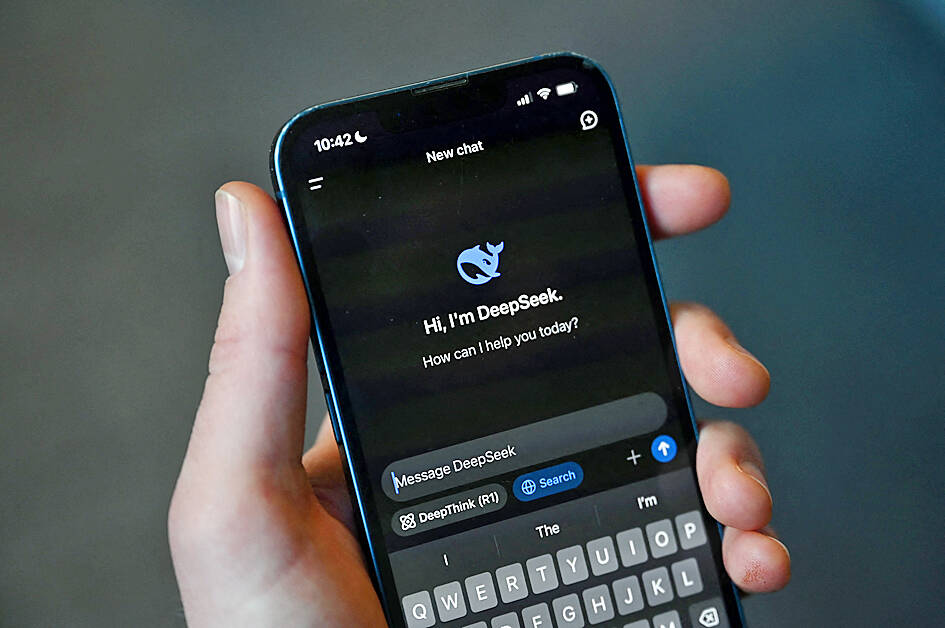

Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) eponymous AI assistant rocketed to the top of Apple Inc’s iPhone download charts, stirring doubts in Silicon Valley about the strength of the US’ technological dominance.

The app’s underlying AI model is widely seen as competitive with OpenAI and Meta Platforms Inc’s latest.

Its claim that it cost much less to train and develop triggered share moves across Asia’s supply chain.

Photo: AFP

Chinese tech firms linked to DeepSeek, such as Iflytek Co (科大訊飛), surged yesterday, while chipmaking tool makers like Advantest Corp slumped on the potential threat to demand for Nvidia Corp’s AI accelerators.

US stock index futures also tumbled amid concerns that DeepSeek’s AI models might disrupt US technological leadership. Markets were closed for holidays in Taiwan and South Korea.

Lauded by investor Marc Andreessen as “one of the most amazing and impressive breakthroughs,” DeepSeek’s assistant shows its work and reasoning as it addresses a user’s written query or prompt.

Reviews on Apple’s app store and Alphabet Inc’s Android Play Store praised that transparency.

The app topped the free downloads chart on iPhones in the US and is among the most downloaded productivity apps in the Play Store.

“DeepSeek shows that it is possible to develop powerful AI models that cost less,” Union Bancaire Privee SA managing director Ling Vey-sern (凌煒森) said. “It can potentially derail the investment case for the entire AI supply chain, which is driven by high spending from a small handful of hyperscalers.”

Founded by quant fund chief Liang Wenfeng (梁文鋒), DeepSeek’s open-sourced AI model is spurring a rethink of the billions of dollars that companies have been spending to stay ahead in the AI race.

“While it remains to be seen if DeepSeek will prove to be a viable, cheaper alternative in the long term, initial worries are centered on whether US tech giants’ pricing power is being threatened and if their massive AI spending needs re-evaluation,” IG Asia Pte market strategist Yeap Jun Rong (葉俊榮) said.

Like all other Chinese-made AI models, DeepSeek self-censors on topics deemed politically sensitive in China. Unlike ChatGPT, DeepSeek deflects questions about Tiananmen Square, Chinese President Xi Jinping (習近平) or the possibility of China invading Taiwan. That might prove jarring to international users, who may not have come into direct contact with Chinese chatbots earlier.

The initial success provides a counterpoint to expectations that the most advanced AI would require increasing amounts of computing power and energy — an assumption that has driven shares in Nvidia and its suppliers to all-time highs.

The exact cost of development and energy consumption of DeepSeek are not fully documented, but the start-up has presented figures that suggest its cost was only a fraction of OpenAI’s latest models.

The DeepSeek product “is deeply problematic for the thesis that the significant capital expenditure and operating expenses that Silicon Valley has incurred is the most appropriate way to approach the AI trend,’ said Nirgunan Tiruchelvam, head of consumer and internet at Singapore-based Aletheia Capital. “It calls into question the massive resources that have been dedicated to AI.”

That a small and efficient AI model emerged from China, which has been subject to escalating US trade sanctions on advanced Nvidia chips, is also challenging the effectiveness of such measures.

“The US is great at research and innovation and especially breakthrough, but China is better at engineering,” computer scientist Lee Kai-fu (李開復) said earlier this month at the Asian Financial Forum in Hong Kong.

“In this day and age, when you have limited compute power and money, you learn how to build things very efficiently,” he said.

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

Taiwan will prioritize the development of silicon photonics by taking advantage of its strength in the semiconductor industry to build another shield to protect the local economy, National Development Council (NDC) Minister Paul Liu (劉鏡清) said yesterday. Speaking at a meeting of the legislature’s Economics Committee, Liu said Taiwan already has the artificial intelligence (AI) industry as a shield, after the semiconductor industry, to safeguard the country, and is looking at new unique fields to build more economic shields. While Taiwan will further strengthen its existing shields, over the longer term, the country is determined to focus on such potential segments as

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced