US President Joe Biden’s administration plans one additional round of restrictions on the export of artificial intelligence (AI) chips from firms such as Nvidia Corp just days before leaving office, a final push in his effort to keep advanced technologies out of the hands of China and Russia.

The US wants to curb the sale of AI chips used in data centers on a country and company basis, with the goal of concentrating AI development in friendly nations and getting businesses around the world to align with US standards, people familiar with the matter said.

The result would be an expansion of semiconductor trade restrictions to most of the world — an attempt to control the spread of AI technology at a time of soaring demand. The regulations, which could be issued as soon as Friday, would create three tiers of chip curbs, said the people, who asked not to be identified because the discussions are private.

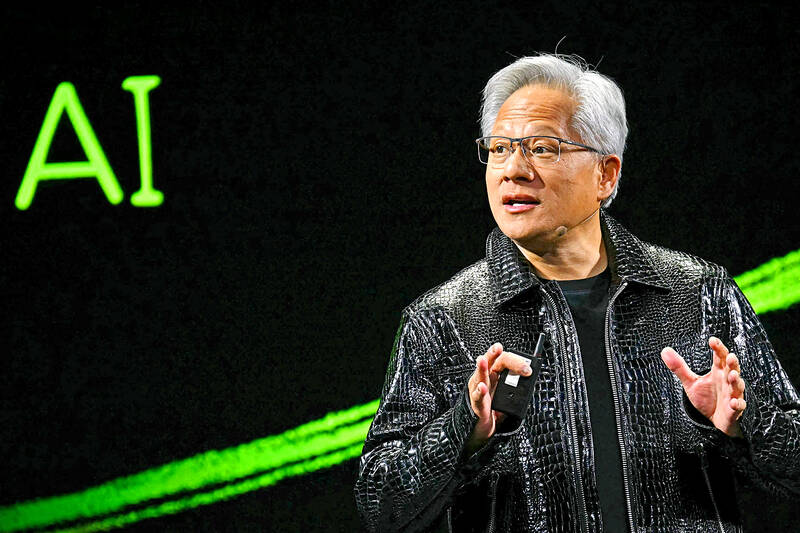

Photo: AFP

At the top level, a small number of US allies would maintain essentially unmitigated access to US chips. A group of adversaries, meanwhile, would be effectively blocked from importing the semiconductors. The vast majority of the world would face limits on the total computing power that can go to one country.

Companies headquartered in nations in that last group would be able to bypass their national limits — and get their own, significantly higher caps — by agreeing to a set of US government security requirements and human rights standards, the people said.

That type of designation — called a validated end user — aims to create a set of trusted entities that develop and deploy AI in secure environments around the world.

Nvidia objected to the proposal in a statement. “A last-minute rule restricting exports to most of the world would be a major shift in policy that would not reduce the risk of misuse but would threaten economic growth and US leadership,” Nvidia said. “The worldwide interest in accelerated computing for everyday applications is a tremendous opportunity for the US to cultivate, promoting the economy and adding US jobs.”

A representative of the White House’s National Security Council declined to comment. The US Department of Commerce’s Bureau of Industry and Security, which is in charge of chip export controls, did not immediately respond to a request for comment.

The measures build on years of curbs that already limit the ability of US chipmakers like Nvidia and Advanced Micro Devices Inc to sell advanced processors in China and Russia. The US also has sought to prevent adversary nations from accessing cutting-edge technology through intermediaries in places such as the Middle East and Southeast Asia.

The rules follow months of debate over how quickly and broadly to deploy US chips to global data centers. US chips far outperform Chinese ones at AI tasks, companies and entire countries have indicated that they are willing to jump through hoops to gain access to US technology. That gives the US potentially significant leverage to shape global AI development.

The US has “a serious once-in-a-generation moment to leverage US AI technology,” the top Democrat and Republican on the House China Select Committee wrote last week in a letter to US Secretary of Commerce Gina Raimondo.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to