challenges” for the industry and that it was working with Intel to develop more advanced, smaller chips and diversify beyond legacy chipmaking.

US-China trade tensions might ease the pain a bit, executives in Taiwan said, as companies hoping to secure supply chains seek chips made outside China. However, US President Donald Trump has said he plans to impose tariffs as high as 100 percent on semiconductors made outside the US.

Blocked by the US in recent years from pursuing high-end chip technology, Chinese foundries doubled down on legacy chips and have undercut Taiwanese rivals on price, because of strong funding support from Beijing and their embrace of lower margins, executives in Taiwan said.

Chinese companies have dramatically increased legacy chip production capacity in the past few years.

China’s share of global mature node manufacturing capacity was 34 percent last year, while Taiwan’s was 43 percent, Taipei-based TrendForce Corp (集邦科技) said.

By 2027, China’s share is projected to surpass Taiwan’s, while South Korea and the US, with single-digit shares, are expected to decline.

Consultancy SEMI forecasts that out of 97 new fabrication plants starting production from 2023 to this year, 57 are in China.

Although Taiwanese foundries can still compete on factors such as process stability and better production yields, one executive working at a Taiwanese chip designer said Chinese foundries had since 2023 become more aggressive in pitching business.

That person, and a second one working at another Taiwanese chip designer, said Chinese customers — especially in consumer-focused sectors such as panels — were increasingly asking Taiwanese chip designers to hire Chinese fabs to make the chips, in line with a call from Beijing for Chinese companies to localize supply chains.

Some respite could come from efforts by Washington to curb China’s chip industry growth, alongside worsening relations between Beijing and other countries that force customers to split supply chains into China-for-China and non-China networks.

Huang said they were already seeing some orders that would have gone to China being directed to their sites in Taiwan and expect that to accelerate. An executive from a chip design company in Taiwan also said they had been receiving more orders from international customers asking to make chips outside China since 2023.

“Some customers will tell us that no matter what, they don’t want us to tape out chips in China; they don’t want ‘Made in China,’” the executive said.

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

Taiwan will prioritize the development of silicon photonics by taking advantage of its strength in the semiconductor industry to build another shield to protect the local economy, National Development Council (NDC) Minister Paul Liu (劉鏡清) said yesterday. Speaking at a meeting of the legislature’s Economics Committee, Liu said Taiwan already has the artificial intelligence (AI) industry as a shield, after the semiconductor industry, to safeguard the country, and is looking at new unique fields to build more economic shields. While Taiwan will further strengthen its existing shields, over the longer term, the country is determined to focus on such potential segments as

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced