Russia could face a wave of corporate bankruptcies this year as the share of enterprises with risky levels of debt in total corporate revenue doubled last year, a leading think tank advising the government said in a research note.

The warning emphasizes the scale of high inflation and slowing growth, which could have made Russian President Vladimir Putin concerned about distortions in the nation’s wartime economy.

“The Russian economy is facing the threat of a large-scale surge in corporate bankruptcies,” TsMAKP researchers wrote.

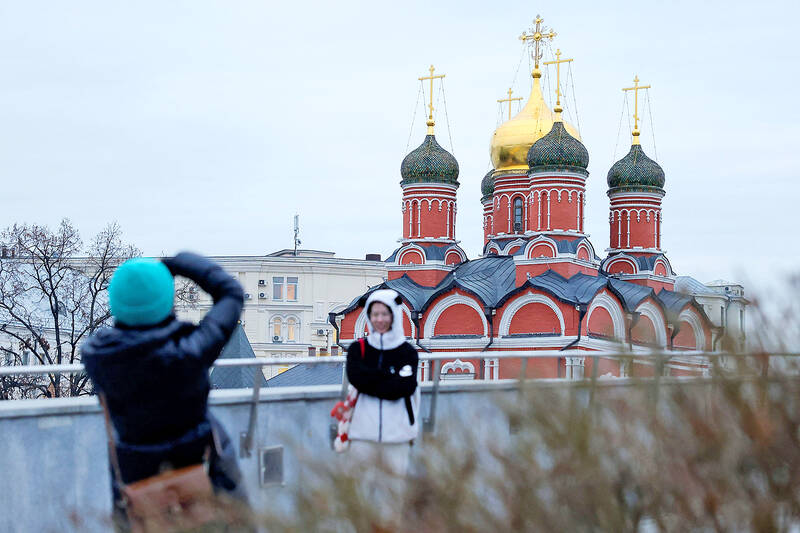

Photo: Reuters

They said that by the end of last year, the share of companies represented in total corporate revenue that had interest payments at a risky level of two-thirds of adjusted earnings, was likely at 20 percent.

The Russian central bank hiked its benchmark interest rate to 21 percent last year, the highest since the early 2000s, to fight inflation which hit 9.5 percent in the year, exceeding the government’s and the central bank’s forecasts.

Many companies have complained about high interest rates, which raise their borrowing costs. Russia’s largest mobile operator, MTS, in November last year blamed an 88.8 percent drop in third-quarter net profit on increased interest expenses.

The state-owned monopoly Russian Railways is facing a US$4 billion rise in interest payment costs this year.

TsMAKP researchers also pointed to a surge in the share of firms experiencing non-payments from their counterparties for supplied goods and services, which rose to 37 percent of total revenue in the third quarter of last year from about 20 percent in 2021 to 2023.

They said many firms preferred to deposit cash at banks amid high interest rates or buy risk-free bonds, which also offer attractive interest, while withholding payment to suppliers.

The research indicated that in the current high interest rate environment, the share of companies with working capital profitability that was lower than the risk-free interest rate also doubled to 66 percent of total corporate revenues.

This was stifling investment, the researchers said.

“A slowdown in the dynamics of investments in production facilities and a reduction in the potential for economic growth are already being factored in,” researchers said, projecting a fall in investments to 1.7 to 2.0 percent this year from 7 percent last year.

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

Taiwan will prioritize the development of silicon photonics by taking advantage of its strength in the semiconductor industry to build another shield to protect the local economy, National Development Council (NDC) Minister Paul Liu (劉鏡清) said yesterday. Speaking at a meeting of the legislature’s Economics Committee, Liu said Taiwan already has the artificial intelligence (AI) industry as a shield, after the semiconductor industry, to safeguard the country, and is looking at new unique fields to build more economic shields. While Taiwan will further strengthen its existing shields, over the longer term, the country is determined to focus on such potential segments as

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors