MediaTek Inc (聯發科), the world’s largest supplier of mobile phone chips, yesterday said that revenue this quarter could grow by up to 10 percent, bolstered by China’s economic stimulus program and customers pulling in orders amid concern over US tariffs.

The first quarter tends to be a slack season, but MediaTek expects moderate revenue growth from its two major business segments — smartphone chips and smart edge platforms such as Wi-Fi chips.

Revenue is expected to increase sequentially by 2 to 10 percent to NT$140.8 billion to NT$151.8 billion (US$4.3 billion and US$4.6 billion) during the quarter ending March 31, the chip designer said.

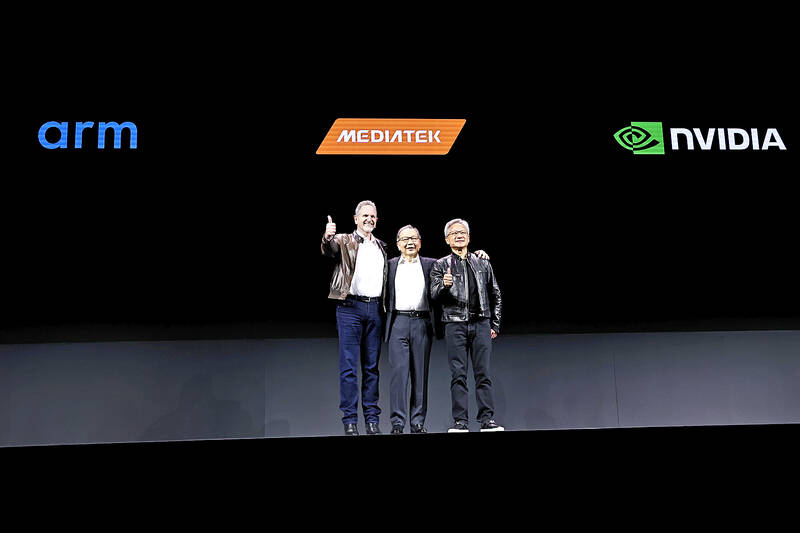

Photo: CNA

“Overall, for the first quarter of 2025, we see healthy smartphone demand thanks to China’s stimulus program, as well as some pull-in demand for products such as televisions, Wi-Fi, tablets and Chromebooks due to global tariff uncertainties,” MediaTek CEO Rick Tsai (蔡力行) told investors during a quarterly conference yesterday.

“Therefore, we expect first-quarter revenue to grow sequentially at a better-than-normal seasonal pace. Corporate gross margin is expected to be stable,” he said.

The company expects gross margin to come in at 47 percent give or take 1.5 percentage points, he said.

MediaTek is highly concentrated on the Chinese smartphone market. Strong uptake of Oppo’s (歐珀) and Vivo’s (維沃) artificial intelligence (AI)-enabled phones has helped the company more than double its flagship smartphone chip revenue last year, significantly exceeding its goal of 70 percent annually.

However, the mobile phone chip designer said that the visibility for the next quarter is low, mostly due to the global tariff war triggered by the US.

However, the AI megatrend is here to stay, the company said.

With recent launch of DeepSeek’s (深度求索) more cost-efficient AI model, MediaTek is “getting more optimistic” about such a trend, given the democratizing of AI applications among average users, Tsai said.

That bodes well not only for the growth of edge AI devices, but also for cloud-based data centers, he said.

As the world’s major cloud service providers are “doubling down” on their investments in AI data centers, MediaTek is investing heavily in AI application-specific-IC (ASIC) business by adding engineers, mainly in the US, and internal resources reallocations, aiming to enhance and broaden its AI ASIC business scope, Tsai said.

MediaTek expects its new AI ASIC business to bear fruit next year and contribute more than US$1 billion in revenue in the first or second quarter, he said.

The global AI ASIC market is estimated to reach US$45 billion by 2028, according to MediaTek’s previous forecast, which did not factor in the impact of DeepSeek.

The budget-friendly AI model from DeepSeek would accelerate the adoption of AI applications, Tsai said.

MediaTek added that its collaboration with Nvidia Corp to roll out a GB10 chip used for AI desktop applications would hit the shelves in May and be available for more diversified applications later this year.

The company reported that net profit last quarter slid 6.9 percent year on year to NT$23.94 billion from NT$25.71 billion. On a quarterly basis, it declined 6.4 percent from NT$25.59 billion.

Last year as a whole, net profit surged 38.8 percent annually to NT$107.14 billion from NT$77.19 billion in 2023, marking the third-highest level in the company’s history. Earnings per share surged to NT$66.92 from NT$48.51.

Gross margin improved to 49.6 percent last year from 47.8 percent in 2023.

Revenue rose 19 percent year-on-year in US dollar terms, beating the firm’s goal of 15 percent growth.

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

Taiwan will prioritize the development of silicon photonics by taking advantage of its strength in the semiconductor industry to build another shield to protect the local economy, National Development Council (NDC) Minister Paul Liu (劉鏡清) said yesterday. Speaking at a meeting of the legislature’s Economics Committee, Liu said Taiwan already has the artificial intelligence (AI) industry as a shield, after the semiconductor industry, to safeguard the country, and is looking at new unique fields to build more economic shields. While Taiwan will further strengthen its existing shields, over the longer term, the country is determined to focus on such potential segments as

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced