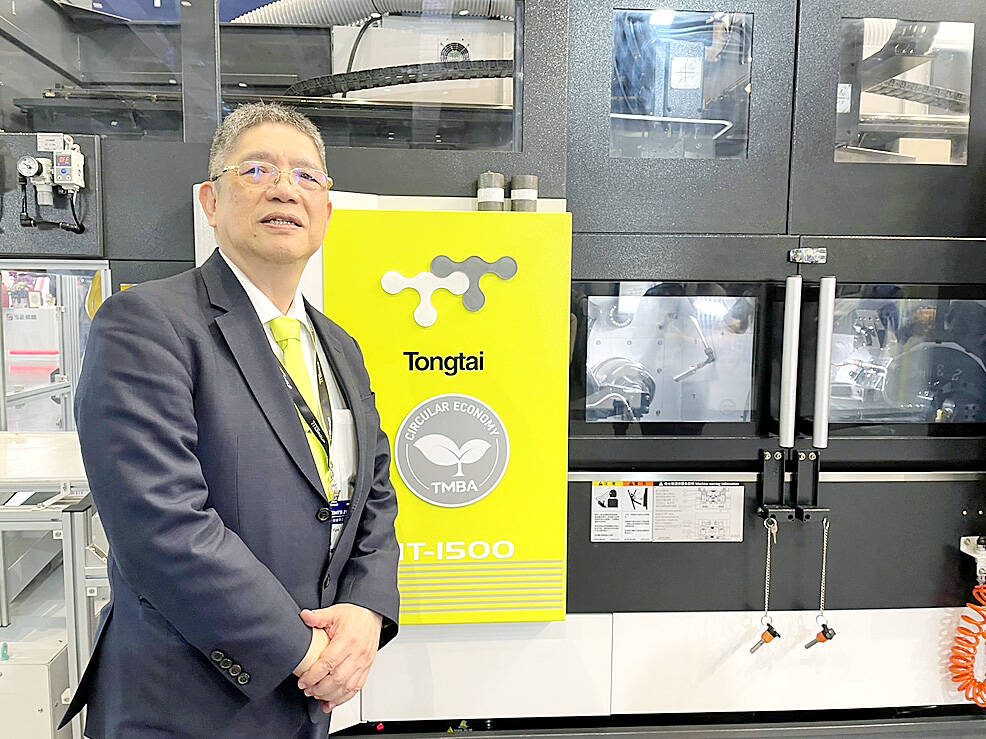

Taiwanese manufacturers have a chance to play a key role in the humanoid robot supply chain, Tongtai Machine and Tool Co (東台精機) chairman Yen Jui-hsiung (嚴瑞雄) said yesterday.

That is because Taiwanese companies are capable of making key parts needed for humanoid robots to move, such as harmonic drives and planetary gearboxes, Yen said.

This ability to produce these key elements could help Taiwanese manufacturers “become part of the US supply chain,” he added.

Photo: CNA

Yen made the remarks a day after Nvidia Corp cofounder and chief executive officer Jensen Huang (黃仁勳) said his company and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) are jointly creating new opportunities in areas such as robotics and self-driving cars.

However, the biggest obstacle to making humanoid robots more widely available is the high cost, said the head of Tongtai Machine, a major machine tool manufacturer based in Kaohsiung.

The current unit cost of humanoid robots is so high that it effectively adds “an extra zero” to the target price, Yen said.

Photo: CNA

However, “reducing the cost of humanoid robots presents an opportunity for Taiwanese key component manufacturers to play a crucial role,” he added.

Huang concluded his three-day “pop-up” visit to Taiwan yesterday. One day earlier, he hosted a luncheon to treat the high-ranking management of his company’s supply chain partners in Taiwan, including TSMC chairman C.C. Wei (魏哲家), Hon Hai Precision Industry Co (鴻海) chairman Young Liu (劉揚偉) and Quanta Computer Inc (廣達) chairman Barry Lam (林百里).

Other big names included Asustek Computer Inc (華碩) chairman Johnny Shih (施崇棠), Pegatron Corp (和碩) chairman Tung Tzu-hsien (童子賢), Siliconware Precision Industries Co (矽品) chairman Tsai Chi-wen (蔡其文), Acer Inc (宏碁) chairman Jason Chen (陳俊聖), Wistron Corp (緯創) chairman Simon Lin (林憲銘) and Inventec Corp (英業達) chairman Sam Yeh (葉力誠).

Huang is upbeat about the prospects of robotics development. He previously revealed that the US-based artificial intelligence (AI) chip designer is actively investing in three major robotics hardware and software solutions: Agent AI, humanoid robots and autonomous vehicles.

In his keynote speech at the Consumer Electronics Show (CES) in Las Vegas earlier this month, Huang showed off the next-generation Thor Blackwell Robotics Processor, which can be used in automated handling machines and humanoid robots.

Tesla Inc cofounder and CEO Elon Musk announced during the CES that the electric car maker plans to produce 50,000 to 100,000 Optimus humanoid robots by next year, with a goal of expanding production to at least an annual output of 500,000 units by 2027.

MULTIFACETED: A task force has analyzed possible scenarios and created responses to assist domestic industries in dealing with US tariffs, the economics minister said The Executive Yuan is tomorrow to announce countermeasures to US President Donald Trump’s planned reciprocal tariffs, although the details of the plan would not be made public until Monday next week, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. The Cabinet established an economic and trade task force in November last year to deal with US trade and tariff related issues, Kuo told reporters outside the legislature in Taipei. The task force has been analyzing and evaluating all kinds of scenarios to identify suitable responses and determine how best to assist domestic industries in managing the effects of Trump’s tariffs, he

TIGHT-LIPPED: UMC said it had no merger plans at the moment, after Nikkei Asia reported that the firm and GlobalFoundries were considering restarting merger talks United Microelectronics Corp (UMC, 聯電), the world’s No. 4 contract chipmaker, yesterday launched a new US$5 billion 12-inch chip factory in Singapore as part of its latest effort to diversify its manufacturing footprint amid growing geopolitical risks. The new factory, adjacent to UMC’s existing Singapore fab in the Pasir Res Wafer Fab Park, is scheduled to enter volume production next year, utilizing mature 22-nanometer and 28-nanometer process technologies, UMC said in a statement. The company plans to invest US$5 billion during the first phase of the new fab, which would have an installed capacity of 30,000 12-inch wafers per month, it said. The

Taiwan’s official purchasing managers’ index (PMI) last month rose 0.2 percentage points to 54.2, in a second consecutive month of expansion, thanks to front-loading demand intended to avoid potential US tariff hikes, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. While short-term demand appeared robust, uncertainties rose due to US President Donald Trump’s unpredictable trade policy, CIER president Lien Hsien-ming (連賢明) told a news conference in Taipei. Taiwan’s economy this year would be characterized by high-level fluctuations and the volatility would be wilder than most expect, Lien said Demand for electronics, particularly semiconductors, continues to benefit from US technology giants’ effort

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his