With its focus on innovative products and cutting-edge technology, the annual CES has not historically paid much attention to energy companies.

However, there were signs of a shift at this year’s Las Vegas event, as the tech sector begins to confront its substantial energy needs, which are certain to grow as cloud computing and artificial intelligence (AI) advance.

“If you’d asked me to do CES five years ago, I wouldn’t necessarily have seen the point,” said Sebastien Fiedorow, chief executive of the French start-up Aerleum, which manufactures synthetic fuel from carbon dioxide.

Photo: AFP

“But we are in a very different CES than five years ago,” he said, adding that even if energy companies remain “on the fringes” of CES, “we’re here.”

Data centers accounted for 4.4 percent of US electricity needs in 2023, a figure that is likely to rise to 12 percent by 2028, the US Department of Energy said.

Gary Shapiro, chief executive of the Consumer Technology Association, which organizes CES, said energy transition was intended to be “a big focus” of this year’s show.

“It’s something we’ve talked about for a while,” he said, stressing that the tech sector needs “innovative solutions” to ensure it has the power it requires.

Among the companies pitching such innovation at CES, which wrapped up on Friday, was the Dutch firm LV Energy BV, which generates electricity from sound and vibrations.

The company’s general director Satish Jawalapersad said their presence at the show was noteworthy.

“The fact that we’re here with the CES does say something, definitely,” he said.

LV Energy did not mention AI in its presentation, which he said likely suppressed interest, with AI being “the magic word” at CES.

“Maybe we’re not the most sexy ... because we don’t say those words,” he said.

Other energy firms also acknowledged a struggle to break through. DataGreen, another French firm, aims to build smaller, greener data centers that run on renewable energy, saving tech companies money by reducing data storage costs.

Cloud computing giants have so far shown no interest, DataGreen’s AI head Julien Choukroun said.

“For now, they don’t see the point, but we’re trying to convince them,” Choukroun said.

The company won an innovation award at CES this year, its first appearance at the show, and Choukroun said its services are essential.

“We can’t continue to increase the hangar space [of data centers],” he said, stressing the land available “is not infinite.”

He voiced confidence that once Big Tech realizes DataGreen offers cost savings, that would “be more persuasive than the ‘green’” aspect.

Jordan Huyghe, product manager at the French firm Otrera, which designs small nuclear reactors, said a major change in the relationship between tech and the energy sector would require investment from giants such as Amazon.com Inc, Google or Microsoft Corp. Amazon is already the world’s largest purchaser of renewable energy.

In September last year, Microsoft signed a deal with Constellation Energy Corp to reopen the Three Mile Island power plant in Pennsylvania. Energy from the plant would power Microsoft data centers.

Solutions could come from companies big enough to fund them, Huyghe said.

“To move forward on projects like these, you need to raise money,” he said.

Anna Bhobho, a 31-year-old housewife from rural Zimbabwe, was once a silent observer in her home, excluded from financial and family decisionmaking in the deeply patriarchal society. Today, she is a driver of change in her village, thanks to an electric tricycle she owns. In many parts of rural sub-Saharan Africa, women have long been excluded from mainstream economic activities such as operating public transportation. However, three-wheelers powered by green energy are reversing that trend, offering financial opportunities and a newfound sense of importance. “My husband now looks up to me to take care of a large chunk of expenses,

SECTOR LEADER: TSMC can increase capacity by as much as 20 percent or more in the advanced node part of the foundry market by 2030, an analyst said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is expected to lead its peers in the advanced 2-nanometer process technology, despite competition from Samsung Electronics Co and Intel Corp, TrendForce Corp analyst Joanne Chiao (喬安) said. TSMC’s sophisticated products and its large production scale are expected to allow the company to continue dominating the global 2-nanometer process market this year, Chiao said. The world’s largest contract chipmaker is scheduled to begin mass production of chips made on the 2-nanometer process in its Hsinchu fab in the second half of this year. It would also hold a ceremony on Monday next week to

TECH CLUSTER: The US company’s new office is in the Shalun Smart Green Energy Science City, a new AI industry base and cybersecurity hub in southern Taiwan US chip designer Advanced Micro Devices Inc (AMD) yesterday launched an office in Tainan’s Gueiren District (歸仁), marking a significant milestone in the development of southern Taiwan’s artificial intelligence (AI) industry, the Tainan City Government said in a statement. AMD Taiwan general manager Vincent Chern (陳民皓) presided over the opening ceremony for the company’s new office at the Shalun Smart Green Energy Science City (沙崙智慧綠能科學城), a new AI industry base and cybersecurity hub in southern Taiwan. Facilities in the new office include an information processing center, and a research and development (R&D) center, the Tainan Economic Development Bureau said. The Ministry

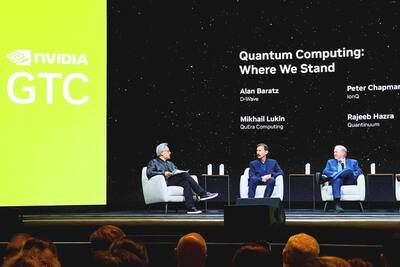

Nvidia is to open a quantum computing research lab in Boston, where it plans to collaborate with scientists from Harvard University and the Massachusetts Institute of Technology, Nvidia CEO Jensen Huang (黃仁勳) said on Thursday. Huang made the announcement at Nvidia’s annual software developer conference in San Jose, California, where the company held a day of events focused on quantum computing. Nvidia added the program after Huang in January said that useful quantum computers are 20 years away, comments that he sought to walk back on Thursday while joined onstage by executives from quantum computing firms. “This is the first event in history