Export orders last year increased 5.1 percent year-on-year to US$589.54 billion, ending two consecutive years of decline, the Ministry of Economic Affairs said in a report yesterday.

The growth in export orders beat the ministry’s forecast last month of an annual increase of 4.5 to 4.8 percent, with the size of orders hitting the third-highest level on record after US$674.13 billion in 2021 and US$666.79 billion in 2022, ministry data showed.

The increase came from strong demand for emerging technologies, such as artificial intelligence and high-performance computing, as well as rising orders for goods related to semiconductor equipment and some non-technology inventory restocking demand, the ministry said.

Photo: CNA

A low comparison base a year earlier also helped, it added.

The better-than-expected showing came as export orders — an indicator of product and component shipments to overseas markets for the following one to three months — last month increased 20.8 percent year-on-year to US$52.92 billion, rising for the 10th straight month and exceeding the ministry’s forecast of an increase of 13 to 17.5 percent.

In a poll of domestic manufacturers by the ministry, only 11.4 percent of respondents were optimistic that export orders would increase this month from last month, while 48.8 percent said that orders would be flat and 39.8 percent expected them to decline, the report said.

In addition, the diffusion index of export orders — a gauge of manufacturers’ expectations on export orders for the following month — fell to 42.4 last month from 48.8 in November and was below the threshold of 50, which suggests manufacturers are remaining cautious, it said.

As a result, export orders this month are forecast to decrease 4 to 8.1 percent year-on-year to between US$44.5 billion and US$46.5 billion, the ministry said.

The latest data showed that export orders last month for electronic components increased 33.5 percent year-on-year to US$19.92 billion, and those for information and communications technology (ICT) products grew 24.3 percent to US$15.25 billion.

Last year as a whole, orders for electronic components grew 11.5 percent year-on-year to US$211.55 billion, while ICT orders increased 3.6 percent to US$172.02 billion, the report said.

Orders for optoelectronic products increased 17.7 percent to US$1.89 billion last month and rose 8.7 percent to US$20.8 billion last year.

However, companies in non-technology sectors had a mixed showing last month, with export orders for machinery goods rising 6 percent, and those for plastic and rubber products increasing 5.5 percent year-on-year, while base metal and chemical products shrank 4.5 percent and 0.6 percent respectively, as firms lost orders amid price competition from foreign peers, the report said.

For the whole of last year, orders for machinery products increased 1.1 percent to US$19.43 billion; orders for base metal products edged up 0.3 percent to US$25.17 billion; orders for plastic and rubber products rose 1.7 percent to US$19.07 billion; and those for chemical goods were up 2.8 percent to US$17.91 billion, it said.

Throughout the year, the US, China and ASEAN were the three major export destinations, with orders from these markets rising 8.6 percent, 5.3 percent and 15.9 percent from the previous year to US$193.64 billion, US$126.68 billion and US$98.27 billion respectively.

Orders from the US last year registered the third-highest level on record, while those from ASEAN were the highest ever, ministry data showed.

Meanwhile, orders from Europe last year declined 9.9 percent year-on-year to US$84.62 billion and those from Japan fell 4.2 percent to US$29.22 billion, the report said.

Anna Bhobho, a 31-year-old housewife from rural Zimbabwe, was once a silent observer in her home, excluded from financial and family decisionmaking in the deeply patriarchal society. Today, she is a driver of change in her village, thanks to an electric tricycle she owns. In many parts of rural sub-Saharan Africa, women have long been excluded from mainstream economic activities such as operating public transportation. However, three-wheelers powered by green energy are reversing that trend, offering financial opportunities and a newfound sense of importance. “My husband now looks up to me to take care of a large chunk of expenses,

SECTOR LEADER: TSMC can increase capacity by as much as 20 percent or more in the advanced node part of the foundry market by 2030, an analyst said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is expected to lead its peers in the advanced 2-nanometer process technology, despite competition from Samsung Electronics Co and Intel Corp, TrendForce Corp analyst Joanne Chiao (喬安) said. TSMC’s sophisticated products and its large production scale are expected to allow the company to continue dominating the global 2-nanometer process market this year, Chiao said. The world’s largest contract chipmaker is scheduled to begin mass production of chips made on the 2-nanometer process in its Hsinchu fab in the second half of this year. It would also hold a ceremony on Monday next week to

TECH CLUSTER: The US company’s new office is in the Shalun Smart Green Energy Science City, a new AI industry base and cybersecurity hub in southern Taiwan US chip designer Advanced Micro Devices Inc (AMD) yesterday launched an office in Tainan’s Gueiren District (歸仁), marking a significant milestone in the development of southern Taiwan’s artificial intelligence (AI) industry, the Tainan City Government said in a statement. AMD Taiwan general manager Vincent Chern (陳民皓) presided over the opening ceremony for the company’s new office at the Shalun Smart Green Energy Science City (沙崙智慧綠能科學城), a new AI industry base and cybersecurity hub in southern Taiwan. Facilities in the new office include an information processing center, and a research and development (R&D) center, the Tainan Economic Development Bureau said. The Ministry

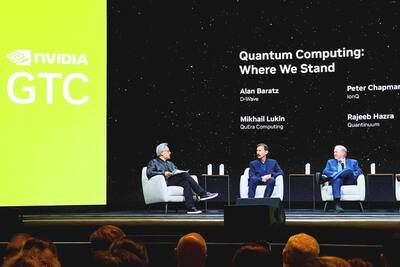

Nvidia is to open a quantum computing research lab in Boston, where it plans to collaborate with scientists from Harvard University and the Massachusetts Institute of Technology, Nvidia CEO Jensen Huang (黃仁勳) said on Thursday. Huang made the announcement at Nvidia’s annual software developer conference in San Jose, California, where the company held a day of events focused on quantum computing. Nvidia added the program after Huang in January said that useful quantum computers are 20 years away, comments that he sought to walk back on Thursday while joined onstage by executives from quantum computing firms. “This is the first event in history