Heading into the World Economic Forum, the thinking was it would be the perfect place for many of the biggest deals in the works among Europe’s lenders to inch their way into existence.

There was Banco Bilbao Vizcaya Argentaria SA’s (BBVA) takeover offer for its smaller rival, Banco de Sabadell SA, for instance. Or UniCredit SpA’s bid for its domestic competitor Banco BPM SpA and its growing interest in Germany’s Commerzbank AG.

For months, those deals have faced resistance from either the target or other stakeholders, including governments. The hope was they might finally come around at Davos, known for its ability to get CEOs in a room together to hash out their differences.

.Photo: Stefan Wermuth, Bloomberg

That was not quite what happened.

Instead, Commerzbank CEO Bettina Orlopp ratcheted up her rhetoric against UniCredit — labeling the lender’s recent overtures “hostile” in a clear escalation of her defense against the unwanted deal. The German government, which holds a 12 percent stake in the bank, said something similar. Meanwhile, Sabadell said it was considering moving its legal domicile back to Catalonia, as it seeks to muster political support to help it fight against BBVA’s bid.

On Friday came the shock announcement that Banca Monte dei Paschi di Siena SpA would seek to acquire its bigger rival, Mediobanca SpA, adding to the flurry of complicated takeover talks. Mediobanca said it considers the approach as hostile and would likely end up rejecting it.

It all underscored the fact that even after years of waiting, European banks and their governments are still resisting the urge to consolidate faster.

That is despite increasing calls from regulators, dealmakers and governments that more radical combinations are needed so Europe’s lenders can become the behemoths they need to be to finance the growth the continent needs.

“Europe needs to decide: Does it want banks which are a utility or a force of capitalism?” Lombard Odier senior managing partner Hubert Keller said.

Just hours before the Orlopp’s announcement on Wednesday, she was spotted wandering through the icy streets of Europe’s highest city and having lunch at a small eatery with her communications chief.

UniCredit CEO Andrea Orcel said that there had been various meetings with the German government and Commerzbank executives before his bank took control of about 28 percent of Commerzbank.

“Commerzbank was the first call we had in the morning to debrief” after the Italian lender acquired a large stake last year, he said in an interview with Bloomberg TV anchor Francine Lacqua. “From there, it moved to surprise. Well, imagine ours. And then it moved to hostility or to opaqueness.”

BBVA chairman Carlos Torres was seen running up Davos’ main drag.

Hundreds of miles away, Sabadell said its board would begin meeting to discuss the possible headquarters move, as it seeks to muster political support to help it fight against the hostile bid.

Over at the confab’s annual meeting, Banco Santander SA chair Ana Botin faced a series of questions about whether she would ever consider selling her business in the UK, where headaches have begun to pile up, as the bank braces for a potentially costly review into its motor finance business.

“We love the UK,” Botin said. “It’s a core market and will remain a core market for Santander. That’s it.”

Lenders’ resistance to do deals has come even as a growing chorus of regulators are supportive of cross-border banking mergers across Europe. European Central Bank President Christine Lagarde has said such deals would be good for the region if it allows lenders to better compete against their rivals in the US and China.

“The good thing is that we identified the issue which is the competitiveness of Europe,” Intesa Sanpaolo SpA chief financial officer Luca Bocca said, adding that cross-border deals will be difficult to execute. “There needs to be flexibility that accounts for regional structural differences.”

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

Taiwan’s foreign exchange reserves hit a record high at the end of last month, surpassing the US$600 billion mark for the first time, the central bank said yesterday. Last month, the country’s foreign exchange reserves rose US$5.51 billion from a month earlier to reach US$602.94 billion due to an increase in returns from the central bank’s portfolio management, the movement of other foreign currencies in the portfolio against the US dollar and the bank’s efforts to smooth the volatility of the New Taiwan dollar. Department of Foreign Exchange Director-General Eugene Tsai (蔡炯民)said a rate cut cycle launched by the US Federal Reserve

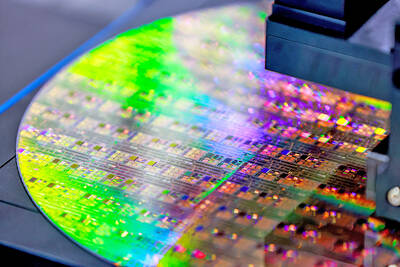

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional