The Fair Trade Commission has approved Advanced Micro Devices Inc’s (AMD) bid to fully acquire ZT International Group Inc for US$4.9 billion, saying it would not hamper market competition.

As AMD is a fabless company that designs central processing units (CPUs) used in consumer electronics and servers, while ZT is a data center manufacturer, the vertical integration would not affect market competition, the commission said in a statement yesterday.

ZT counts hyperscalers such as Microsoft Corp, Amazon.com Inc and Google among its major clients and plays a minor role in deciding the specifications of data centers, given the strong bargaining power of those technology giants, the commission said.

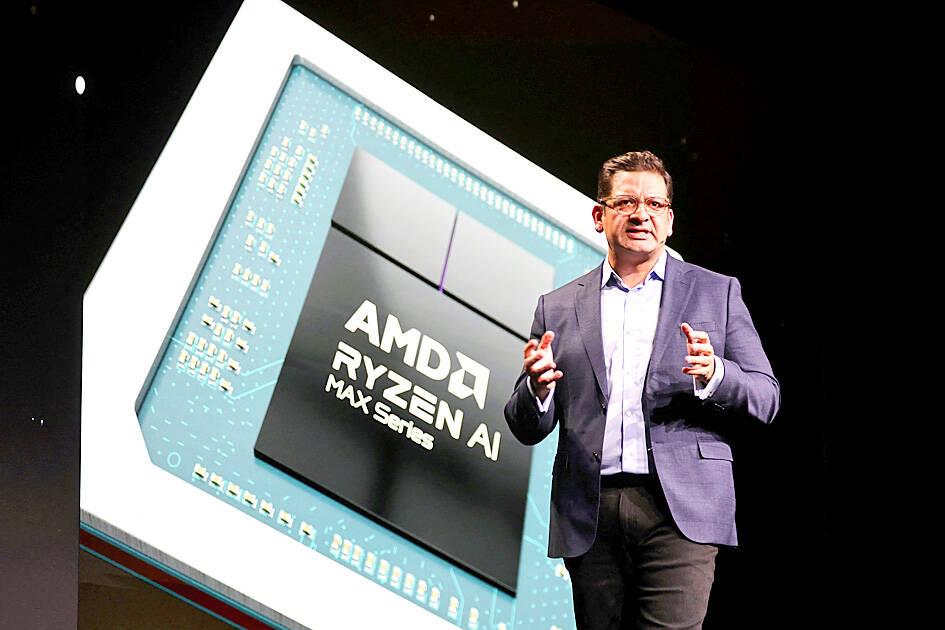

Photo: Reuters

After acquiring ZT, AMD would still face strong competition from market leaders — Intel Corp, the world’s biggest supplier of CPUs used in data centers, and Nvidia Corp, the top supplier of graphics processing units (GPUs) for data centers, the commission said.

In addition, AMD’s local suppliers expect their business partnerships with the new entity would remain intact following the merger, it said, adding that some suppliers have said the deal would not block their access to the market.

“As the merger of the companies would not fan fears of hindering competition, the commission would not ban the consolidation,” it said.

The strategic deal marks the next major step in AMD’s artificial-intelligence (AI) strategy to deliver leadership AI training and inferencing solutions based on innovating across silicon, software and systems, the company said in August last year.

ZT’s extensive experience designing and optimizing cloud computing solutions would also help cloud and enterprise customers significantly accelerate the deployment of AMD-powered AI infrastructure at scale, it said.

AMD said it expects the transaction to be accretive on a non-GAAP basis by the end of this year. The US firm has agreed to acquire ZT in a cash and stock transaction valued at US$4.9 billion, inclusive of a contingent payment of up to US$400 million based on certain post-closing milestones.

Inventec Inc (英業達), the biggest shareholder of ZT with a 10 percent share, said it would book NT$13.16 billion (US$398 million) in disposal gains from the deal.

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not

TARIFF CONCERNS: The chipmaker cited global uncertainty from US tariffs and a weakening economic outlook, but said its Singapore expansion remains on track Vanguard International Semiconductor Corp (世界先進), a foundry service provider specializing in producing power management and display driver chips, yesterday withdrew its full-year revenue projection of moderate growth for this year, as escalating US tariff tensions raised uncertainty and concern about a potential economic recession. The Hsinchu-based chipmaker in February said revenues this year would grow mildly from last year based on improving supply chain inventory levels and market demand. At the time, it also anticipated gradual quarter revenue growth. However, the US’ sweeping tariff policy has upended the industry’s supply chains and weakened economic prospects for the world economy, it said. “Now

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced